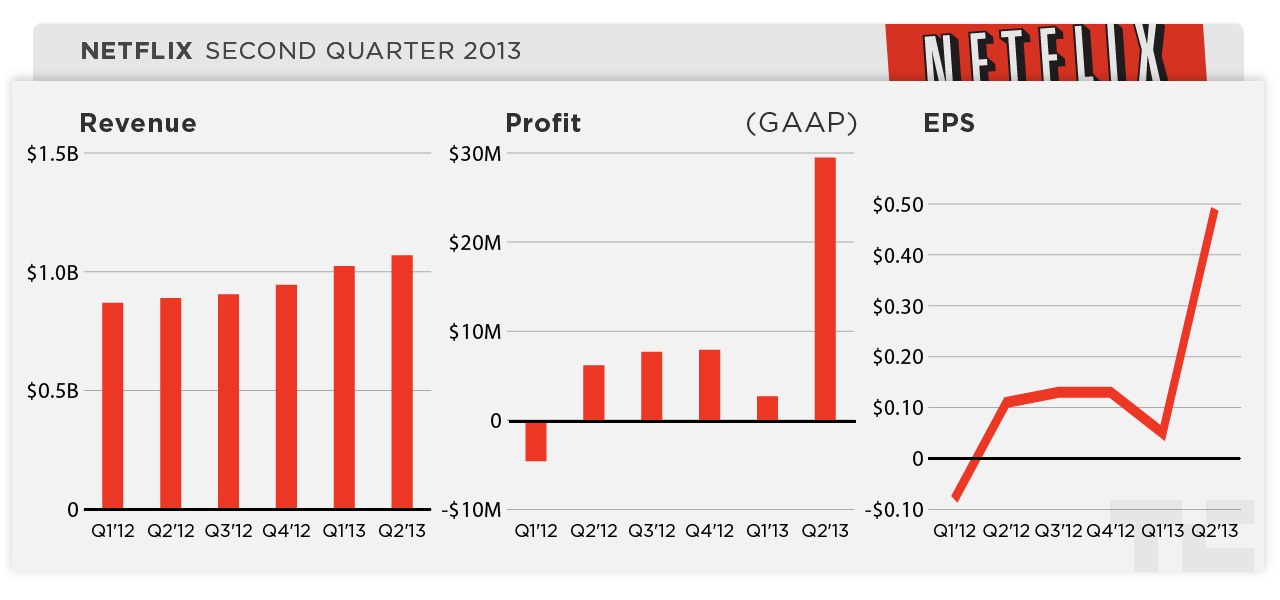

Netflix just released its second-quarter earnings report, missing analyst expectations with lower-than-expected subscriber numbers. For the second quarter, Netflix reported earnings of 49 cents per share on revenues of $1.07 billion. That compared to earnings of 11 cents per share on sales of $889 million in the year-ago quarter. Earnings were above analyst expectations of 40 cents a share, while revenues were in-line with the $1.07 billion forecast for the second quarter.

But the most closely watched number was probably Netflix’s domestic subscriber growth. On that front, the company reported net additions of 630,000, compared with 528,000 a year ago. The second quarter is typically a weak one for new subscribers, especially compared to the prior two quarters. Nevertheless, Netflix’s numbers were in-line with its guidance but it underperformed analyst expectations of domestic subscriber growth of around 700,000 net additions.

While Netflix’s push into original programming is working to get more people signed up and subscribing to the service, just not as quickly as some bulls might have hoped. In the first quarter, Netflix released the Kevin Spacey-led political drama House of Cards, and has followed that up in the second quarter with the highly anticipated release of the fourth season of Arrested Development, as well as Eli Roth’s horror series Hemlock Grove. (Orange Is The New Black, the company’s latest original release, wasn’t reflected in the report, as it came out in the third quarter.)

Its shows have received a bit of critical acclaim recently, with Netflix receiving 14 Emmy nominations last week. That includes nine nominations for House Of Cards, three for Arrested Development, and two for Hemlock Grove. But Emmy noms didn’t necessarily translate into subscribers for the company.

Looking beyond the company’s domestic streaming market, Netflix posted relatively strong growth in international markets for the second quarter. It added 610,000 international subscribers, which matches growth from last year’s second quarter, when it launched in the U.K. and Ireland. According to its management comments, it saw strong growth in Brazil after raising the price of the service in that market. International contribution loss was lower due to better-than-expected growth and lower content spend across multiple markets.

Its DVD service lost nearly half a million subscribers, but it continues to be a huge profit driver for the company, contributing about $109 million in profit to the company. That said, the contribution profit declined 19 percent year over year, which the company said is in line with its decline in members and revenues.

For Netflix, this quarter’s financial results follow several strong quarters in a row, in which the company has outperformed analyst expectations. After a rough couple of quarters nearly two years ago, as it raised prices and separated its DVD and streaming business units. And those positive results have driven its stock price up, from a 52-week low of $52.81 up into the $260s today. But after today’s release, the stock is down more than 5 percent in after-hours trading.