Motif Investing, a vehicle that allows you to invest in ideas, is expanding its offerings today to include the ability to invest in 10 new fixed income “motifs,” which are specialized portfolios of bond ETFs tied to certain macro-economic trends.

As we’ve written in the past, Motif was founded last year to give individuals a new way to invest based on themes. Instead of choosing to buy stock in specific companies, Motif allows investors to invest in different portfolios of stocks, each called a “motif,” that are centered around everyday ideas. For example, motifs can be built around themes and ideas ranging from cloud computing to mobile internet.

With the current market volatility, many investors may want to allocate their money in fixed income products (i.e. bonds), says Motif CEO Hardeep Walia. These Motifs, says the company, are created in the same way stock motifs are built—the company’s investment team searches for real-world ideas and trends that can be turned into investment opportunities. Fixed income motifs track more fundamental economic topics, like inflation, deflation, and AMT. Fixed-income motifs also include up to 30 securities, but they are constructed from bond ETFs (exchange-traded funds).

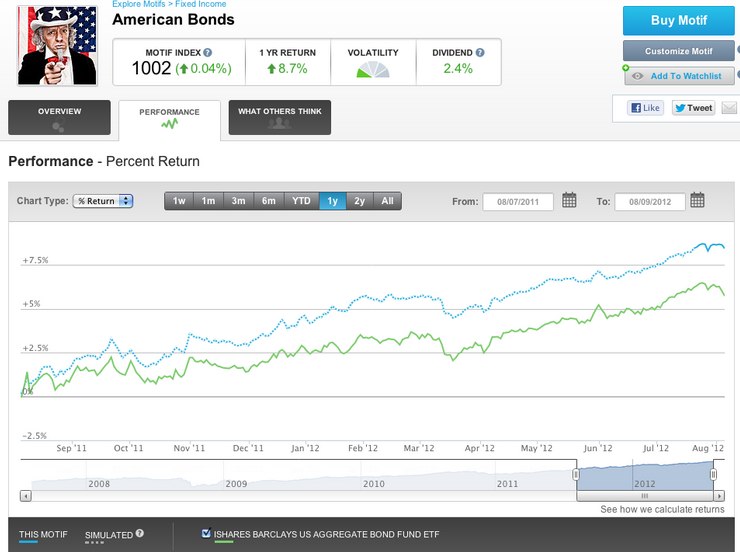

For example, the American Bonds motif includes US government and corporate bond ETFs and sees an average 1-year return of around 7.93%. Investors can also customize their fixed income motifs. An entire fixed income motif can be bought for $9.95. There is a $250 minimum investment per motif but there are no minimums to open an account with the vehicle.

Motif, which officially launched to the public in June, is hoping to attract investors who still want to invest in ideas, but are hoping for more steady returns with their money in the bond market.

And some big names in the finance world are advising Motif. Former Citigroup CFO Sallie Krawcheck is a board member and former SEC Chairman Arthur Levitt is a board advisor.