My parents have yet to receive their Christmas gift. Because they are avid skiers, I bought them gift cards to Heavenly Mountain last December, and because of some issue with either the ZIP code or security code on my credit card, my charge keeps getting rejected. I have tried five different cards.

I have called AmEx. I’m about to call Chase since I just got a new card, and sit there and go through the transaction step-by-step with them to make sure there’s not some sort of security thing on my card’s side preventing the transaction from going through. I’m going to do that once this post is finished. Why won’t you let me give you my money, AmEx?

My mom did, however, receive her Mother’s Day gift yesterday, and the payment experience was exactly the opposite of the middle-class problem described above. That’s because I challenged myself to use Max Levchin’s new startup, Affirm, as a payment method.

Optimized for mobile, Affirm lets you pay without a credit card via phone in literally two taps (that’s their marketing pitch, in case that’s not obvious). It “loans” you the money with no fee, then gives you 30 days interest-free to pay it back. Affirm monetizes by charging a fee to merchants in return for guaranteeing payments through its social media-enabled risk assessment.

Right now the service is only available if you’re buying something from 1-800-Flowers, which is fitting. I don’t know about you, but lots of people are happy to pay $20 more for the convenience of not having to call a random florist by your mom’s house and pay by credit card over the phone during normal business hours.

Pro tip: You can always get cheaper flowers by calling a local florist, but I prefer to do my parent gift shopping at 1 a.m. on my cell phone in bed so …

“Given 1-800-FLOWERS.COM’s culture of innovation, we are always looking for innovative experiences to test and learn [!],” 1-800-Flowers head of VP of Mobile and Social Amit Shah told me on why they chose to be Affirm’s guinea pig during their high season. “This is an important focus for 1-800-FLOWERS.COM as we have been in the mobile space for more than five years — serving a rapidly increasing number of our customers who are using our mobile site and apps to send gifts every day.”

They’re on to me.

The real simple Affirm/1-800-Flowers integration lets you choose “Affirm Express Checkout” as one of the payment methods when buying your “Fields Of Europe ™ For Mom Large” and then asks you to log in with Facebook or Gmail to your Affirm account to complete the order. No credit card numbers, no security codes, no phone calls to customer service. Hallelujah.

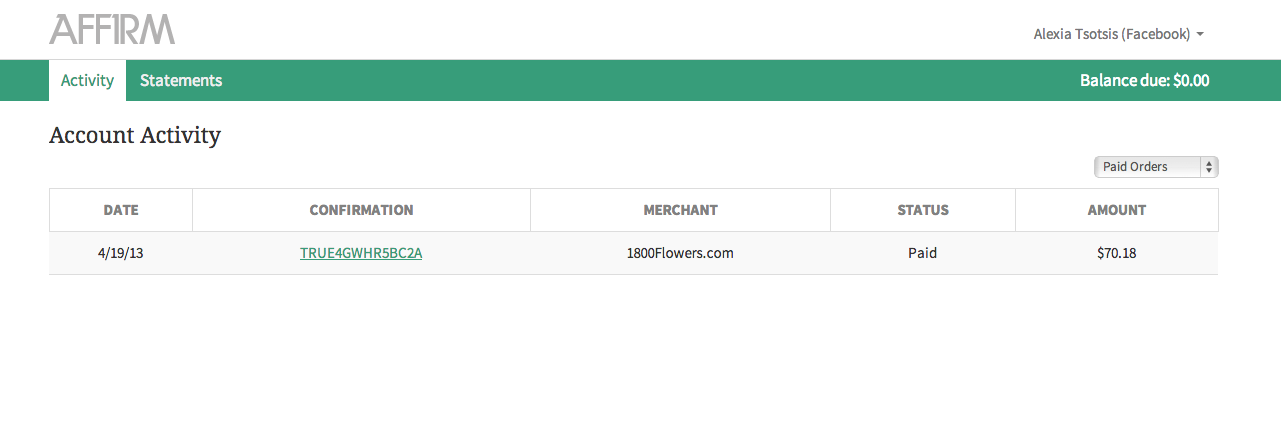

Because it is born mobile, Affirm then texts you that you’ve completed your order, and you have about a month to log back in to Affirm to pay for your blossoms. I forgot about it after I did it, and about a week later Affirm emailed me to remind me that I hadn’t paid. So I did. Right then.

“It’s hard to build something really convenient,” Levchin said in an interview about the startup, below. Though he wouldn’t confirm the rumors, we’re hearing that, in addition to Levchin himself through HVF, a lot of the PayPal mafia (i.e. Levchin’s homies) went in on the company’s $3 million – $5 million seed round, namely Peter Thiel and David Sacks. Competitors include Signifyd and Klarna.

Now it sucks that Affirm wouldn’t let me use a promo code to buy my overpriced bouquet, especially since overeager Google Wallet desperately wants to pay me $10 just to try it, but overall Affirm was worth it. (Levchin says that the Promo Code feature is coming in a new release.) Other than that, I wish that all online checkouts were this painless. This kind of friction removal has the potential to greatly expand the e-commerce market, bridge online-to-offline payments and engender trust among users.

Are you there AmEx? It’s me, Alexia.

Full interview below.