“Last night was an epic event for San Francisco,” says investor Ron Conway, whose advocacy group, sf.citi, championed the successful passage of Proposition E, which changes the San Francisco payroll tax into a tax on gross receipts for businesses in selected revenue brackets. The widely supported proposition was designed so that burgeoning technology startups, which often run without profits for many years, will end up paying less taxes. “The payroll tax was a disincentive to place more jobs in San Francisco,” he explains. So what does this mean for startups? We’ve broken down the numbers and provided a handy calculator so that our startup readers can calculate their own savings.

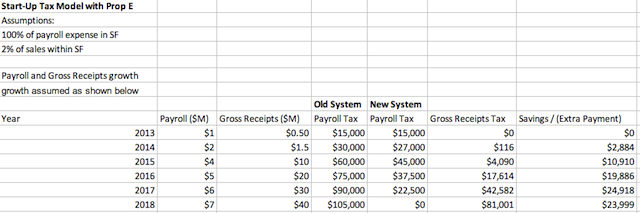

According to Dr. Ted Egan, Chief Economist at the SF City’s Controller’s Office, a typical startup with $1 million in payroll will save around $24,000 a year once Proposition E fully implemented. The law will gradually phase in until 2018. We’ve provided a spreadsheet of projected savings below. You can also access a public calculator on a Google Doc here: