Japan, long called the “Galapagos Islands” of the mobile industry for its cornucopia of sophisticated and unusual feature phones, is finally transitioning to Android and iOS in a serious way. Given the country’s historically high levels of spending on mobile apps and games, it’s becoming a market that Android and iOS developers can’t ignore.

For one, it surpassed the U.S. as the most lucrative market for Google Play last fall.

App Annie, a mobile app intelligence firm that started out of Beijing, took an in-depth look at the Japanese market. Ironically, Japan has had a relatively slow transition to smartphones if you consider how advanced handsets were throughout the last decade. At the end of 2011, only 23 percent of handsets being used in the country were smartphones.

That’s because the carriers like NTT DoCoMo, Softbank and KDDI are extraordinarily powerful. They, like their counterparts in the rest of the world, have historically been the gatekeepers for content. They took a revenue share (although often not as high as Apple’s 30 percent cut) on purchases made through smartphones. That allowed freemium gaming companies like GREE and DeNA to blossom into multi-billion dollar businesses well before we saw similar companies mature in the West.

Like in the rest of the world, the iPhone threatens carrier power. NTT DoCoMo doesn’t partner with Apple. It can’t control the flow or sale of content through the iTunes store, which threatens an important revenue stream for the company. They instead focus on Android, and promote their own carrier stores — called “dmenu,” which is a portal for accessing Internet-based content, and “dmarket,” which is a market offering videos, music, books, and apps.

Meanwhile, KDDI and Softbank have offered the iPhone, and in turn are gaining subscribers at the expense of DoCoMo.

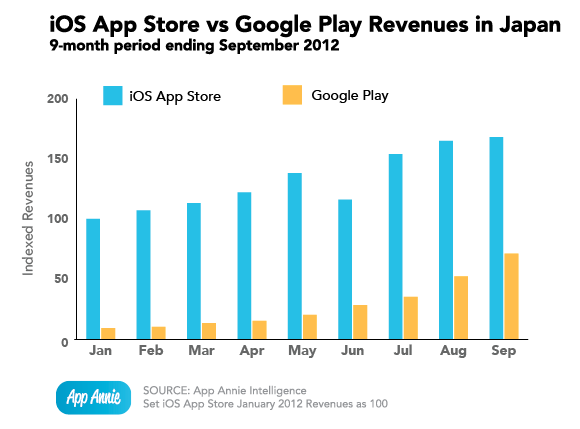

Because of these dynamics, two-thirds of Japan’s smartphone population is on Android, while the other third is on the iPhone. Even in spite of this, Apple’s app store easily beats Google Play on revenue. But this gap is narrowing like it is in other markets.

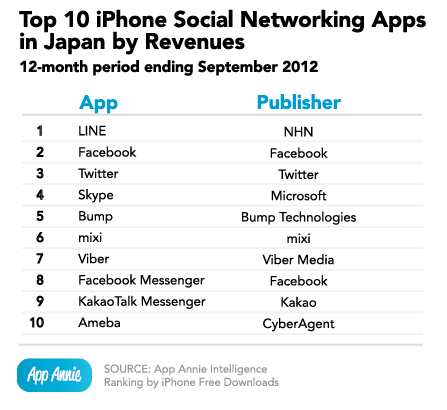

The other thing to note is that Japan is an incredibly hard market to break into. The top five publishers dominate, with nearly one-third of all revenues (and they’re all Japanese). The success that domestic game developers have had in the feature-phone era has crossed over into smartphone, as well. Japanese companies absolutely dominate the local charts in terms of revenue. The exceptions are NHN, which produces the hit messaging app Line, France’s Gameloft and Apple.

The other thing to note is that Japan is an incredibly hard market to break into. The top five publishers dominate, with nearly one-third of all revenues (and they’re all Japanese). The success that domestic game developers have had in the feature-phone era has crossed over into smartphone, as well. Japanese companies absolutely dominate the local charts in terms of revenue. The exceptions are NHN, which produces the hit messaging app Line, France’s Gameloft and Apple.

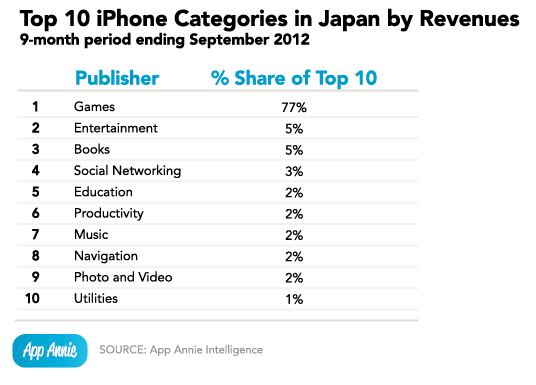

Unsurprisingly, gaming dominates in terms of revenues. This mirrors other countries. Gaming is also the dominant revenue category in the U.S., but it only makes up 59 percent of revenues.

Unsurprisingly, gaming dominates in terms of revenues. This mirrors other countries. Gaming is also the dominant revenue category in the U.S., but it only makes up 59 percent of revenues.

When looking at social networking, which is a category that is usually equal to gaming in terms of time spent, Facebook wasn’t the top app in terms of revenues. That distinction belongs to Line, which recently passed 100 million users and earns revenue through sales of “stickers” or chat emoticons. That business model helped social networking revenues grow 383 percent from January to September of last year.

Facebook’s local revenue would be harder to estimate anyway, since the company is dependent on advertising. Since Apple doesn’t incorporate ad revenues in its grossing rankings, it’s harder for an external observer to guesstimate or back out monthly revenues compared to other ranked apps.