Samsung Electronics has been knocked hard on mobile phone design innovation in the last few days, but in what might be a spectacular display of diversionary tactics, it is also doubling down on another significant part of its business — chipmaking. Today, the Dutch semiconductor machine maker ASML announced that Samsung would be investing close to $1 billion — yes, more or less the same amount for which the jury in California held it liable over Apple patent violations on Friday — towards R&D and an equity stake in the business. In doing so, Samsung will be joining Intel, which took a 10% stake in ASML in July for $2.1 billion.

Samsung’s interest in ASML — along with another investor, Taiwan Semiconductor Manufacturing Co.’s — was registered at the time of the Intel investment, and today’s announcement makes a point of saying that Samsung will “commit” the funds. That implies although the deal isn’t signed, sealed and delivered, Samsung was keen to get some news out quickly that pointed to it coming out fighting in the wake of the bad news delivered on Friday.

ASML describes itself as “one of the world’s leading providers of lithography systems for the semiconductor industry.”

The machines it makes, which employs a technique called extreme ultraviolet lithography, can help speed up the production of more powerful and smaller semiconductors — an essential component of smartphones, tablets and other devices. As Samsung pointed out in its internal memo to employees in response to the jury verdict, Apple is one of its most important customers for this part of the business.

Under the terms of the “commitment” announced today, ASML says that Samsung Electronics will put €276 million ($345 million) into ASML’s research and development program over the next five years. The company had targeted total backing of €1.38 billion for that R&D program, and it says that has now been met.

Separately to this, Samsung will also investing €503 million ($629 million) for a 3% equity stake in ASML. In total, Samsung, Intel and TSMC have 23% of ASML, equivalent to €3.85 billion, which will get returned to shareholders in a share buyback scheme.

Provided that Samsung has to pay the full penalties recommended by the jury, and that it follows through on its ASML investment, that $2 billion potentially will weigh heavy on profits in a typical quarter, especially if there are any injunctions attached to the first of those. In Q2, Samsung Electronics made $6 billion in operating profits — essentially, the news of the last couple of days would have wiped out one-third of that.

Worth pointing out that at the moment, the shining star for Samsung is its mobile phone business — which includes its Galaxy line of Android-based smartphones, the same ones that were the subject of the lost U.S. lawsuit. At the same time, its chip business actually declined by 6% in terms of revenue — a sign that Samsung needs to continue investing in the division to keep it in fighting form.

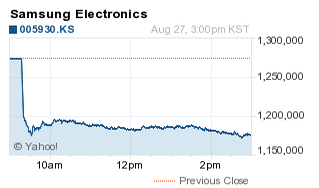

While we will still have to wait and see if Samsung will have to pay up the full amount of damages, and whether it will have longer injunctive effects, the ramifications have already come out in short-term investor activity. Just look at the drop in how Samsung’s stock performed in trading this morning, dropping nearly 8%:

(via Yahoo Finance)