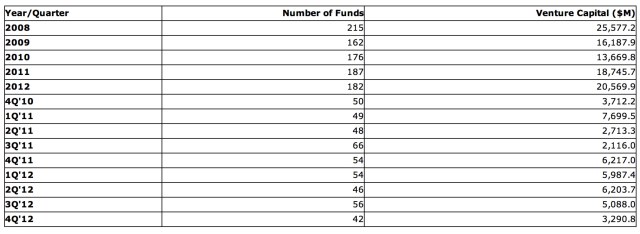

A new report from Thomson Reuters and the National Venture Capital Association released today finds that U.S. VC firms raised $20.6 billion from 182 funds in 2012, representing a 10 percent increase in dollar commitments when compared with 2011, which saw 18.7 billion raised from 187 funds. This is the most capital that VC firms have raised since 2008, which saw $25.6 billion raised, but from a larger number of funds – 215 in total.

(See chart below for more details on historical trends).

In the fourth quarter of 2012, VC funds raised $3.3 billion, a 35 percent decrease by dollar commitments and a 25 percent decrease by number of funds versus Q3 2011, when 56 funds raised $5.1 billion.

In this most recent quarter, the top five VC funds accounted for 55 percent of the total fundraising, the same as the quarter prior.

According to Mark Heesen, president of NVCA, capital is concentrating on two distinct ends of the VC spectrum, and this is where firms are also raising follow-on funds. “The venture capital fundraising environment has settled into a ‘new normal’ which is characterized by a barbell structure of larger funds which are stage and industry agnostic on one end, and smaller, early-stage, industry or region-specific funds on the other,” he noted in a statement, explaining the current landscape.

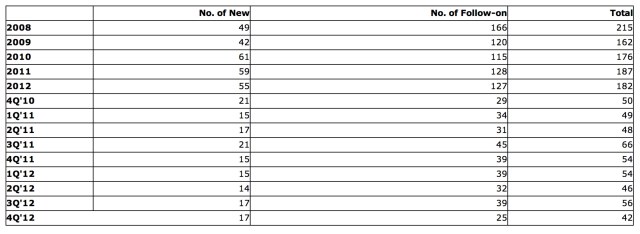

There were 127 follow-on funds and 55 new funds raised in 2012, at a ratio of 2.3 to 1 of follow-on to new funds. In Q4, 25 follow-on funds and 17 new funds were raised, a ratio of 1.5 to 1.

The largest new fund this quarter was Raleigh, NC-based Novaquest Pharma Opportunities Fund III, L.P. with $244.1 million raised. Sequoia Capital Global Growth Fund, L.P. raised the most in Q4 with $700 million. Trailing was Portola Valley, Calif.-based Venture Lending & Leasing VII LLC, which raised $373.1 million.

IPO Dollars Also Up

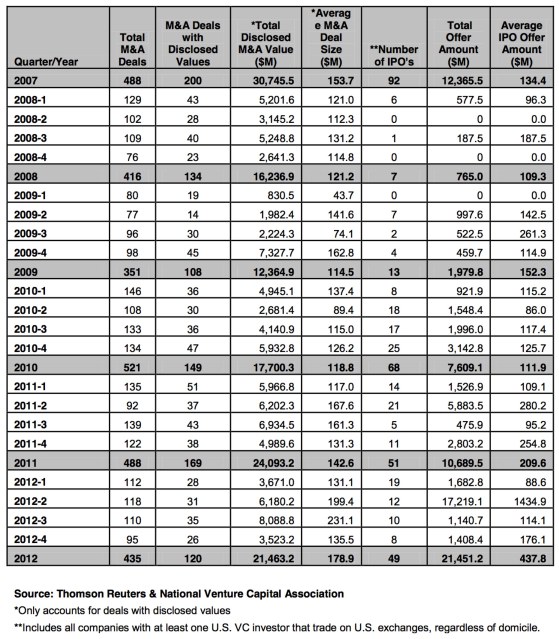

The year-end analysis also found that venture-backed IPO activity raised $1.4 billion from eight offerings valued at $1.4 billion in Q4 2012, a slight decline in volume from Q3, but a 23 percent increase in dollars. Five of the eight were IT-related companies, and seven of the eight were U.S.-based companies. The only exception was China-based online game community YY, Inc.

The largest IPO for Q4 was Workday, which develops HR enterprise solutions. It raised $733 million and began trading on the NASDAQ on Oct. 11. Five companies listed on the NASDAQ in Q4, and three on NYSE. Seven of the eight are currently trading above their offering price.

For the year, VC-based IPOs raised $21.5 billion from 49 listings, representing the strongest IPO period since 2000 in terms of dollars, according to the NVCA, and this was, in large part, thanks to Facebook. Thirty companies listed on the NASDAQ in 2012, and 18 on NYSE. Thirty are now trading above their offer price.

However, although by dollars, IPOs were up, as Heesen noted earlier in January, the year was a disappointment when it comes to volumes.

“The promise of a more robust IPO market driven by a stronger, JOBs Act fueled pipeline never materialized as the market stalled in the third quarter after the Facebook IPO and again as we approached the Presidential election and fiscal cliff in Q4,” he said at the time. “That same uncertainty kept M&A volumes lower as well, as strategic buyers also stood on the sidelines and awaited decisions in Washington.”

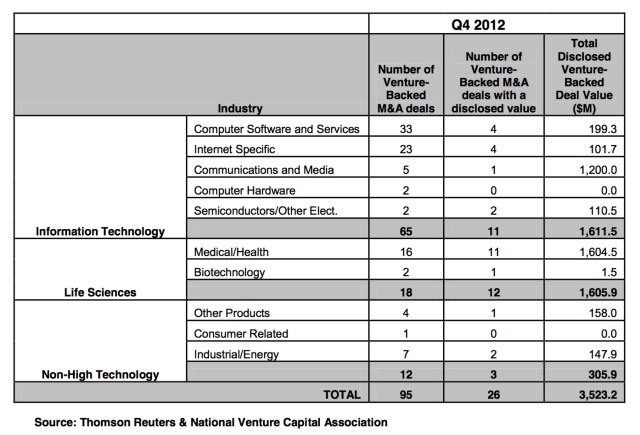

In addition, in Q4, there were 95 VC-backed M&A deals, and the average disclosed deal value was $135.5 million, up 3 percent from Q4 2011. Acquisitions of VC-backed companies also totaled $21.5 billion for 2012, an 11 percent decline from 2011. The largest M&A deal in Q4 was Cisco Systems’ $1.2 billion purchase of Meraki, a San Francisco-based provider of wireless network deployment solutions.

“While the venture capital and startup communities were optimistic about a more robust IPO market in 2012, political, economic, and market conditions served as the backdrop for a series of fits and starts which hurt volume growth throughout the year for public offerings and acquisitions alike,” Heesen said. “Yet, while increased volumes remained elusive, the overall quality of exits this year was quite strong, and certainly sends a message that the market is receptive and open for business in 2013.”