Editor’s note: Mike Moyer is the author of Slicing Pie, a book about implementing dynamic equity splits. Follow him on Twitter @GruntFunds.

Few topics cause more rifts in startup teams than equity splits. Today, the vast majority of equity splits are fixed: set amounts of equity are issued to founders during the early days of a startup forcing them to renegotiate when things inevitably change. For instance, two founders split the equity “50/50” and one does all the work. Then what? Unanticipated changes in the contributions of individual members or the addition and subtraction of employees put team members at odds, each one vying for the largest share they can get of the pie.

However, there is another way that is gaining popularity among bootstrapped startups: the dynamic split. Using a dynamic-split model, entrepreneurs are able to determine exactly how much equity each person in the startup deserves with a level of precision not possible in a fixed-split model. In a fixed-split model, equity decisions are based on what founders anticipate each member of the team will contribute. In a dynamic-split model equity decisions are based on what founders actually contribute.

The dynamic model assigns a relative value to the various contributions from each participant. Time, for instance, is one of the main contributions. The value of an individual’s time is calculated relative to the other members of the team. A senior-level Oracle programmer’s time is more valuable relative to a recent college grad, for example. Other contributions include cash, intellectual property, facilities, supplies, equipment and even important relationships with potential customers or investors. A relative value can be set to each contribution (a list of relative value calculations can be found here).

The dynamic model determines the appropriate percentages by dividing the contributions of one individual by the contributions of all the members of the team. This provides an exact calculation of ownership based on a person’s actual influence on the organization.

Unlike a fixed-split, the dynamic model changes over time as additional contributions are made making it easy to add or subtract team members as needed. Because all values are relative, the model ensures fairness for all participants regardless of their contributions. Those who contribute the most will get the highest rewards.

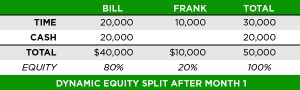

Take, for example, a small tech startup with two founders. Bill is a seasoned salesperson with 20 years’ experience and a well-developed personal network; and Frank is a young, talented developer. Bill and Frank decide that Bill’s “market value” is probably twice what Frank could get. They set Bill’s hourly rate at $200 and Frank’s at $100.

Additionally, Bill invests $5,000 cash into the company to pay miscellaneous expenses. Cash has a higher relative value than time because it’s much harder to save $5,000 than it is to earn $5,000 (not to mention that all startups need cash). They set the relative value of the cash at four times the actual value. This reflects the importance of the cash and the risk that Bill may lose it all.

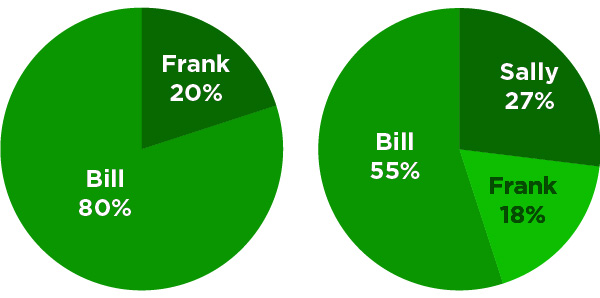

At the end of the first month in business Bill and Frank have each worked 100 hours. So, Bill has contributed $20,000 in time and $20,000 in cash ($5,000 times four). Frank has contributed $10,000 in time. So, the total “value” of the firm is $50,000. Bill owns 80 percent and Frank owns 20 percent. Note that the dollar value isn’t an actual reflection of the firm’s value; it simply serves as a way to track the relative value of each person’s contribution (we hope it will be worth much more!)

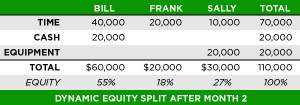

The following month they hire Sally, another developer. They set her hourly rate at $100 because her skills and experience are similar to Frank’s. Sally also contributes some equipment valued at $10,000. They agree that the equipment isn’t the same as cash, but it’s still more valuable than their time. They value the equipment at twice the cash value ($20,000).

The following month they hire Sally, another developer. They set her hourly rate at $100 because her skills and experience are similar to Frank’s. Sally also contributes some equipment valued at $10,000. They agree that the equipment isn’t the same as cash, but it’s still more valuable than their time. They value the equipment at twice the cash value ($20,000).

Each team member works 100 hours during the next month. Bill adds $20,000 to his existing $40,000, Frank adds $10,000 to his $10,000 and Sally contributes $10,000 in time plus $20,000 in equipment. Now the total “value” of the firm is $110,000. Bill owns 55 percent, Frank owns 18 percent and Sally owns 27 percent. The dynamic model has easily accommodated the new participant and percentages have adjusted fairly. What Bill owns is a perfect reflection of what he contributed; likewise for Frank and Sally. Bill and Frank have a lower ownership, but they are still happy because the value of the firm has increased.

The equity split will continue to adjust during the formation stages of the company. By the time the company is ready for a significant investment their team will be more settled. Investors will enjoy the benefit of a clean cap table that treats everyone fairly. If the company chooses not to seek outside investment the cap table provides a tool for distributing profits or dividends.

The equity split will continue to adjust during the formation stages of the company. By the time the company is ready for a significant investment their team will be more settled. Investors will enjoy the benefit of a clean cap table that treats everyone fairly. If the company chooses not to seek outside investment the cap table provides a tool for distributing profits or dividends.

The dynamic equity split is most relevant for early-stage companies. The model virtually eliminates equity allocation mistakes that are common with fixed-equity models and allows teams to move forward with perfectly aligned interests. Equity programs that include traditional options and vesting schedules are better suited for larger companies with less volatility.

The perfect cap table is well within the grasp of any entrepreneur. Implementing a dynamic equity model will accommodate the inevitable changes that companies go through, especially in the early days of a startups life. Traditional fixed models run the risk of unfair equity splits that can cause relationship problems between founders that often lead to the startup’s demise.