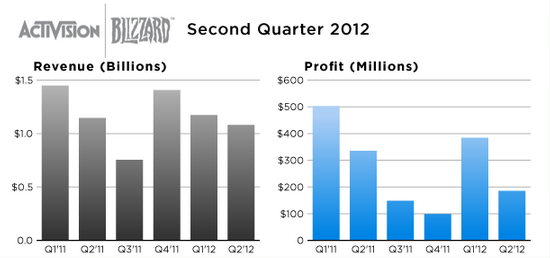

Activision Blizzard announced its second quarter results today, beating estimates with net revenues at $1.08 billion, compared to $1.15 billion for the second quarter last year. Meanwhile, net revenue from digital channels came in at $343 million and represented 32 percent of the company’s total revenues, up from a 27 percent-share last quarter. Earnings per share came in at $0.16, compared to $0.29 for Q2 2011.

The consensus on Wall Street was that Activision would see 18.7 percent revenue growth and 20 percent earnings-per-share growth to $829.7 million and $0.12, respectively. For the first quarter (the period ending March 31st), the company’s net revenues were $1.17 billion, with net revenues at $587 million and EPS at $0.33. So, all in all, Activision beat estimates, the fifth quarter in a row they’ve done so. And based on those better-than-expected results, the company is raising its calendar year net revenue and earnings per share outlook.

Of course, as you can see from the chart above, put in context, it’s not all roses for Activision Blizzard. The company, like EA and others of its ilk, has found a rocky road during its transition to the social, mobile, ahem, digital era. In fact, rumors have persisted (via Bloomberg) that the company’s majority owner, Vivendi SA, is eager to sell its $8.1B stake in the company.

What’s more, net income for the quarter came in at $185 million, down from $335 million in Q2 2011 and down from $384 million in Q1 2012. As a result, Activision ended the day down 5 percent and dropped an additional 3 percent in after-hours trading.

Naturally, Activision CEO Bobby Kotick was optimistic in the company’s earnings statement thanks to its renewed international efforts and its gains online mitigating shrinking retail sales:

On a non-GAAP basis, we delivered record Q2 and first half net revenues, operating income and earnings. Our performance was driven by strong audience demand for our great games. We are very excited to have announced our expanded investment in China through Activision Publishing’s agreement with Tencent to bring the Call of Duty franchise to the Chinese market.

Somewhat surprisingly, Activision has become a bright spot among the videogame giants, weathering lethargic industry sales (especially for console games) by pushing out more content for Call of Duty and developing a new title in a partnership with Hasbro (Skylanders Spyro’s Adventure) that features console games and action figures, among other things.

Zynga also recently inked a deal with Hasbro, as it the gaming giants look to stem slowing console sales with action figures and merchandising. And to that point, Activision performed markedly better than Zynga, which missed expectations in its own earnings announcement as well as Take-Two. EA hit expectations, but didn’t exactly look like the Hulk.

As for other highlights, the company said that, unsurprisingly, World of Warcraft remains the top subscription-based MMORPG, with approximately 9.1 million subscribers, and announced that it expects to release its newest WoW title on September 25th — “World of Warcraft: Mists of Pandaria.”

The company also claims that Diablo III, released May 15th, “set a new industry launch record for PC games” and was the best-selling PC game for the first six-months of 2012. As of July, more than 10 million players have joined in.

Together, the company said, Diablo III, Spyro’s Adventures and Call of Duty represented three of the best-selling games in North American and Europe.

“For the remainder of the year, we are excited about our product slate which includes Activision Publishing’s Skylanders Giants and Call of Duty: Black Ops II, and Blizzard Entertainment’s World of Warcraft: Mists of Pandaria,” said the Activision CEO. “While we are increasing our financial outlook for full year 2012, we remain cautious given economic uncertainty, risks to consumer spending especially during the holiday season and the recognition that the majority of our key franchise launches are still ahead of us.”

For more, find Activision’s Q2 earnings release here.