Pandora has had a busy quarter. In March, the social radio company saw its long-time CEO Joe Kennedy abruptly step down, leaving the board to scramble to find a replacement. On the bright side, Kennedy’s exit, while likely a result of stress, followed relatively good times for Pandora. And it’s continued to push forward since.

Pandora launched an ad-free version for Windows 8 in March, surpassed 200 million users (with over 140 million accessing Pandora via mobile) in April, then launched a “Premieres” station for U.S. users and deepened its Facebook integration with a new Timeline App.

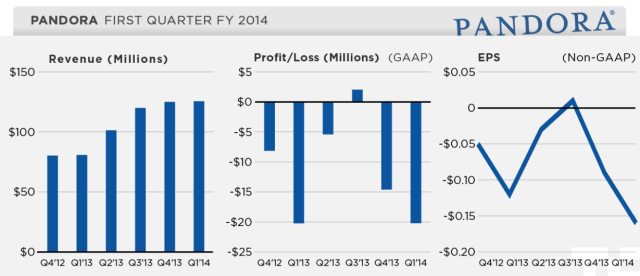

Today, Pandora’s first quarter earnings reflected this flurry of activity, as the company saw GAAP total revenue increase 97 percent year-over-year to $83.9 million (with non-GAAP mobile revenue of $86.7 million), which outpaced mobile listener hour growth at 47 percent year over year. Meanwhile, total revenue came in at $125.5 million, representing 55 percent year-over-year growth and non-GAAP total revenue of $128.5 million.

What’s more, share of total U.S. Radio listening for Pandora grew to 7.33 percent in April — an increase from 5.86 percent in the same period last year.

This news followed a strong earnings report from Pandora for the fourth quarter as well, thanks chiefly to mobile revenue growth of 111 percent year-over-year (to $80.3 million), which caused the company’s stock to jump for joy.

Based on this performance, Wall Street expected the trend to (mostly) continue for Pandora in the first quarter, with forecasts pegging revenue at $123.9 million (on losses of $0.10 per share) for the quarter, compared to a loss of $0.09 per share for Q1 last year — and revenue of $123.5 in Q4. And so it did.

Of his company’s performance, Kennedy said:

Mobile listening hours and mobile ad revenue reached record highs, with growth in mobile ad revenue exceeding growth in mobile listening hours. During the quarter, we successfully implemented a mobile listening limit, enabling us to manage our content acquisition costs with minimal impact on listenership or revenue growth. Pandora’s subscriber base surpassed 2.5 million, adding more net new subscribers in the quarter than in all of fiscal 2013, giving Pandora the largest US streaming subscriber base of any music service.

It’s also interesting to note that Kennedy resigned after last quarter (as mentioned above), yet Pandora’s release today names him as Chairman and CEO. It seems either Pandora’s copy editors need more coffee or their communications team knows something we don’t. Perhaps Kennedy’s resignation (due, understandably, to heavy stress) was a bit more abrupt than intended and announced early. Although that’s not totally clear at this point.

All in all, it was a strong quarter for Pandora, with advertising revenue showing a 49 percent year-over-year increase to $105.1 million, with non-GAAP subscription and other revenue coming in at $23.4 million — a 114 percent year-over-year increase. Non-GAAP basic and diluted EPS were $0.10, right in line with Wall Street’s expectations, while the company ended the quarter with $75.4 million in cash, compared with $89 million after the prior quarter. (Cash used in operation activities came in at about $12.6 million.)

Some other notable metrics: Pandora’s total listener hours grew 35 percent to 4.18 billion for the first quarter, compared to 3.09 billion for the same quarter last year. According to Kennedy, Pandora’s mobile listening hours hit an all-time high this quarter, alongside significant growth of its subscriber base (which Kennedy claims above makes it the biggest in the U.S.).

As to guidance, non-GAAP revenue is expected to fall in the $155 million to $160 million range, while Pandora expects non-GAAP EPS to be in the range of -$0.02 and +$0.01.