Retargeting company AdRoll has released some data today intended to suggest that advertisers shouldn’t rush too quickly to embrace Facebook Exchange (the ad retargeting service that the social network launched last year) exclusively — it’s not anti-Facebook, but it doesn’t want advertisers to forget other forms of retargeting.

That’s probably what you’d expect to hear from a company with a profitable business in web retargeting (where ads are targeted based on your previous online behavior). However, AdRoll was also an early Facebook Exchange partner, and it says that it has run Exchange campaigns for more than 700 advertisers. Facebook said last month that there are more than 1,300 total advertisers on Exchange. So the data it’s releasing today is based on 468 campaigns from the past six months that ran simultaneously on Facebook and the web.

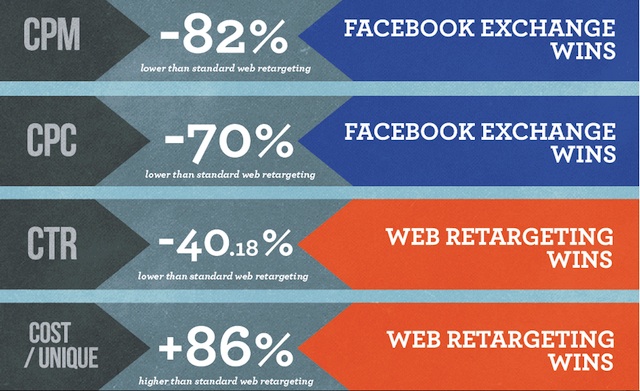

What did AdRoll find? Well, some of the costs for advertisers were much lower on Facebook Exchange campaigns — CPMs (cost per thousand impressions) were 82 percent lower, while CPCs (cost per clicks) were 70 percent lower. However, clickthrough rates were 40.18 percent lower on Facebook than on the Web, and Facebook Exchange ads also had an 86 percent higher cost per unique.

“There were some things that we expected, like the lower CPM and CPC on FBX, but other things were surprising,” said President Adam Berke in an email interview. “In particular, the fact that the cost per unique user is actually better in standard web retargeting. This basically tells us that you can reach highly engaged users very efficiently at a low CPC on Facebook, but you really need to tap into the rest of the web to reach as much of your valuable retargeting audience as possible.”

That ties into Berke’s larger message: That it might be “tempting to overweight FBX as percent of media spend” based on the initial data, but that temptation should be resisted. (For example, Triggit reported more consistently positive results on Facebook, and said that’s where it’s betting its business.) Backing that up is another data point from AdRoll that there was only an 8.3 percent overlap between the audiences reached by the Facebook campaigns and the web campaigns.

“No doubt that based on the performance of FBX, it’s a crucial component of a retargeting campaign,” Berke said. “However, you don’t want to forget about the rest of the web.”

You can read more about AdRoll’s data here.

Update: There are two comments on this post that are worth bringing up into the post itself. First, from AdRoll’s Jonathan Lau:

To clarify, we’re not cautioning against using FBX. In fact, we’ve found the performance to be a boon for most of our advertisers, and people are implementing at an astonishing rate and growing their budgets.

Over the past 6 months, we’ve run over 1,000 FBX campaigns for 700+ advertisers – over half of our total impressions come from FBX and almost half of our clicks do as well. We have seen better CPAs and ROI from FBX campaigns, but the total return is larger when both types are used.

As our blog post mentions, we found that standard web retargeting is still a crucial component of a holistic retargeting strategy – using only one type of retargeting is leaving money on the table.

(I’ve actually tweaked the headline of this post — it originally read “AdRoll Warns Against Betting Too Heavily On Facebook’s Ad Exchange” — and the first paragraph, since some people seemed to be interpreting them as an all-out slam against Facebook Exchange, as opposed to a “don’t put all your eggs in one basket” statement. Other than that, I believe I have accurately represented my discussions with AdRoll.)

And from Triggit’s Christina Park:

Maybe it’s not worth it for SMB advertisers (which AdRoll focuses on), but for large advertisers and agencies (which is the segment Triggit focuses on), FBX works best for direct response marketers that see millions of monthly unique site visitors and thousands of items in their product catalogues. We did find the exact same 8.3% stat (8.25%, actually) and definitely agree that retargeting on both FB and traditional display exchanges is good practice since people use the internet differently. But I think AdRoll’s interpretation of this stat along with the rest of their data is frankly just whack. If CTRs are higher elsewhere but CPCs on FBX are 82% lower, then it’s still a better deal to pay for a cheaper ad on a high quality inventory source for a cheaper click in finding unique users you didn’t find anywhere else on the web.

With regard to the higher cost per user stat… doesn’t it just mean that the internet is bigger than Facebook? Why is that surprising to anyone? To put it another way, you can find more unique users on FBX than off of FBX up to a certain point. Obviously there are still more people on the internet than there are people on Facebook, so after a certain point you’re going to hit a higher cost/unique user on Facebook (especially if it’s not at full volume) compared to the REST OF THE INTERNET. Sounds like this was a manipulation of the data to support a business model that was working before FBX came along…