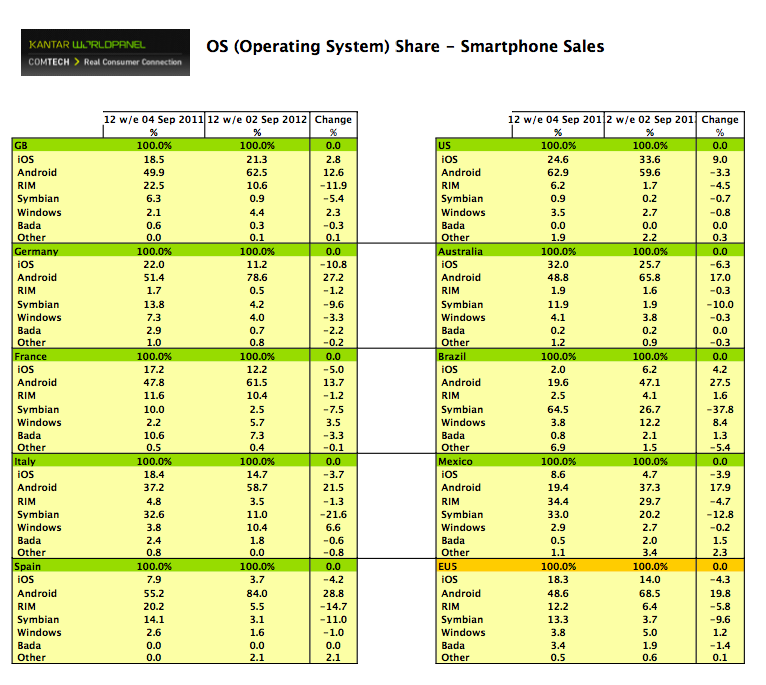

Kantar Worldpanel ComTech, the WPP-owned market research group, today released its latest 12-week smartphone sales figures across the key markets in Europe, the U.S. and elsewhere, and the figures show that Microsoft’s Windows Phone platform is definitely making some progress, and in at least one case, in Italy, overtaking RIM as the fourth-largest smartphone OS in terms of actual sales. But it has a long way to go before getting enough critical mass to challenge the combined dominance of Google’s Android and Apple’s iOS in the smartphone race. Combined, the latter two are currently accounting for 93% of sales in markets like the U.S.

Kantar Worldpanel analyst Dominic Sunnebo tells TechCrunch that smartphone penetration in the UK is now at 57.6%, while the U.S. penetration is 42% (that includes both prepaid and postpaid).

What’s telling is that it’s the lower-end devices such as the Lumia 610 that appear to be driving sales in markets where it is doing well, according to Kantar Worldpanel, rather than the high-end, high-price flagship handsets. This trend of lower-end Windows Phone models driving sales is something that we have also been hearing from Gartner, which says that despite the introduction of Windows Phone 8, it will be the older WP7 (and lower-cost handsets) that will be doing the heavy lifting when it comes to sales volumes.

Kantar Worldpanel notes that this trend was played out in Italy, France and the UK, where WP market share respectively grew by 6.6% in Italy, 3.5% in France and 2.3% in Great Britain. Among those, Italy now stands as one of Windows Phone’s strongest markets, relatively speaking: it accounted for 10.4% of all sales in the last 12 weeks, which doesn’t sound like much, but it was enough to push it past RIM, which accounted for only 5.5% of sales and declined by 14.7% over last year. Surprisingly, if trends continue into the next 12 weeks — unlikely though given the launch of the iPhone 5, but who knows — Windows Phone might even be able to surpass Apple in the Italian market. Apple accounted for 14.7% of sales in the last 12 weeks but that was actually a decline of 3.7%. Italy’s not a massive market in world terms, but could be a key symbolic achievement.

Italy, on the other hand, may be marching to the beat of a different drum. Symbian is still selling more than Windows Phone or RIM, taking 11 percent of all sales in the period. However, it is declining percipitously fast, with numbers down by nearly 30% over last year.

And Sunnebo also points out that even if WP is having a good run in Italy, it’s still pretty small in Europe, at just 5% in the big-five markets, compared to Android/iOS share in that region at 82.4%.

Indeed, in other progress on the Kantar Worldpanel tables — and perhaps more of the issue than beating a challenged RIM for companies like Microsoft and Nokia — is that the strong simply appear to be getting stronger in Europe. Samsung accounted for 48% of all smartphone sales across the big-five European economies, with Android overall taking 68.5% of all sales, a rise of nearly 20% over last year. The story, however, continues to remain a slightly challenged one for Android over in the U.S. There Google’s OS accounted for nearly 60% of sales — so still quite a lot — but as with last month’s figures, Android’s share is still declining, this time by about 3.3%, with Apple once again growing its share.

The big question is whether we should be looking at the U.S., or Europe, as a bellwether for the wider market. My personal guess is that both are significant: we’re seeing a growing split, with Android getting ever-stronger in the low-cost smartphone division, and Apple getting better at cornering the high end, a position it’s likely to continue to hold in the next set of figures, which will include sales of the iPhone 5. That’s partly borne out by the fact that in Brazil and Mexico, Android saw some of its very highest gains, respectively growing share of sales by 47% and 37%. Although Apple’s been effectively creating “low end” handsets by continuing to circulate older models at lower prices, it remains to be seen whether the company decides to extend that to actually launch “nano” new handsets intentionally pared down and costing less to target emerging/developing and more price-sensitive markets more directly.