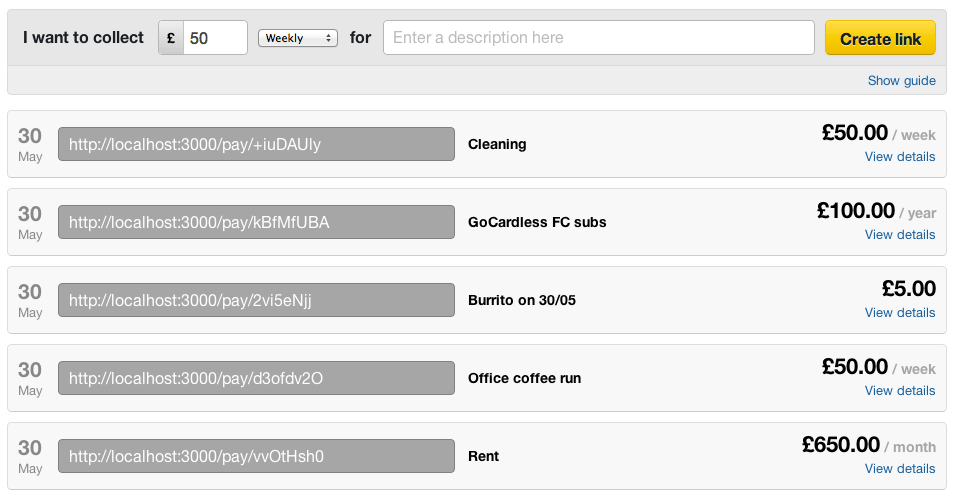

GoCardless, the Y Combinator-backed startup founded in 2010 by Oxford graduates Hiroki Takeuchi, Tom Blomfield and Matt Robinson, is today launching a new product called PayLinks which aims to be something like a Bit.ly for payments. With its dead simple interface, anyone can create a shortened, tweet-friendly link in around 60 seconds, the company claims, allowing you to start collecting money online immediately.

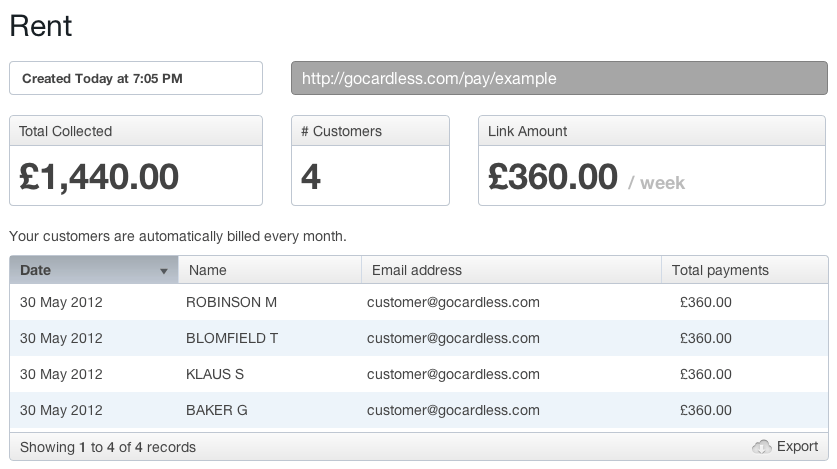

These payments can either be one-off requests (throw in on the keg!), regular/subscription-based (subscribe to my blog!), or pre-authorized. The latter, which makes sense for B2B scenarios, lets a company collect a pre-authorized amount over a pre-determined period of time.

The U.K.-based service is interesting because it doesn’t send these payments through the traditional credit card networks. Instead, GoCardless has built an API wrapper around the bank transfer process – that is, the “interbank transfer,” which is also known as an “Automated Clearing House” payment. That means the payment amount is automatically deducted from one bank account and transferred directly to another without having to go through credit card network or without you having to write a check. It’s the same kind of thing that powers the online “Bill Pay”feature your bank offers.

Since GoCardless’ launch in February, the company has signed up over 2,000 businesses to its service and is now growing at a rate of 50%+ every month, company co-founder Matt Robinson tells us. And B2B use (which has investors excited), is exploding. Over 70% of its current customers are using it for B2B transactions.

One API partner is the online accounting firm KashFlow, which introduced the GoCardless service to its 10,000 small business customers. These integrations made the GoCardless team think about other ways they could get their service in front of a large number of users, consumers and businesses alike. Hence, PayLinks.

With the new PayLinks product, the company is going after all types of transactions, including B2C or even smaller, personal use cases (you know, that beer?), and it’s starting to encroach a little more into WePay territory. Not only is there now a shortened URL you can share through email, chat, IM or social networks, there’s also a “Buy Now” button which can be embedded on a website.

Fees for the service are low, too. It’s free to use and the company only takes 1% of the transaction cost, compared with the 3%-5% average for other types of transactions, says Robinson. Pure interchange fees are 2%-3%, explains Robinson, but most people offer a PayPal type of pricing model of a percentage plus a fee, making GoCardless more affordable for smaller transactions. Its fees are also capped at $2, he adds.

OK, so now for the bad news. The service is U.K.-only, with plans to roll out to all of Europe in the next few months. As for the U.S., there aren’t immediate plans. But Robinson says it’s “next on the agenda.”

Interested U.K. customers can try out PayLinks now, from here.

GoCardless has $1.5 million in funding from Accel Partners, Passion Capital, SV Angel, Start Fund, and Y Combinator.