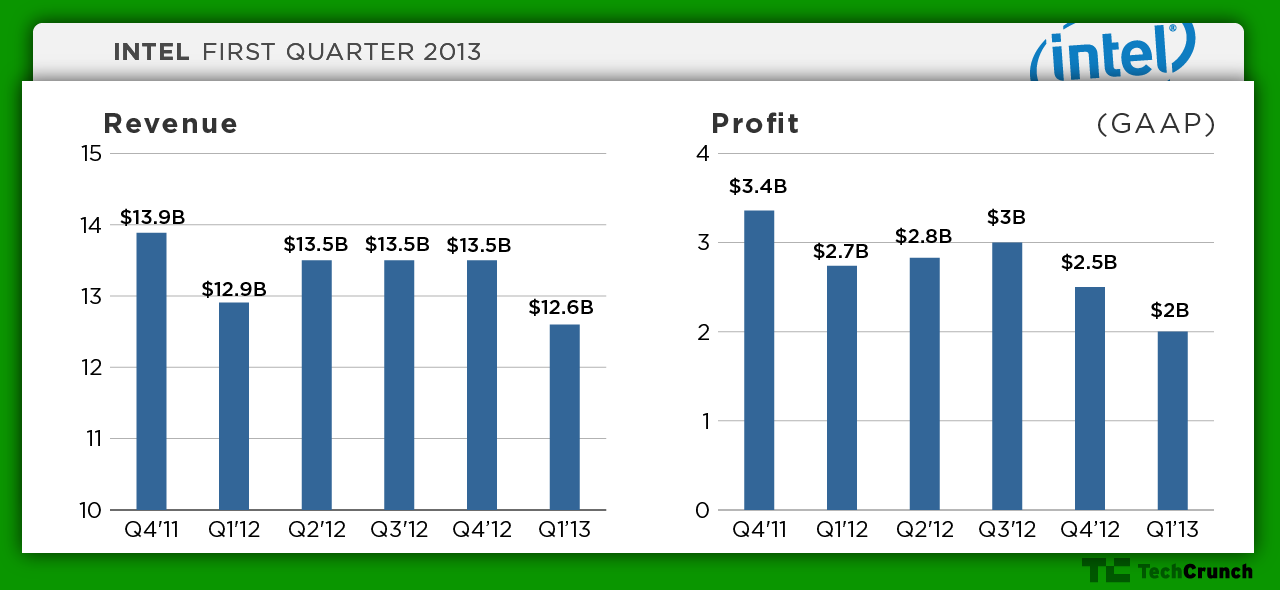

Intel’s fiscal Q1 earnings are out today, and the company reported profit and earnings at expectations on revenue with $12.6 billion for the quarter, and below on earnings per share at $0.40, according to Bloomberg’s analyst consensus. Revenue was down from Q1 2012, as were earnings per share, as the chip-making giant continues to weather the storm of a declining PC market.

PC sales for the beginning of the year were reportedly steep, according to research firm IDC, with Windows 8 taking blame for the decline. IDC found that overall, sales were down 13.9 percent for PCs, a category which excludes tablets and notebooks with removable keyboards. Even if you count those in, the news still wouldn’t be great for Intel, which continues to struggle with making any real headway in the mobile processor market. The PC group’s revenue alone totaled only $8 billion, down nearly 6 percent year over year. Intel said in a statement from the CFO’s office that the sequential decline in overall revenue of 7 percent was in line with what they’d expect to see coming out of a holiday season.

Intel CEO Paul Otellini is leaving the company after eight years leading the company in May. Otellini announced that he’d be leaving Intel late last year, giving the company ample time to plan for and put in place succession arrangements. Otellini has been vocal about Intel’s work on “reinventing the PC” as it continues to face challenging market conditions and try to overcome them.

Intel CEO Paul Otellini is leaving the company after eight years leading the company in May. Otellini announced that he’d be leaving Intel late last year, giving the company ample time to plan for and put in place succession arrangements. Otellini has been vocal about Intel’s work on “reinventing the PC” as it continues to face challenging market conditions and try to overcome them.

This definitely wasn’t a great quarter for Intel, and that means the incoming CEO will have a lot of expectations to live up, in a very challenging market environment. Intel’s roadmap includes big plans for mobile, like the Bay Trail 22nm design with native quad core processing built in, slated to arrive by the end of this year. It’s going to power budget, convertible PC designs, Intel says, which might inject some fresh life in the sluggish PC market, though we’ve yet to see any real promising indication that Microsoft’s efforts along those lines with the Surface RT are paying any big dividends – in fact, quite the opposite.

Intel spent over $10 billion on research and development in 2012, up $2 billion from the previous year, as Intel said it was investing heavily in mobile, tablets, ultrabooks and server technologies. The company is clearly spending big to try to make sure it can shore up divisions that are stronger than those serving the PC industry. The company’s shares are down slightly, but nearly flat in aftermarket trading.

We’ll be listening in on the conference call and will update here if the company reveals anything interesting about its plans for turning things around, or about a potential replacement for Otellini, but the official release says the board is still working to choose a successor.