Paidpiper launched at Disrupt NY today, aiming to make your physical wallet, and presence, less necessary — in a good way.

At the beginning of my freshman fall at Stanford I was wandering around campus with a lanyard around my neck buying books, a bike, a mini fridge and more. Not destined to be an accounting major, I forgot to check to make sure I had enough money in my account, so I had to wait for my mom to transfer money to me before I was able to buy an Intro to Humanities book that served as a top-notch coaster.

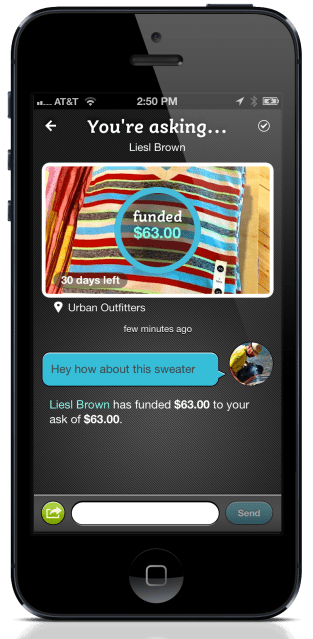

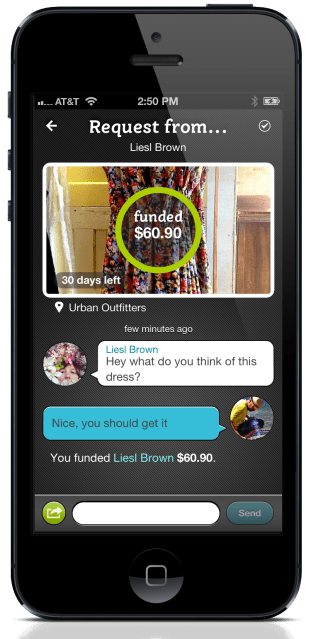

Paidpiper aims to solve that problem (not the education one) with its consumer-facing app, Ok’d. Using Ok’d, you can walk into a store, snap a picture of a product, and send it to a friend, parent, employer, etc. and ask them to pay for it.

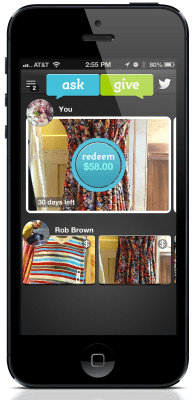

The payer receives a request, complete with price, product information, and a chat function between requester and payer, all in real time. Once the payer approves the request, the requester gets a barcode on their Ok’d app that they show to the cashier.

Ok’d runs on the secure messaging payment platform built by Paidpiper, which works on the existing credit card payment rails to program one-time use cards. The funder decides where, when and what can be purchased, but doesn’t have to be physically in the store or give someone else their credit card information.

Paidpiper says the merchant doesn’t need any new hardware or software to accept payment via these one-time use cards, as they just have to enter the card number or scan the barcode. The company also says it takes care of security by leveraging the credit card rails and handles card issuance regulations and Money Transfer Licenses requirements to make things easier for merchants.

Paidpiper raised $1,200,000 in March 2012 from CrunchFund (founded by TechCrunch founder Michael Arrington), Blumberg Capital, and T5 Capital.

The company says you can send money to anyone, whether they have a bank account or not; as long as the recipient has a phone number, they can receive money via Paidpiper.

Paidpiper makes the cards redeemable only through the store where it is asked for, and every card has an expiration date, after which unspent money is automatically returned to the payer.

For now, the Ok’d pilot charges a service fee of up to 5 percent for every transaction. Ok’d is available now, and CEO and founder Atif Hussein tells me the company is now focusing on APIs to support Brands.

Hussein says the company believes every person naturally belongs to multiple networks, as small as our families and larger like followers of popular brands. Ok’d allows people to send and receive money in their small networks. Hussein says their goal is to drive measurable loyalty through fan-based foot traffic to brick-and-mortar stores in a highly curated, controlled way.

“What you saw was a platform to move money around safely and securley,” Hussein explained, concluding the Disrupt presentation. “We built the Ok’d application on top of that.”