News Corporation has just reported its quarterly earnings. For Q4 it had revenues of $8.4 billion with earnings per share of $0.32, both down compared to the year before (Q4 2011 the company reported revenues of $9 billion with EPS of $0.35).

The company also reported a net loss of $1.6 billion for the quarter, compared to a net income of $683 million in the same quarter a year ago. The company said the figure included a $2.8 billion restructuring charge for its publishing division, which News Corp. is planning to separate from its entertainment division. That includes publications like the Wall Street Journal and Dow Jones, as well as the Times and the Sun in London, along with educational assets. The company unveiled a new brand, Amplify, for digital content for the K-12 segment, which will also include a venture to create a learning platform for “4G tablets” developed with AT&T.

The earnings per share met analysts expectations, but revenues fell short, with analysts expecting $8.722 billion. Those estimate numbers were down by 11% and 3% respectively on the same quarter a year ago, on the back of pressures in advertising in its publishing sector and fewer blockbusters in the entertainment division of the business. The company noted that gains in its cable network business mostly offset declines in all other divisions. Full-year revenue was $33.7 billion, only 1% up on the year before.

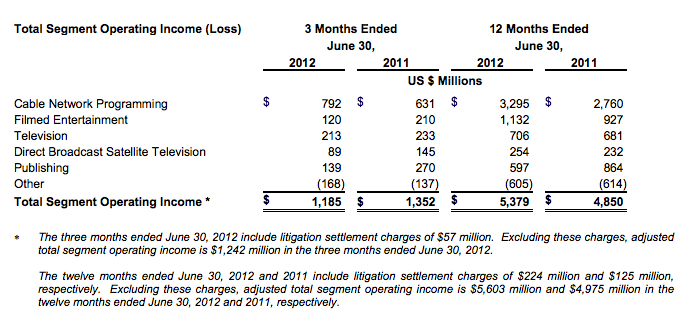

And there was other bad news: the company has taken a charge of $224 million for the year on related to “litigation settlement charges,” presumably in connection with the phone-hacking scandal in the UK. The charge for litigation in 2011 was $125 million. The charge for Q4 alone for litigation was $57 million.

In terms of operating segments, all but cable network programming saw declines for the quarter. Here’s how it broke down:

Given the pressure that some of these segments are seeing, its understandable that News Corp had wanted to take full control of its UK pay-TV operation, BSkyB. It currently owns 39%, and that business reported revenues of $249 million, compared to $144 million in the quarter a year ago.

Despite revenues being down on a year ago, News Corp. is also making some significant moves that have pleased the street. In addition to splitting its entertainment and publishing businesses, it has initiated a $10 billion stock buyback plan.

In its last quarter, which ended March 31, 2012, the company had cash reserves of $61 billion and reported annual revenues of $34 billion.