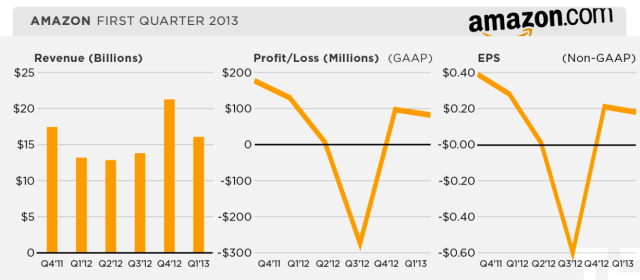

Last quarter, Amazon, which has been a freight train and Wall Street darling over the last year, surprised analysts by reporting lower-than-expected earnings. Expectations were high considering the holiday shopping season, but Amazon saw net income drop 45 percent to $97 million in Q4, compared to $177 million in 2011, although on the bright side, net sales continued to increase (by 22 percent) to $21.2 billion.

Today, Amazon continued the trend, still finding itself in a bit of a hangover after missing expectations in Q4. The eCommerce giant reported earnings from Q1 after the market closed this afternoon, in which it saw cash flow increase 39 percent to $4.25 billion, compared to $3 billion for the prior year, while net sales increased 22 percent to $16.07 billion in Q1, compared to $13.18 billion in first quarter 2012.

And by mixed results, we mean that Amazon blew away earnings-per-share expectations at $0.18 in Q1 on revenue of $16 billion. Leading up to today’s announcement, Wall Street expectations were much lower for EPS, with analysts expecting $0.08 EPS for the quarter. In turn, the Street expected Amazon to report sales of $16.2 billion, which the company just missed with $16.07 billion in sales.

In spite of the mixed results, as the market has been wont to do over the last year, Amazon’s stock was trending up, closing at $274.70 per share, on rumors that the company could be launching its own TV set-top box this fall, bringing more of the company’s hardware into your living room.

Tellingly, in today’s announcement, Amazon founder and CEO Jeff Bezos didn’t touch on the numbers or falling profits, instead plugging the company’s efforts to take on Netflix with some original programming of its own for Instant Video customers. Last week, the company launched 14 new comedy and kids pilots on Instant Video, which quickly became the “most watched TV shows on Instant Video,” the company said Monday.

“Amazon Studios is working on a new way to greenlight TV shows. The pilots are out in the open where everyone can have a say,” Bezos said in today’s earnings release. “I have my personal picks and so do members of the Amazon Studios team, but the exciting thing about our approach is that our opinions don’t matter. Our customers will determine what goes into full-season production. We hope Amazon Originals can become yet another way for us to create value for Prime members.”

Other points of interest: Amazon’s free cash flow fell 85 percent to $177 million year-over-year, compared to $1.15 billion in the year prior, due in part to dishing out $1.4 billion to purchase new office space in Seattle. Operating income decreased 6 percent to $181 million in Q1, compared to $192 million in the same quarter last year, while net income fell 37 percent to $82 million from $132 million in Q1 2012.

The upside for Amazon continues to rise, thanks to its move into original programming and the expansion of its selection for Prime Instant Video, which is in part due to new licensing agreements with A+E, CBS, FX, PBS And Scripps. This means that shows like Downton Abbey, Justified and Under The Dome, as well as content from Food Network, the Cooking Channel, the Travel Channel and HGTV will all be headed to Amazon. The company said that Prime Instant Video now has 38,000 movies and TV episodes in its collecton.

In addition, Amazon touted the launch of its new MP3 store for Safari, which allow iPhone and iPod touch users to discover and purchase digital music from the company’s catalog. This comes on the heels of reports today that the influence of the company’s Appstore is growing and shows high revenue potential. Amazon also announced its Cloud Player for iPad and iPad Mini this quarter, extended AutoRip to vinyl records and announced the launch of Kindle Fire HD 8.9″.

Good news also came for authors and readers, as Amazon announced that it will start paying its authors their royalties monthly, ahead of the twice-a-year industry standard, along with the acquisition of popular book recommendation hub, Goodreads.

All in all, it was a busy quarter for Amazon, especially for AWS, which launched a slew of new products over the last few months and again lowered its prices. The company said in its announcement today that AWS “has lowered prices 31 times since it launched in 2006, including 7 price reductions so far in 2013.”

Looking forward, Amazon is lowering expectations, however, as it said today that it expects sales to come in between $14.5 billion and $16.2 billion next quarter — equivalent to a 13 to 26 percent increase from Q2 2012. In turn, it expects operating income to be between -$340 million and +$10 million. In other words, a potential loss.

For more, find Amazon’s Q1 earnings announcement here.