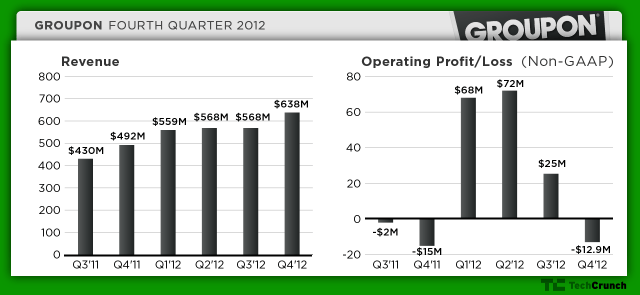

Groupon has just put out its Q4 and full-year results. It has reported quarterly revenue of $638.8 million with an operating loss of $12.9 million and a loss per per share of 12 cents, falling short of analyst expectations on the EPS front — they had predicted $638.41 million in revenue and EPS of $0.03.

Those numbers show 30 percent revenue growth and a slightly smaller ($12.9 million versus $15 million) operating loss compared to the same period last year. (Those Q4 results needed to be restated about a month after reporting because Groupon had higher-than-expected refunds, due to selling more expensive products and having customers make more returns of those goods.)

As of 4:31pm Eastern, Groupon shares had fallen 22.44 percent (to $4.64) in after-hours trading.

The earnings release emphasizes gross billings, which grew 24 percent year-over-year to $1.52 billion.

“Record billings growth this quarter is a clear signal that customers love Groupons,” CEO Andrew Mason said in the release. “We will continue to invest in growth through 2013 as we see new opportunities to give our customers what they want.”

For the year as a whole, Groupon is reporting revenue of $2.33 billion (up 35 percent) and operating income of $98.7 million (compared to a loss of $233.4 million in 2011).

There were some bright spots for the company this past quarter due to holiday season shopping, particularly in the area of mobile commerce, one of the services that it wants to expand as part of its plan to expand beyond daily deals to provide more services to local businesses. It noted that Black Friday mobile transactions were up 140 percent year on year, with four times as many mobile purchases as on a normal Friday morning; mobile drove over 40 percent of Groupon’s overall transactions during that period as well as over half of Groupon Goods’ transactions. The earnings release says that nearly 40 percent of transactions were completed on mobile in January, up 44 percent from the previous year.

Focusing on international, Groupon reported gross billings of $802 million (up 6.2 percent) and revenue of $263 million (down 15.9 percent). Groupon’s international business, which covers 47 countries outside of the U.S., with the U.K. being the biggest market, is still based around the company’s legacy business of daily deals. This is largely because Groupon’s growth has been inorganic and acquisition-based, and so each country has its own back-end system, which makes it a challenge to integrate into what the U.S. is doing. It’s about a year behind but apparently integration of some of the mobile commerce services is on the agenda, so we may see services like Breadcrumb point of sale solution coming to international waters soon.

The results are coming in ahead of a Groupon board meeting tomorrow.