Yes, the nine-figure exits and even acquihire stories certainly do seem glorious in the TechCrunch headlines every day. But what do founders actually walk away with?

It’s often a very different picture when dilution, taxes and retention are factored in.

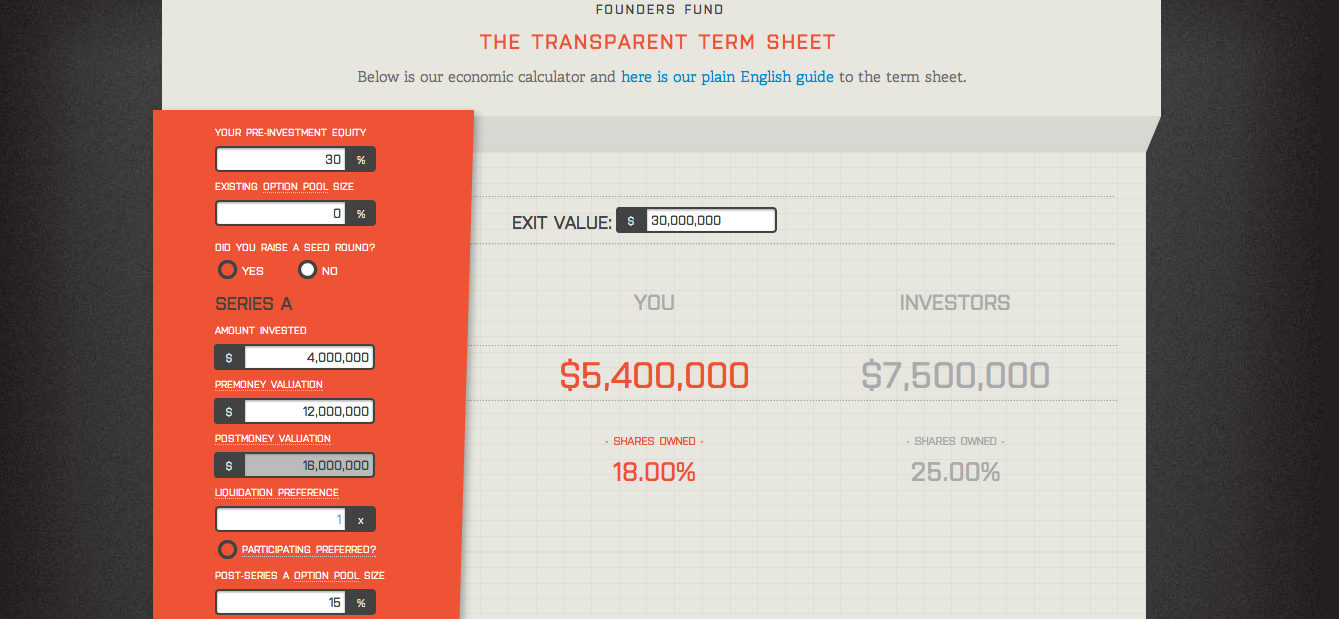

Founders Fund, the irreverent venture firm from PayPal co-founder Peter Thiel and Sean Parker, is shedding light on how term sheets ultimately affect outcomes for founding teams. They’ve created a so-called “transparent” term sheet that calculates how options pools, dilution and liquidation preferences impact returns for founders in different exit scenarios.

“Terms sheets will always be complicated. It’s hard to accommodate 10 years of highly divergent outcomes in a single eight-page document, but term sheets are more complex than they have to be,” said Founders Fund’s growth partner Bruce Gibney. “People can view their obscurity as an opportunity to get away with something. Sometimes VCs will do this. Sometimes the entrepreneurs will do it.”

The term sheet, which was the brainchild of Gibney, is basic for now. But it does replace those complicated Excel spreadsheets that we’ve heard founders often circulate to figure out the math themselves.

It allows you to adjust your options pool for employees, your initial stake in the company and your pre- and post-money valuations based off the seed and Series A rounds. For those less familiar with these terms, the options pool is the equity made available to current and future employees. The pre- and post-money valuations refer to the company’s worth before and after the venture investment. There’s a lengthier explainer here from Gibney, who calls term sheets the “world’s most irritating not-quite-contract(s),” since they don’t legally bind an investor to actually put capital in a company.

The term sheet also lets you change your investors’ liquidation preferences, which lets them demand their capital back or a multiple of their initial investment in the company during an exit. Liquidation preferences are typically 1X, although higher preferences can mean that investors take two or three times their initial investment out before employees and founders even see any returns.

It also looks at convertible debt in seed-stage rounds, letting founders factor in the discount and interest rate on the debt. There isn’t an option though if you have variable or rising caps during your seed-stage round. Some founders like to raise the caps on the company for investors who commit later, rewarding those who take the risk earlier.

The term sheet also doesn’t look at more advanced stages of investment. The thinking is that by the time a company reaches a Series B or later-stage round, they should have enough lawyers and legal advice to evaluate growth-stage term sheets with a critical eye.

Like other younger firms in the valley, Founders Fund has tried to align itself in name and practice with entrepreneurs. This term sheet is a marketing tool that could help them stay atop founders’ minds during fundraising. As the venture business has gotten far more competitive over the last 10 years, many firms like Founders Fund and Andreessen Horowitz have tried to brand themselves as more entrepreneur-friendly by offering value-added services like recruiting or by hiring general partners that have significant operating experience.