Yandex, the “Google of Russia” that runs the country’s dominant search engine along with a number of cloud-based apps, has just announced its quarterly and full-year earnings. And while the company saw one setback in its efforts to expand its presence internationally and on to new platforms like mobile, the mainline figures show that the company continues to grow. In the quarter that ended December 31, 2012, Yandex pulled in $290.4 million in revenues (8.8 billion roubles), a rise of 37% compared to the same quarter last year, and beating analyst expectations of $286 million. Full-year revenues are $955 million for the company, up 44% on 2011.

Net income for the quarter was 3.0 billion roubles ($97.6 million), a rise of 35% compared with the quarter a year ago.

The volume of searches being conducted by Yandex are growing at a nice pace compared to others in the market — recently passing Microsoft’s Bing to become the world’s fourth-biggest search engine, according to comScore. But looked at another way, Yandex’s domestic (Russian) search share has largely stagnated over the last couple of quarters. Currently it is at 60.5%, around the same mark that it has been on average over the last five quarters.

This is part of the reason why Yandex has been working hard to develop more products and services for people to use, and in more markets beyond simply Russia — as with Google, these extra channels become conduits for more ads. In Yandex’s case, this has seen the launch of services like Yandex Maps outside of Russia (and specifically Turkey), a Dropbox-style cloud storage service available internationally, Yandex.disk, and a number of apps, including the ill-fated but nice-looking iOS-based social/locaal discover app Wonder, launched only in the U.S.

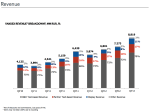

As with Google, the lion’s share of Yandex’s revenues comes from advertising that it runs alongside its services. The main one of these is search. While the company continues to make headway in its search traffic, revenues from text-based search ads, Yandex’s biggest sales generator, actually accounted for a smaller part of declined slightly over last quarter, although they were offset by a rise in display ads:

Another trend to watch is how Yandex continues to try to grow its network beyond its own holdings. A couple of weeks ago we saw that AOL, another media company that makes revenues from online ads, was growing the amount of ads that it was running on third-party sites. The same goes for Yandex: the company still counts third-party as a small proportion of revenues compared to Yandex’s own properties — 6,181 million roubles versus 1,482 million roubles — but that’s growth of 41%, the highest of any of its ad segments. For the full year, the growth of third-party was even stronger, at 68%.

Release below.

Yandex Announces Fourth Quarter and Full-Year 2012 Financial Results

MOSCOW and THE HAGUE, Netherlands, February 19, 2013, Yandex (NASDAQ: YNDX), one of Europe’s largest internet companies and the leading search provider in Russia, today announced its financial results for the fourth quarter and the full year ended December 31, 2012.Q4 2012 Financial Highlights

Revenues of RUR 8.8 billion ($290.4 million1), up 37% compared with Q4 2011

Ex-TAC revenues2 (excluding traffic acquisition costs), up 36% compared with Q4 2011

Income from operations of RUR 3.1 billion ($102.3 million), up 19% compared with Q4 2011

Adjusted EBITDA3 of RUR 4.3 billion ($140.1 million), up 30% compared with Q4 2011

Operating margin of 35.2%

Adjusted EBITDA margin2 of 48.2%

Adjusted ex-TAC EBITDA margin2 of 57.5%

Net income of RUR 2.7 billion ($88.6 million), up 27% compared with Q4 2011

Adjusted net income3 of RUR 3.0 billion ($97.6 million), up 35% compared with Q4 2011

Net income margin of 30.5%

Adjusted net income margin2 of 33.6%

Adjusted ex-TAC net income margin2 of 40.1%

Cash, deposits and investments in debt securities of RUR 27.2 billion ($895.3 million) as of December 31, 2012

FY 2012 Financial HighlightsRevenues of RUR 28.8 billion ($947.1 million1), up 44% compared with FY 2011

Ex-TAC revenues2 (excluding traffic acquisition costs), up 41% compared with FY 2011

Income from operations of RUR 9.5 billion ($311.2 million), up 34% compared with FY 2011

Adjusted EBITDA3 of RUR 13.1 billion ($432.7 million), up 42% compared with FY 2011

Operating margin of 32.9%

Adjusted EBITDA margin2 of 45.7%

Adjusted ex-TAC EBITDA margin2 of 54.8%

Net income of RUR 8.2 billion ($270.7 million), up 42% compared with FY 2011

Adjusted net income3 of RUR 8.8 billion ($288.7 million), up 46% compared with FY 2011

Net income margin of 28.6%

Adjusted net income margin2 of 30.5%

Adjusted ex-TAC net income margin2 of 36.6%

“Yandex delivered strong fourth quarter and full year 2012 results with robust revenue growth, solid search share and a continuing stream of important innovations,” said Arkady Volozh, Chief Executive Officer of Yandex. “In Q4, we launched key products aimed at improving the user experience, including new mobile apps, personalized search and our Yandex.Browser, which has already captured a considerable share of the Russian browser market. I am also proud to report that, for the first time ever, we became the fourth largest search engine in the world, according to comScore.”The following table provides a summary of key financial results for the three and twelve months ended December 31, 2011 and 2012:

Q4 2012 Operational Highlights

Share of Russian search market (including mobile) averaged 60.5% in Q4 2012 (according to LiveInternet)

Search queries grew 26% from Q4 2011

Number of advertisers grew to more than 213,000, up 22% from Q4 2011 and up 5% from Q3 2012

Rolled out a new search platform code-named Kaliningrad

Launched Yandex.Browser

Launched Yandex.Search app for the iPad

Announced the formation of a Yandex.Money joint venture with Sberbank1 Pursuant to SEC rules regarding convenience translations, Russian ruble (RUR) amounts have been translated into U.S. dollars at a rate of RUR 30.3727 to $1.00, the official exchange rate quoted as of December 31, 2012 by the Central Bank of the Russian Federation.

2 This is a non-GAAP financial measure. Please see “Use of Non-GAAP Financial Measures” below for a discussion of how we define this non-GAAP financial measure. You will find a reconciliation of this non-GAAP financial measure to the most directly comparable US GAAP measure in the accompanying financial tables at the end of this release.

3 Adjusted EBITDA and adjusted net income are non-GAAP financial measures. Beginning with Q1 2012, our adjusted EBITDA and adjusted net income include adjustments for the accrual of expense related to the contingent compensation that may be payable to certain employees through November 2013 in connection with our acquisition of the mobile software business of SPB Software. Beginning with Q3 2012, our adjusted net income includes adjustment for gains from the sale of our equity investments. Please see “Use of Non-GAAP Financial Measures” below for a discussion of how we define adjusted EBITDA and adjusted net income. You will find a reconciliation of adjusted EBITDA and adjusted net income to GAAP net income, the most directly comparable US GAAP measure for both non-GAAP measures, in the accompanying financial tables at the end of this release.