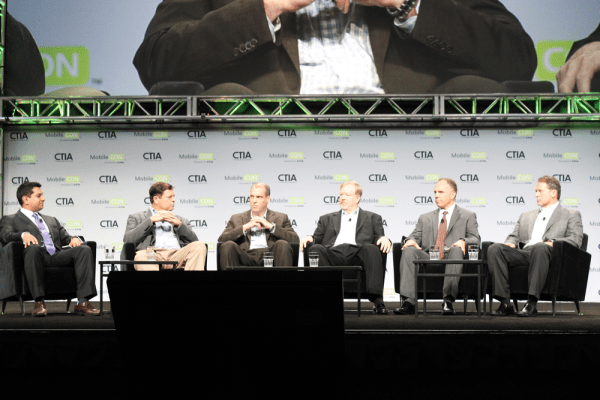

At CTIA MobileCon’s third day keynote in San Diego, a panel of mobile commerce industry leaders discussed the state of mobile payments, the challenges it faces in terms of adoption and regulatory concerns, and where we might be headed next. The bottom line: it’s the wild west out there, and unlikely to gain any clarity any time soon.

The discussion began with a clarification that mobile commerce is actually about far more than just mobile payments – loyalty, rewards, deals and the shop, search and sell pipeline are all involved. But pretty quickly, the discussion turned to focus almost exclusively on payments, which is both a reflection of the participants and their backgrounds (Dekkers Davidson, Head of Mobile Commerce Business for Barclaycard; Ryan Hughes, CMO for Isis; Mike Love, EVP and CTO for Mozido; Dodd Roberts, MCX executive and Tayloe Stansbury, SVP & CTO at Intuit) and the real interesting area and remaining biggest question around how mobile commerce will shake out.

On the subject of mobile payments, the panel was divided about how we’ll see the next few years shake out, and that left participants obviously drawing different conclusions about potential outcomes. Roberts and MCX spoke about the need for a unified, consistent experience across retailers and payment methods, which is essentially the whole point behind its organization. Roberts said they saw mobile payments tech emerging in a “clunky” manner, with no harmony across solutions, and noted that “patience for reusing something that doesn’t work well is very thin.” That’s why it’s trying to put together a solution to encourage mass, rapid adoption via a mechanism that works the same everywhere, for everyone, regardless of device or retailer.

That’s an approach that was echoed by Isis, the carrier partnership that’s also now managed to sign up six handset OEMs, four payment terminal manufacturers and four issuing banks. Hughes said that forming those kinds of partnerships (a herculean task he called “convening an industry”) are “table stakes” for even getting into the mobile payments game – obviously a big boy table attitude that likely wouldn’t have been very welcome at startups like Square in the early days. In fact, Hughes said that over-the-top solutions that are “just an app” aren’t going to cut it anymore in the evolving m-commerce space.

By contrast, Barclaycard’s Davidson expressed a much more open view of the market that doesn’t necessarily see anyone taking the reins and becoming an overarching control point. Shopkick, he noted, was one example of a mobile commerce startup that’s interesting, and while it looks like a competitor now, could present as an ideal partner down the road. He emphasized that looking out for those opportunities and taking a more experimental approach, is more what the market needs right now than any one initiative angling to be the so-called overall “winner” of the mobile payments industry. Davidson said that while this may “frustrate” those looking for a winner-take-all solution conclusion, it’s going to be better overall, and he noted we probably won’t see the space settle for at least another five to eight years.

Technical and software standards aside, everyone at the panel seemed to agree that government regulation be unable to really tackle the fast-moving mobile payments space in a way that’s appropriate to the multitude of methods involved. Instead, Intuit’s Stansbury said that adhering to established principles for businesses that handle money transport is the best way to make sure things stay secure for users in this “wild west” type of environment. In general, as you might expect from private industry representatives, the feeling was that trying to move too fast or aggressively with government regulations for mobile payments would inhibit innovation, and could ultimately be counter-productive rather than helpful.

In the end, the question essentially came down to whether or not consumers were even having a pain point with existing payment methods, and in need of a new solution. In general the answer was that yes, it does, but the consumer needs to see clearly demonstrated proof of how things will be better with mobile payments for it to move forward. “Nobody ever said they had a problem with the vinyl record,” Hughes said, but they eventually embraced the CD and digital music anyway. Likewise, expect mobile payments to have a watershed moment, but looking for that to happen within the next couple of years could be something of a pipe dream, according to some of those at the forefront of trying to make it happen.