Today, TechCrunch has learned that Quarterly.co, a subscription giftbox service that features monthly instalments curated by respected entrepreneurs, designers and organizations is buying 12Society, a rival startup with a similar, celebrity-endorsed approach to subscription commerce. Terms of the deal are not yet being disclosed, although a source tells us that it’s a small cash and equity deal that is expected to officially close in the next week or two and will lead to the closure of 12Society this summer.

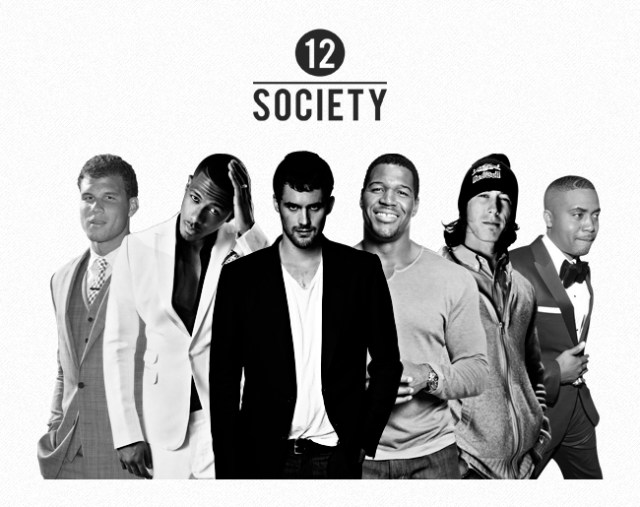

While 12Society’s 11 employees are all headed in new directions, the startup’s celebrity co-founders, which include veteran rapper Nas, rapper and comedian Nick Cannon, L.A. Clippers star Blake Griffin, the Timberwolves’ Kevin Love, all-star San Francisco Giants pitcher Tim Lincecum and former New York Giant Michael Strahan, will take a stake in Quarterly as part of the deal.

Co-founders Nadir Hyder and Sameer Mehta were both offered the opportunity to join the new company and, while Hyder opted not to stay, Mehta is staying on in a consulting role while joining Five Four Clothing to lead the brand’s new eCommerce and subscription box service.

Another key result of the deal is that, as part of taking a stake in the new company, 12Society’s celebrity co-founders will join Quarterly’s pool of influencers to help expand its scope and diversify its roster. While 12Society’s site will go dark this summer, the startups plan to have the celebrity contributors integrated and active on Quarterly by August.

So What?

The 12Society-Quarterly deal is an important one for the fledgling subscription commerce market, coming at a potentially pivotal point in its evolution.

Evolution tends to be cyclical in Startup Land; hang around long enough and you’re bound to experience deja vu. For the most recent example, look no further than subscription commerce and its business model’s reappearance over the last few years. In reality, the subscription model is as old as these hills.

The comfort and stability of subscription-based recurring revenue streams have held sway over businesses for ages. But ever since Birchbox tipped the domino, a new generation of subscription-based, home-delivery startups have poured into the market — and they come bearing gift boxes. A lot of them.

Over the last two years, startups have churned out a litany of Birchbox-inspired variations, across every vertical (yes, even sex toys), but, in truth, FedExing stuff-in-a-box and flanking it with a pretty website doesn’t a revolutionary business make. In reality, subscription commerce is just a spin on the standard eCommerce business model, and like its predecessor, it’s still just a race to scale.

A few years ago, the hype around daily deals and flash sales led to a similar gold rush and, while a couple of big companies were minted in the process, fatigue eventually set in and the consolidation began in earnest.

History

In the wake of the surge in popularity of the Birchboxes and Dollar Shave Clubs of the world, the space has attracted increasing attention both from consumers and investors over the last two years. But it’s also begun to attract the attention of bigger fish. In fact, last year, Gartner (via BusinessWeek) estimated that more than 40 percent of media and digital products companies would use subscription services for fulfillment, billing and renewals by 2015.

Beginning at the end of last year, not only did Birchbox make its first acquisition (of European copycat/competitor, JolieBox), but it marked the first real interest from behemoths like Walmart, which launched a food subscription service that aims to offer specialty products not usually found in its trillion-odd stores.

The presence of giants like Walmart will pose a very real threat to subscription commerce startups going forward. The space is maturing, and the “bigger” startups and companies are already racing to hit scale and expand internationally, and many of these players will have to turn to acquisitions if they hope to survive. And, on the flip side, it’s likely that we’ll see an increasing number of the “sub-scale” startups in subscription commerce begin looking for exit opportunities.

Against The Threats

By teaming up at this stage of the game, Quarterly and 12Society appear to be making a smart move. “I think it makes sense to start consolidating more of the sub-scale players, which I think we’re going to see more and more of in the ‘subscription box’ space,” says Diego Berdakin, a co-founder of subscription commerce startup, BeachMint, and an investor in 12Society. Ultimately, by starting early, Quarterly (which has raised $1.25 million from True Ventures and the Collaborative Fund) and 12Society (which raised under $1 million from the Lightbank partners and others) may be putting themselves in a better position to be players in future subscription commerce consolidation.

The 12Society acquisition also makes a lot of sense given the similarities in the way the two startups have approached the market. Both startups set out to leverage the early success of celebrity-endorsed subscription services, like ShoeDazzle and Kim Kardashian, Christina Applegate’s FabKids and BeachMint’s categories, each of which is endorsed by a different celeb — to name a few examples.

12Society put a spin on this model by not only going after the men’s market by offering customers monthly boxes of products that ranged from razors to headphones, but by making their celebrities co-founders. The startup’s box-o-dude-stuff cost $39 a pop and included $125 worth of items, which was part of the initial appeal of quality items at a discount that allowed the company to attract 5,000-plus subscribers and generated several hundred thousand in revenue.

Lessons Learned

However, Mehta tells us that this model also proved to be a problem for the company. Margins were tough as was sourcing, Mehta said, as as its small team had to not only curate, fill and ship boxes every month for its customers, but they were only able to get about 40 percent of those products for free.

While it was able to lean on the networks and brand affiliations of its co-founders, the company still had to purchase the majority of its product, which it bought in bulk.

Quarterly launched in late 2011 with a similar model, offering customers the chance to sign up to receive monthly boxes curated by its list of “influential contributors.” Yet, unlike athletes and musicians, Quarterly’s influencers hailed more from the startup, media and design worlds, including writers, Behance founder Scott Belsky, the New Yorker’s Sasha Frere-Jones, Rhode Island School of Design President John Maeda, and Alexis Ohanian of Reddit, Breadpig, and Hipmunk fame.

Ultimately, in hindsight, the 12Society co-founder believes that Quarterly’s decision to allow influencers to curate their own boxes (instead of consolidating several in one), its wider price range (Quarterly subscription prices range from $25 to $100 depending on the curator), larger roster of influencers and the reduced demand inherent to less frequent shipping and fulfillment deadlines put Quarterly in a better position to be successful over the long-term.

From the outside (and, really, from the perspective of an investor and entrepreneur), the subscription commerce market looks pretty attractive, as it continues to grow in popularity and reach among consumers. Plus, its relatively low barriers to entry make it look like an easy way to make a buck. But, in reality, subscription commerce isn’t a walk in the park.

Some Netflix Help

But you know what helps give Quarterly some critical street cred in a noisy market? The fact that its new CEO, Mitch Lowe, is the co-founder one of the largest subscription-based services out there, in Netflix, and helped lead movie rental giant Redbox as an early executive before eventually taking over as president. Lowe initially joined Quarterly as an advisor, but after experiencing some hiccups, according to PandoDaily, he took over as chief executive from former GOOD Magazine editor, Zach Frechette, in September.

Ultimately, outside of the most familiar names, it’s nearly impossible to say with any authority which startups will survive the evolution of the subscription commerce landscape. Building a distinct and lasting brand while keeping costs low is tough, especially in this space. If Quarterly is smart about how it curates its own box of diverse influencers and can incentivize them to really commit and spend time creating memorable experiences for their fans, then it could be the next-gen “Fan Club for Adults.” While that’s a tricky balance, having someone at the helm who helped build Netflix and Redbox into giants is key.

What’s more, by acquiring 12Society, it continues to expand and diversify its roster of influencers, and it’s a lot easier to be optimistic about Quarterly’s chances of surviving and becoming a real player in subscription commerce.