One of the more interesting paradoxes of the last five years on the consumer web has been how small teams of developers have been able to build products that reach tens or hundreds of millions of users. Yet few, if any of those users, get to own equity in the companies that they contribute so much to ahead of a large liquidity event like an IPO.

Loyal3 is hoping to start changing this by allowing consumers to easily buy stock from companies they love directly from their websites or Facebook pages. He said Loyal3 is seamless enough that a transaction can happen in three clicks for as little as $10 without typical brokerage fees.

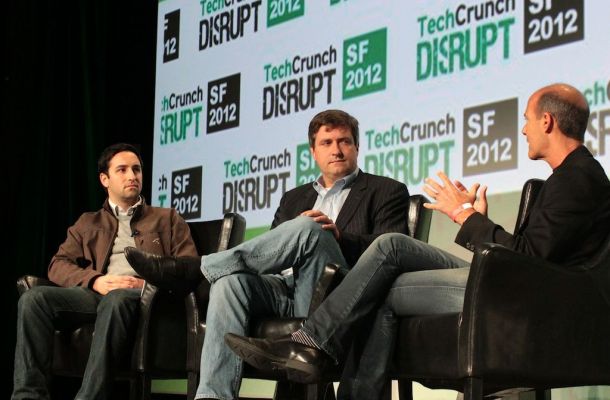

“Ownership is the ultimate like and it changes everything,” said CEO Barry Schneider on-stage at the TechCrunch Disrupt conference in San Francisco. He said that stock ownership is a relatively limited phenomenon in the U.S. Only 18 percent of Americans actually invest in companies and if Loyal3 can lower the barriers to entry of ownership, it may ease access to capital for many more companies.

“That’s going to create a lot of new capital formation,” he said. He added, “You’re an orphan company if you’re not doing a $100 million IPO or more. So when you’ve got a platform like ours that can bring new capital to the marketplace…, that’s going to make it easier for companies to go public.”

Loyal3 works with publicly-traded companies on creating a Customer Stock Ownership Plan or CSOP. In a CSOP, a company pays the brokerage fees on behalf of the investor because it might want to have more of a connection and more loyalty from its shareholders (in contrast to dealing with day traders, high-frequency trading algorithms or other types of activist shareholders). A customer that loves the company’s product might be more inclined to stick around during a difficult patch, for example.

There is actually even a company that is going into an IPO on the Loyal3 platform. (The company didn’t disclose which one.)

In a so-called IPO CSOP, a company would give its customers the ability to invest on the same terms that the IPO underwriters’ wealth management clients get. In highly hyped IPOs, it’s practically impossible for a regular retail investor to get in on the initial price that better-connected, wealthier investors or bigger funds get. It’s one of the reasons Google opted to do an unusual reverse auction in its 2004 IPO. Facebook shied away from such an unusual approach in its May debut.

Loyal3 spent months with the Securities and Exchange Commission working through all of the rules and regulations to make this happen. Considering this and the recent passage of the JOBS Act, it’s a fascinating moment for equity ownership in pre-IPO companies. Secondary markets are maturing for growth-stage companies and there are plenty of crowdfunding startups waiting in the wings to see how the SEC’s interpretation of JOBS Act’s crowdfunding provisions play out.

But Schneider was a little concerned. He said the JOBS Act is stripping away many hard-won investor protections like Sarbanes-Oxley regulations on accounting and more historical financial data in initial IPO filings.

“We need to have a balance,” said Schneider, “If investor protections go back up, access to capital goes back down. But we should be able to do both.”

Moderator and TechCrunch co-editor Eric Eldon asked about the risks of losing money on the Loyal3 platform. It’s the same risk like if you were investing in non-CSOP, publicly-traded companies. All of the same, old investing advice — like Caveat Emptor — still applies.