Streaming content giant, Netflix, released its fourth-quarter earnings report today, and it was an auspicious one. The company’s revenue and subscriber numbers well exceeded expectations, with $945 million in revenue for the quarter, up from $876 million last year. These developments have gotten investors excited and Netflix is on the rise after-hours. Part of the reason for this is that Netflix has been aggressively expanding in international markets, with new appendages sprouting up in Nordic countries, Europe and South America, but now it’s beginning to tap the breaks.

While its international subscriber base grew from 4.3 million subscribers in Q3 to 6.1 in the fourth quarter, Netflix said in its letter to shareholders this afternoon that it will not be launching in any additional markets for the first half of 2013. The company is “evaluating several expansion markets for late 2013 or 2014, but has not made any decisions yet.”

The company’s international losses hit $105 million for Q4, an increase from a loss of $92 million in the prior quarter thanks to its launch in Nordic countries. However, the loss still came in below its guidance at $113 million, which Netflix likes to think of as a silver lining.

Because it’s planning to take a breather on international launches, the company naturally expects losses to decline in international markets, as member growth picks up to fill the gap, with an improvement of $18 million expected in Q1 and bigger improvements going forward.

Netflix said, of course, that its launch in the Nordics was “very successful” and confirmed the market opportunity there, before quickly moving on to discuss what it clearly sees as its ace in the hole: Latin America. Having made progress on its consumer payment infrastructure by launching a direct debit payment option with several major banks in Brazil, the company moved on to Mexico, where it’s enabled debit cards, in some cases bank-by-bank.

With over 50 million households paying for residential broadband across Latin America (over half of what it is in the U.S.), Netflix is salivating over the potential opportunity. Netflix also said that “The Hunger Games” continues to be a big hit, most recently in Canada, which followed its debut in Latin America. It will debute in the U.K. and Ireland next, with the U.S. bringing up the rear.

However, while declining losses may spark more short-term optimism from investors, it is also clear that Netflix is beginning to worry more over the increasing competition it’s finding in international markets. Netflix has to wrestle with local broadcasters and distributors for its streaming TV licenses, from piracy and, most notably, the expansion of Clarovideo, Sky NOW TV, HBO Nordics, Amazon LOVEFiLM, Viaplay and others.

Netflix claims that, as of now, it leads the pack in terms of viewing and revenue, but it’s basically asking you to take its word for it. That being said, it does have an increasingly significant international user base (again, now over 6 million), which it believes will help it secure rights to exclusive content and give it negotiating power as it expands in these regions.

That being said, Netflix is now conspicuously beginning to keep its cards closer to its chest and said in its investor letter that it will now be sharing less data by country and region than it has in the past:

Given this heightened competition, we’ll say a little less about country by country results than in the past, to avoid inadvertently helping our competitors. Long-term international success for Netflix is consumer adoption and contribution margins at the levels of our domestic market. Progress towards that can be seen quarterly in our growing international membership and declining international losses.

Not to make a mountain out of a molehill, but Netflix is clearly beginning to feel the heat from the competition. Sharing less data is smart and a measure to protect the business, but the point remains.

Going forward, a big potential upside for Netflix in the short-term will be the launch of the fourth season of Arrested Development (in Q2), which the company expects will provide a bump to its user base. As a result of this, and the recent news of its exclusive content deals, Netflix is forecasting a larger increase in user growth in Q2.

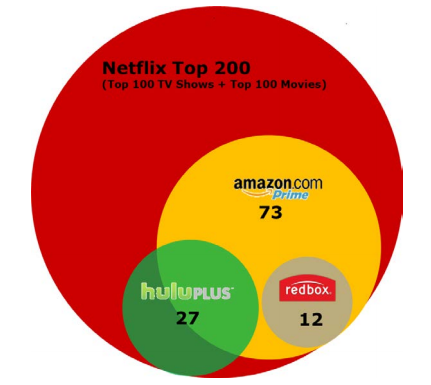

The other key to Netflix’s growing (or declining) market share is (and will be) its breadth of content. In an effort to examine domestic competition, Netflix compared its top 200 (or most popular) titles to Amazon Prime, Redbox Instant and Hulu Plus. Of those 200 titles, 113 of them are not offered by any of the three competing platforms.

More from Netflix here and infographic below:

Of the 87 that are available on at least one of these services, Hulu Plus offers 27 of the 200; Amazon Prime 73 of the 200; and Redbox Instant 12 of the 200, with significant overlap in TV between Hulu Plus and Amazon Prime, and in movies between Amazon Prime and Redbox Instant. In other words, when it comes to the most popular content with members on Netflix, none of these services are good substitutes to Netflix.