Green Dot, a Sequoia-backed company that focuses on pre-paid debit cards and eventually went public two years ago, just unveiled a new banking account that can be registered entirely from a smartphone. The team that came from the $43.3 million acquisition of location-based social network Loopt was behind the product, called GoBank.

It’s available today in a limited beta launch. Just like any other bank account, deposits are insured by the FDIC. But you can sign up for it directly from a mobile phone using your name, address, social security number, e-mail address and phone number. While Green Dot has historically focused on pre-paid cards sold at retailers like Walmart, GoBank could introduce the company to a new kind of clientele.

“There are hundreds of millions of people with bank accounts and smartphones and some of them are looking for better options without all of the fees,” said Sam Altman, who joined Green Dot and became its executive vice president for mobile after co-founding Loopt. Green Dot currently has 4.4 million active accounts on the pre-paid card side.

GoBank has taken a page from Humble Bundle, another Sequoia-backed company, that experiments with pay-what-you-want pricing for packages of games, software or music. GoBank lets you decide what you want on your monthly checking fee to be on a sliding scale for up to $9. They don’t know what the ultimate median price will be, but early tests suggest that people will end up paying around $2 to 3.

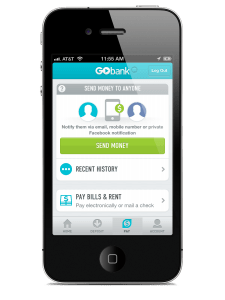

GoBank won’t have overdraft fees, penalty fees, minimum balance requirements, or required monthly fees. There are other little perks like the ability to easily send money to Facebook friends (who will either need a Paypal or GoBank account to receive money).

On top of that, they’ve made it easy to check your balance using the slide to unlock feature in the app log-in’s screen (see below).

Then there are standard features which are common to other banking apps like the ability to mail paper checks to people from the app or depositing checks by snapping photos of them. Then there are notifications and alerts for specific kinds of transactions.

Another feature called the “Fortune Teller,” helps consumers decide whether to buy items if it fits within their budget.