Opera Software is probably best known for its mobile browser software for smart and feature phones, but over the last couple of years it’s also been buying up mobile advertising companies to help it monetize those browsers. Today it’s released its first report looking at trends in its ad network — partly, perhaps, to raise the profile of that business, but also to highlight where some of the biggest action may be today on its platform.

There have been a lot of mobile ad reports published — they seem to have replaced the infographic as the primary visual marketing currency — but this one caught my eye, not just because Opera may get bought by Facebook (although hasn’t that rumor gone quiet).

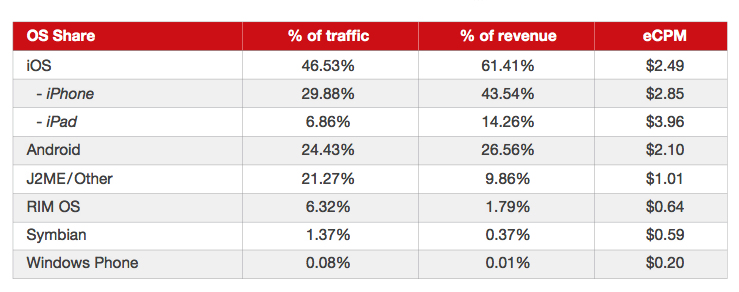

For starters, contrary to what ad networks like Adfonic, inMobi and Millennial Media have shown, in Opera’s report Apple’s iOS is the dominant operating system, rather than Android (the other three have all noted that Android traffic has overtaken that of iOS on their ad networks).

According to Opera’s numbers, iOS makes up nearly 47 percent of traffic on its network, compared to just over 24 percent for Android. It also took up a healthy majority of ad revenues, at over 61 percent, with CPMs at $2.49. Within that, Opera broke out the performance of different devices: the iPhone accounted for more traffic, but iPad tablets had the highest CPMs of all devices/platforms, at $3.96. Opera did not break out Android by device, but overall it noted that it accounted for almost 27 percent of revenues with eCPMs at $2.10.

Windows Phone was the loser in Opera’s rankings. Its eCPMs were only $0.20, with only 0.8 percent of traffic and 0.1 percent of revenues.

Opera’s conclusion is that features on a phone that enable you to interact with ads (strong processing power, cameras on devices, big screens) all contribute to a stronger placement on the list, but it also noted that this wasn’t the issue with Windows Phone — the lack of users was the problem.

The other reason for why numbers may leaning in favor iOS is because of Opera’s own traffic on its browsers — the iOS app is one of the most popular, and iOS users happen to be some of the most engaged when it comes to mobile use. Opera says the data it uses for this report comes from 9,000 global customers and over than 35 billion ad impressions per month, with that resulting traffic bringing $240 million+ in revenue to mobile publishers in 2011 (not 2012).

Another notable point in the report is the correlation it shows between rich media and engagement with ads. That’s partly demonstrated, Opera notes, in the high CPMs for the iPad, which has a bigger screen and a better experience for video and other highy visual formats.

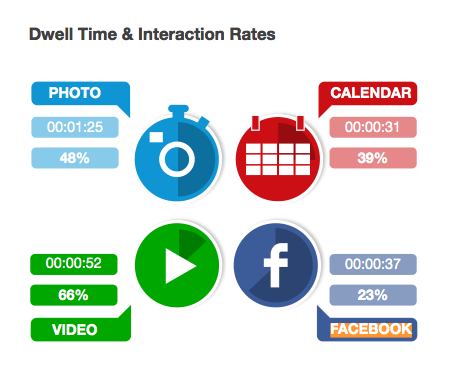

The success of rich media compared to more static interfaces also comes through in time engaged with an ad. Facebook doesn’t get too much of a mention in the report, except to note that it’s comparing poorly at the moment against mediums like photos and video when it comes to ad engagement. Among those users that click through to a video, 66 percent of them will complete the interaction and then spend about 52 seconds dwelling on the next screen. Photo users spent even more time, interestingly, at 1 minute and 25 seconds, although fewer clicked through. Only 23 percent clicked through to a Facebook action, and spent 37 seconds on the site. (That may also partly explain some of Facebook’s own moves to add more media to its site overall.)

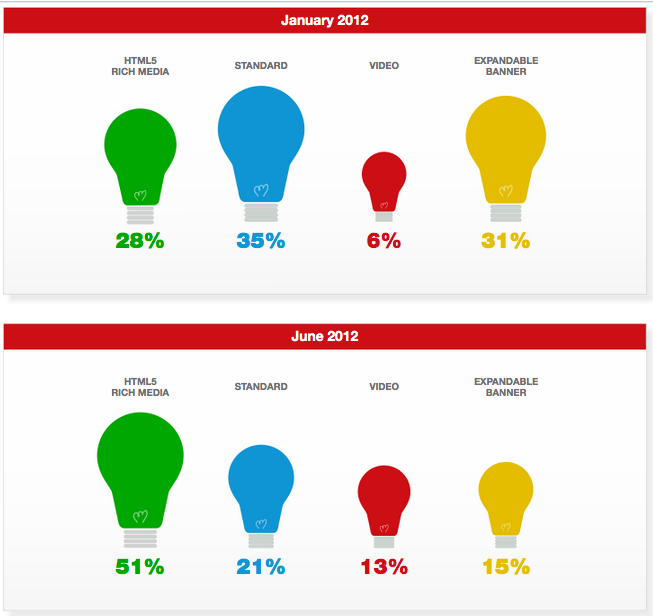

Stats like these are having an impact on what advertisers are buying these days. Opera pointed out that generally speaking the trend seems to be among advertisers to use the more enhanced formats compared to standard and expandable banners. These latter two categories have seen shrinking investment over the last six months. Interestingly HTML rich media ads now account for the most ad executions on Opera’s network, taking the top slot from standard ads.