With Apple and Samsung still duking it out in the patent courtroom, a survey of U.S. consumers conducted by Morpace has taken a look at how the dispute is playing out among the gadget-buying public. Apple, it found, comes out pretty rosy, but ultimately the survey delivers some discouraging conclusions about where cases like these are taking the mobile industry overall.

Last week, a study from Localytics noted that sales of Samsung’s latest device, the Galaxy S3, have actually being doing quite well since Samsung lost a $1 billion patent verdict to Apple in August — growing on average about 9 percent every week, including the one where the iPhone 5 was launched. So it is a little surprising to see that according to Morpace’s results, general consumers are now showing more skepticism about the Samsung brand as a whole.

According to responses from 1,000 adult consumers — Morpace says that it matched these to U.S. Census demographics data to get a complete snapshot — Samsung had a 12 percent net decline among consumers “likely” to consider buying a Samsung smartphone or tablet, a decline that was softened to 6 percent when looking only at people considering purchases.

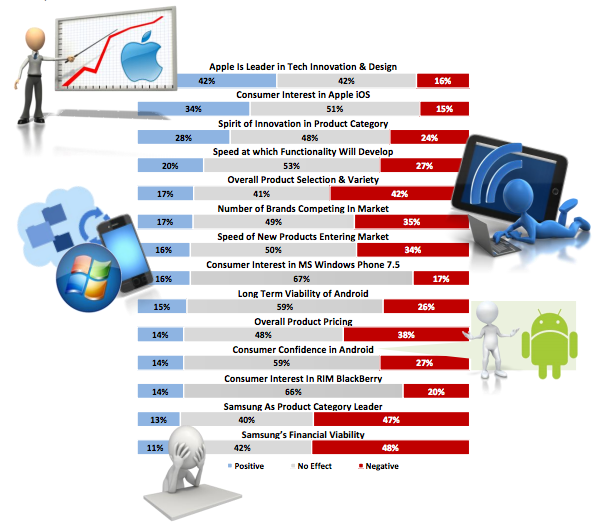

Respondents also believed that the patent ruling had a mostly-negative (47 percent) impact on Samsung’s long-term competitive position in smartphones and tablets, as well as its long-term viability as a mobile device maker (48 percent of respondents called the patent ruling impact “negative”).

Apple, meanwhile, got the reverse treatment. It had a 9 percent net increase in the number of consumers “likely” to buy an Apple smartphone or tablet, with that number increasing to 22 percent among those preparing to buy a device.

Apple also had a mostly positive response for being perceived as a leader in technology and design as a result of the $1 billion patent verdict, with 42 percent of respondents deeming the verdict had a positive impact on Apple’s leadership in these areas. Morpace notes that when looking only at those who intend to purchase smartphones or tablets, or have influence on purchasing decisions, 48 percent thought of Apple as a technology and design leader.

The two caveats here are that the conclusions in the survey are opinions rather than fact, and that these are responses given relatively soon after the $1 billion patent verdict. Samsung at the moment is the world’s largest handset maker and the world’s largest smartphone maker. So questioning its longer-term viability based on the negative outcome of one patent case may be just a little out of proportion. And consumers may be likely to change their opinions with new product launches.

On the other hand, consumer perception counts for a lot when looking at what drives sales to one handset maker or another — sometimes even despite the quality of the handsets in question (just ask Nokia, which has found it hard to reach any kind of critical mass with its new Lumia devices, despite some positive reviews).

And it is striking to me how much of an impact a patent case can have in this regard. Some 70 percent of respondents had heard of the Samsung/Apple patent disputes, with that number increasing to 77 percent among those who are planning to buy a smartphone or tablet in the next six months.

Whether the public has it right with Samsung’s market position under threat or Apple as the true technology and design leader, another set of issues to consider is how the patent issue has impacted consumers’ view of the smartphone market in general.

When considering the range of devices on the market, 42 percent said this would be impacted negatively by the Apple/Samsung patent case, and 35 percent thought that the number of handset makers was also going to be reduced. In other words, consumers think we will be seeing fewer handsets as a result of the verdict; not more.

Specifically, only 14 percent had a positive view of consumer confidence in BlackBerry or Android. And only 16 percent had a positive view of Microsoft’s Windows Phone 7.5.

When considering price, 38 percent thought this too would be impacted negatively, meaning they believe phones and tablets are going to get more expensive as a result of all of this.

And — as you might expect with fewer devices, fewer players and higher prices — consumers also believe that we will enter a period of less innovation in devices. Some 27 percent think new features will be impacted, with only 17 percent thinking this will have a positive effect on innovation.

Coming from another angle, the patent industry’s negative impact on innovation already appears to be well in place. Last year, both Apple and Google actually spent more on patent litigation and patent purchases than they did on R&D, according to this article from the New York Times.

Again, these are just opinions — not facts as such — but when buyers have such a negative take on the overall landscape, at a time when mobile sales are seeing an overall slowdown, you have to wonder whether the net effect of these cases is a loss for the market as a whole. That’s something all of them — including the so-called winners and losers — need to consider.