Attention mobile entrepreneurs: if you are looking for funding for your big idea, now might be a good time to work in a consumer angle if you haven’t already. According the latest figures from boutique investment bank Rutberg & Co., consumer apps were by far the most popular area for investment among VCs in the first half of this year, accounting for $1.009 billion in value, or just over one-quarter of the $3.9 billion invested in mobile companies worldwide — itself the highest level of mobile investment activity since Rutberg initiated coverage in 2001, and growing by $1 billion over the same period a year ago.

That makes consumer apps the single-biggest area for VC investment at the moment, but the story here is one of quantity of deals, rather than the size of individual fundings: when looking at the 10 biggest investments in mobile, the most valuable investments remain in non-software, capital-intensive areas like devices and carrier infrastructure. The biggest VC deal so far this year has been for Xiaomi Tech, which picked up $216 million in a Series C round from undisclosed investors. The first consumer app in the rankings is Evernote’s $70 million Series D round — coming in at number-seven.

And the next recognizable consumer names are Hotspot Shield makers AnchorFree, at number 10 for its $52 million round; and three tying for number 12 at $50 million: Foursquare; SoundCloud; and Instagram, now being bought by Facebook (pending regulatory approvals).

Indeed, although consumer apps represented 26% of all VC value, it is strength in numbers: they made up 35% of all deals. In all, Rutberg tracked 166 VC investments in consumer mobile apps, out of a total 479 investments in the first six months of the year.

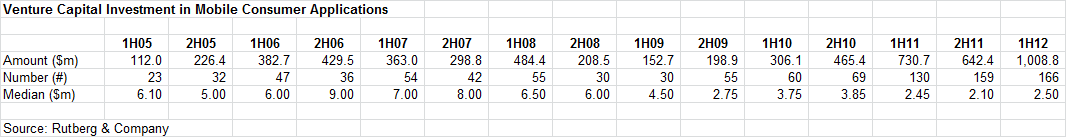

Investor interet in consumer applications, as you can see from the table below, has been rising over the last couple of years — a consequence of the growing popularity of smartphones and tablets and the apps that run on them and other mobile devices like feature phones. But as the number of investments has grown, their mean value has declined.

Whereas the median value of investments in consumer apps prior to the introduction of the iPhone was as high as $9 million in one period (2nd half of 2006), today it is at a much more modest $2.5 million.

This is not a straight dilution in value, though: there has been a rising interest in lower-value seed and other early stage rounds. Rutberg notes that taking the full 479 mobile investments in H1, 61% them had round sizes of $5 million or less. Investors seem to be spreading their investments much more widely, and getting in on the action earlier, these days.

Mobile now represents 46% of all VC investments — so not quite the majority, but the highest proportion of total investments it has had to date.

Just as consumer app interest has grown very steadily, it looks like interest in other areas has been significantly more choppy. Some areas, like telecom infrastructure and semiconductors — once taking a significant proportion of mobile VC funding — appear to have fallen off the radar by quite a lot. That could also have to do with the maturity of the sector: a lot of the building work has been done (for now), and now it’s time to milk those networks for all the revenue they can give.

Update: As one reader points out below, there are some grey areas here. For example, what about companies that offer “consumer mobile” services that are not consumer companies per se — such as Box and Dropbox? That effectively means sometimes it may be problematic to label companies in one category or another, and so, for example, some categories like “enterprise apps”, or even non-mobile-first companies may actually be pulling more money than this report suggests, even if they are not primarily working in those areas. (That kind of supports what I meant in my opening sentence. It’s about angles, with two big ones right now consumer and mobile, as shown by the pattern of investment in them.)

Update 2: Rutberg gives its own explanation for how it categorizes companies. Writes Rajeev Chand, MD and head of research: “In our database, we include companies that are mobile-first, i.e. 50% or more of users, usage, or revenues from smartphones/tablets/wirelessly connected devices. For consumer applications, we include D2C and private label consumer applications. For enterprise applications, we include corporate applications that are designed for use by employees within an company, including IT employees and line employees. Overall, we believe that the lines between mobile and not-mobile are blurring, as everything is mobile to at least some degree today.”

The full slidedeck telling the story is below: