A new Y Combinator-incubated startup is entering the fintech scene today, aiming to disrupt payday loans and consumer finance. LendUp, is leveraging technology to redefine the payday lending experience, bringing a new level of innovation and transparency to an industry that desperately needs disruption. And the San Francisco-based startup is launching today with funding from an impressive group of VC firms and angels including Y Combinator, Kleiner Perkins, Yuri Milner’s Startfund, Andreessen Horowitz, Google Ventures, Thomvest Ventures, Kapor Capital, Bronze Investments, Founders CoOp, Data Collective, Garry Tan, Harj Taggar, Alexis Ohanian and others.

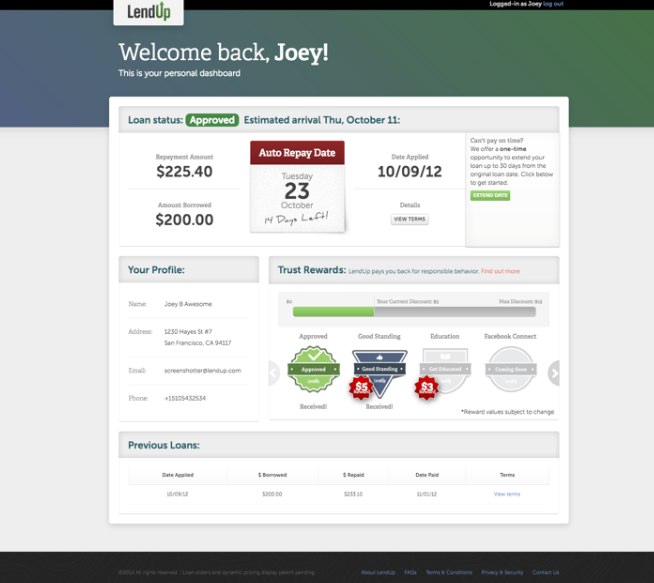

At a basic level, LendUp is direct lender and has created a way to use small-dollar loans as an opportunity for consumers to build credit and move up the financial ladder. Consumers who have poor or no credit can apply for and receive small-dollar, short-term loans (up to $250 for up to 30 days). But it doesn’t stop there. The company’s mission is to use small-dollar loans as a way to help customers build credit and move up the financial ladder.

As the startup explained to be, last year alone over 15 million Americans took out payday loans, borrowing a total of $45 billion dollars. Many of these Americans are unbanked, meaning they don’t have any credit and can’t use the traditional financial outlets for loans and cash. But most of these payday transactions are a simple fix, and the cycle of poor or no credit continues. Many end up trapped in long-term debt caused by hidden fees, costly rollovers and opaque terms and conditions. Credit agencies don’t acknowledge the payday loan, so even if consumers pay them on time, they don’t receive the positive marks on their credit report.

LendUp prides itself on no hidden fees, no rollovers, lower interest rates, exceptional customer service, instant loan decisions, and an open platform. The company has a selective lending process that uses risk analysis and only approves 15% of applicants, but partners with non-profits to more optimal solutions for the 85% of applicants the startup can’t help. LendUp says that it uses data analytics, a new type of risk model that utilizes non-traditional data sources like social media to make decisions.

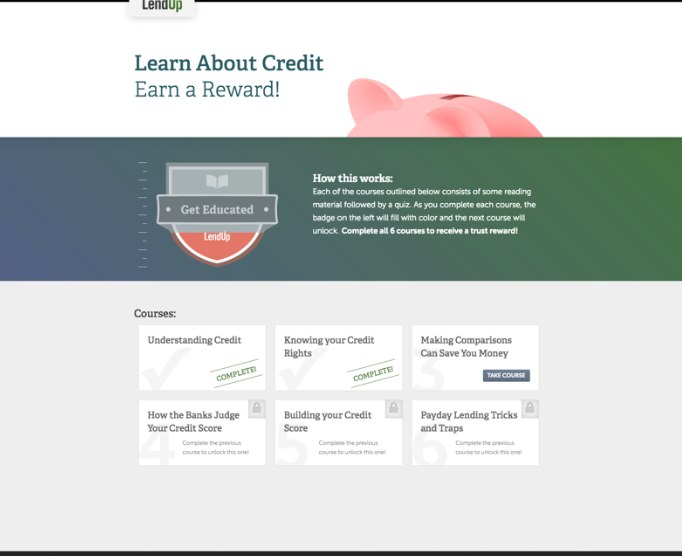

For those who do qualify, LendUp starts with a fee of 15 percent of the loan amount. But that fee can be lowered and discounted for repaying the loan early, and by taking educational courses on the platform on good credit, financial planning and more.

LendUp takes it one step further. The company has developed a predictive model to see if these users will be able to be better financial candidates, and if they show good payments behavior, take the online credit courses, LendUp will graduate them up to a type of loan that a bank or credit agency would consider as a real product. And the consumer can start actually developing a credit history. Already customers who are testing LendUp are improving their credit.

For background, the company’s founders are two stepbrothers from Oakland, CA. Sasha Orloff worked at the Grameen Bank (whose founder won the 2006 Nobel Peace Prize), The World Bank, and Citigroup. Jacob Rosenberg was the 80th employee at Yahoo and CTO of Platform at Zynga.

As the Orloff brothers explained to me, the company seeks to differentiate itself from companies like Zestcash by creating an actual ladder for the unbanked to gain credit and use traditional financial resources and instruments.