Let the mobile payment wars continue! Only yesterday Square announced its ever-expanding retail availability (20,000 outlets nationwide), and today competitor Intuit GoPayment is following up with some major news of its own. Intuit is now merging its traditional POS software, QuickBooks POS, with its mobile offering (and Square rival) Intuit GoPayment.

The two solutions will now be able to communicate with each other, syncing both inventory and financial data from PC to mobile or vice versa.

Intuit has been in the POS business for 10 years and its QuickBooks POS solution is aimed at the small to medium-sized business customer. Currently, the company has 200,000 SMB retail customers who together reach 23 million customers across the U.S. Combined with GoPayment, the businesses process $6 billion in transactions annually.

Intuit GoPayment launched back in summer 2009, and now competes with Square, VeriFone’s PayWare, PayPal Here and many other “POS Light” solutions, as Chris Hylen, VP of Intuit Payments, calls them.

The GoPayment mobile app is free and the basic service includes no monthly transaction or cancellation fees. The swiped transaction rate is 2.7% for pay-as-you-go users, and, like Square, it has eliminated the per transaction fee. Intuit also offers a $12.95/month option, which reduces the swipe rate to 1.7%. QuickBooks POS users pay $19.95/month, and get a rate of 1.64% when using GoPayment. QuickBooks has increased pricing for its software by $100, based on enhancements offered. The GoPayment credit card readers will continue to be available for free.

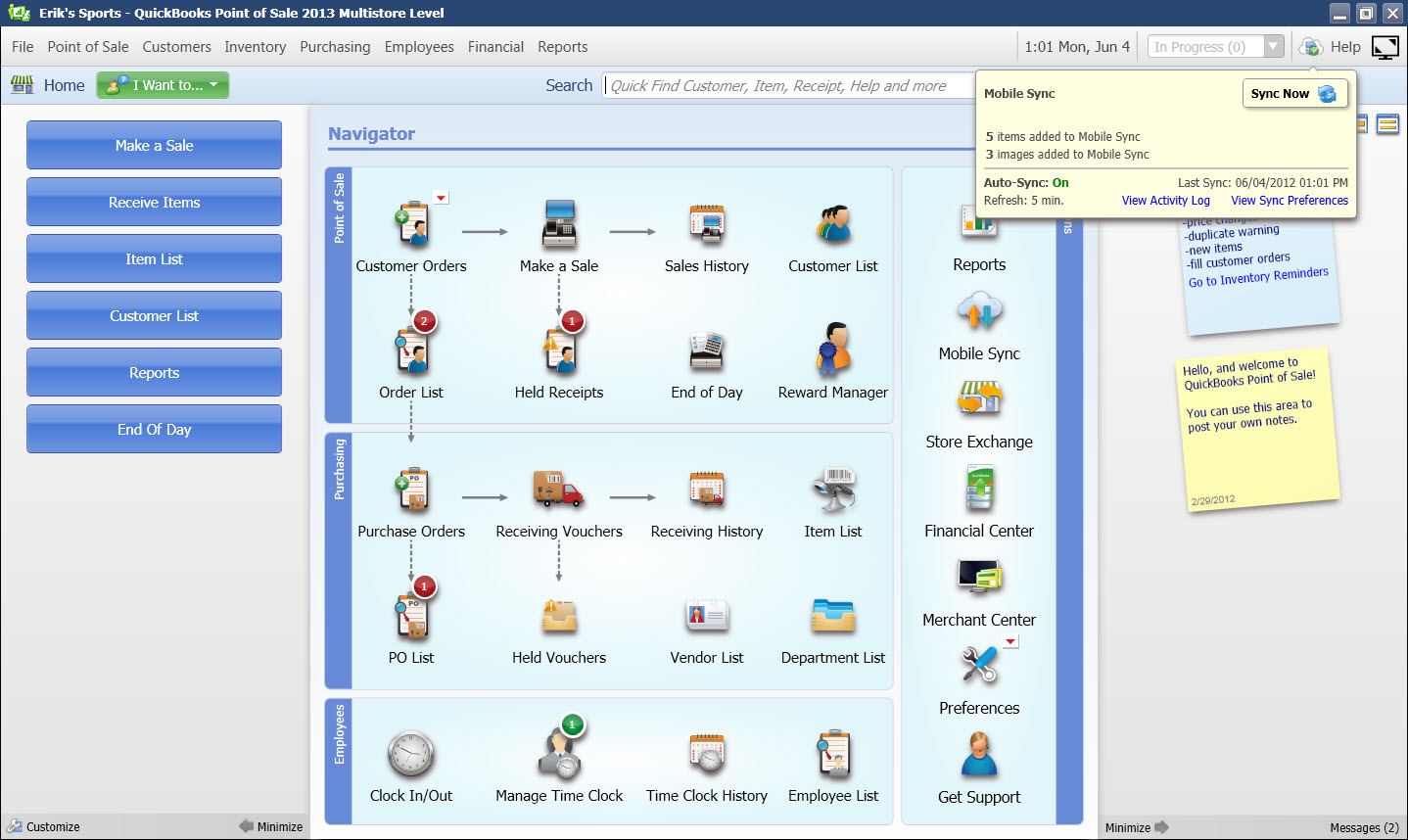

Key to the integration are the two products’ ability to sync their data from PC to mobile or the other way around. With QuickBooks POS, businesses can manage multiple locations, track customers, create and management inventory, run reports, and more. There are also features that allow it to track employee clock-ins and clock-outs and automatically calculate commissions, as well as advanced controls which allow businesses to lock down permissions for certain tasks by user. (E.g., who can process returns, who can add inventory, etc.).

Post-integration, inventory levels and transaction data can sync between the products both ways. By default, the sync occur every hour, but you can also press “sync now” to force a refresh at any time. By doing so, GoPayment can then work as either a lightweight alternative to a traditional POS, or can supplement a traditional POS system with mobile capabilities.

While Intuit doesn’t reveal the size of its GoPayment user base, it has been moving to expand the service outside the U.S. In January, GoPayment became available in Canada, and now, says Hylen, Intuit is “exploring a variety of countries and geographies,” and its strategy is “to move aggressively” in terms of international expansion. (QuickBooks Online, it should be noted, is already available in Canada, the UK, and Singapore, for example.) However, integration between GoPayment and QuickBooks POS is not yet complete for Canadian business customers. Although the POS solution is a somewhat old-school, PC-only product at present, Hylen says the company is exploring bringing that online, too.

Originally targeted at field trades (contractors, plumbers, electricians, etc.), the GoPayment user base is now 40% service-based customers, and just 17% field trades with the rest being retailers. “We’re seeing a lot more businesses that are using it every day to run their business, and are bit larger than the single hairdresser,” says Hylen of the typical GoPayment user. Plus, he adds, “it’s the QuickBooks integration that hooks them in.”

GoPayment’s integration with Intuit’s POS solution is just the one of many steps the company is taking to create a platform from its separate products, both business and consumer-facing alike, Hyden explains. Further down the road, the company has plans to bring other products like its payroll solution, website solutions, and financial data tracker Mint.com under the same umbrella, too. “That’s the larger story for Intuit, we’ve had separate products and we now need to get to an ecosystem,” says Hylen, “because that’s where the power comes for the customer.”

Update: Some info given around pricing info wasn’t correct; updated article to reflect new pricing;