After 13 years as a partner at VC Doughty Hanson, Ivan Farneti says he is “returning my badge and my gun” and moving back into the entrepreneurial life. The move had been doing the rumour mill rounds for the last couple of weeks but was only confirmed today. It’s a slightly unconventional move for a previous Internet VC. In a couple of weeks he will take on the new role of Executive Director for… Glory Sport International to promote the “Glory World Series” a new fighting sport brand dedicated to professional Kickboxing.

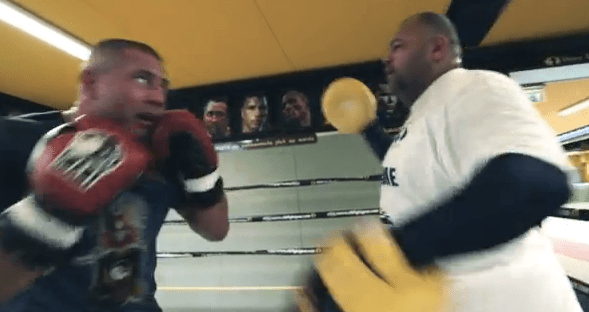

The market leader in this space is the Ultimate Fighting Championship, but Farneti says they plan to “take them on with a differentiated product in live arenas around the world, and different TV formats televised in 200 countries.” Here’s a little taste. Well ok then!

Farneti joined joined Doughty Hanson in 2000 and focused on the Internet and software sectors. He serves on the board of directors of SecretSales (UK) and Handmade Mobile Entertainment (UK) and oversees the investment on Everbridge (US). He previously was a member of the Board of Gomez Inc., the Internet-performance-monitoring company acquired by Compuware (Nasdaq: CPWR) in 2009 for $295 million. He also served on the boards of Tridion, an enterprise content management software company acquired by UK-based SDL Plc in 2007 for $94 million; Plazes, a location software company acquired by Nokia in 2008; and Mobango, a mobile content company acquired by People Infocom in 2010. In 2011 he completed the sale of micro-display manufacturer Forth Dimension Display to Kopin Corp (Nasdaq: KOPN) and in 2012 the sale of privacy data software company Garlik to Experian.

Though Doughty Hanson will no doubt miss him, the move is not a killer blow to the firm by any stretch and was clearly a planned exit. It comes, however, only a few months after DH associate Sitar Teli jumped ship to another (startup) VC, Connect Ventures. It’s another sign that Doughty Hanson is effectively mothballing its early-stage investment activity until it needs to ramp up again – but that time is not now.

This is further evidence that we have entered the beginning of a new startup cycle, with long-time VCs in Europe finding new pastures, the pace of funding announcements slowing and new, smaller/faster VCs springing up. It’s likely we will see fewer IPOs, fewer exits and more ‘nose to the grindstone’ stuff, as existing companies build on what they have and newer companies start to find it harder to raise significant rounds. It’s not quite the “Series A” crunch in Europe, but it’s clear we are at the start of another cycle.