The Facebook IPO was supposed to be Silicon Valley’s shining moment. It’s the book-end for the decade of recovery that followed the first wave of consumer Internet companies. It was the debutante ball for the next great Silicon Valley company, the one with the most potential to last a generation or longer.

Instead, it’s turned into a public relations disaster. If we look a little more closely though, the Facebook IPO probably has more devastating consequences for the rest of the late-stage private market than it does for the company itself.

The late-stage market may have to reprice: Facebook is the latest major consumer Internet IPO that has underperformed compared to where it traded in secondary markets. In the final weeks of secondary market trading, we were seeing shares change hands at $40 and $44 a piece. Even though trading volumes aren’t that high in these secondary markets, Facebook had the most activity and it had years of pricing history.

The thought was that those prices were probably close to the public market prices. It was going to be hard to gauge what turned out to be an abnormally high amount of interest from retail investors. Those secondary markets may have helped convince Morgan Stanley and Facebook to raise the range from to the original $28 to $35 to the higher $34 to $38 range.

The thought was that those prices were probably close to the public market prices. It was going to be hard to gauge what turned out to be an abnormally high amount of interest from retail investors. Those secondary markets may have helped convince Morgan Stanley and Facebook to raise the range from to the original $28 to $35 to the higher $34 to $38 range.

But actually, later-stage valuations were kind of wrong. Zynga and Groupon are in similar positions. Investors like T. Rowe Price who went in on Zynga’s Series C round in February 2011, bought shares at $14.03 a piece. They’re now at $6.61. (Sad face.)

Secondary market buyers just need to be a little more cautious about investing in pre-IPO companies if they are not in it for the long haul. It’s still possible to make money. It’s just that public markets are not blindly going to 2X or 3X a late-stage valuation. Investors that gave Groupon, like, a billion dollars a year and a half ago are still in the black. They paid what is now $7.90 a share, if you factor in stock splits. Now the shares are at $12.05. The last big financing round in Facebook is also up by about 80 percent from a year ago, when Goldman Sachs went in on Facebook at a $50 billion valuation.

Last week at TechCrunch Disrupt in New York, Union Square Ventures’ Fred Wilson said, “Wall Street is going to value your business on your growth rate and your cash flow. Once you go public, you’re going to have to deal with a different kind of investor.”

He added, “The IPO market is back. But what people have to recognize is that companies are not going to get valued in public markets the same way they were valued in the late-stage market. The late-stage market is giving higher valuations than the public market is, so that means that the late-stage market is going to have to settle down.”

So investors need to be more conservative about how they think public markets will ultimately value their late-stage deals. Evernote at $1 billion? Dropbox at $4 billion? Spotify at $4 billion? These companies can only go out to public markets at those valuations if they have the current run-rate and growth trajectory to support them.

Facebook can overcome this if it has another “Calm down. Breathe.” moment:

If we’re debating about whether this was a “good” IPO or a “clusterfuck” of an IPO, it really depends on whose point of view you’re taking.

If you’re looking at the long-term picture for Facebook, the IPO was not bad at all. They raised $16 billion, with about $7 billion going directly into the company and the rest going toward early shareholders. Even though Facebook had the worst five-day start for an IPO out of the largest deals of the last decade, the company is washing out more of the short-term speculators, leaving room for believers who will hold the stock for the long-haul.

Also remember: Pissing people off, then apologizing and iterating your way out of it is classic behavior for Facebook. Facebook usually does one thing a year ago that really pisses people off. Then they fix it. It’s what they do. It’s never really intentional either. The euphemism for this is, “Move Fast. Break Things.” The only reason they can’t address the situation is because of the quiet period, but they’ll have a strategy once they’re out.

If we’re looking at Morgan Stanley, it’s complicated (hah). They’ve demonstrated to pre-IPO candidates in Silicon Valley that they will stand by their clients, support the price and take some bad publicity. If I were a company thinking of going public, it might be pretty attractive that Morgan Stanley appears willing to eat dirt for Facebook. But on the other hand, if I were a retail investor, I would be more skeptical of technology offerings they bring to the market in the future.

If we’re looking at Morgan Stanley, it’s complicated (hah). They’ve demonstrated to pre-IPO candidates in Silicon Valley that they will stand by their clients, support the price and take some bad publicity. If I were a company thinking of going public, it might be pretty attractive that Morgan Stanley appears willing to eat dirt for Facebook. But on the other hand, if I were a retail investor, I would be more skeptical of technology offerings they bring to the market in the future.

The next several quarters will be tough. Facebook has to prove it has more than display advertising:

While some analysts have already lowered second quarter estimates, I’ve also heard that the third quarter is projected to be soft too.

Chris Dixon said it best. Advertising that is about generating intent has lower value because it’s farther from the point of purchase. For a few years, Facebook’s theory has been that the sheer number of ads that generate demand on the web is something like 10X larger than the amount of ads at the bottom of the funnel (e.g. Google’s search ads). They believe the volume makes up for lower cost-per-click numbers.

But the sequential quarter-over-quarter decline in advertising revenue suggests that Facebook will need more legs to stand on. Flat quarter-over-quarter revenue growth in payments also suggests that the gaming vertical is mature and that Facebook will have to expand payments to other areas very, very soon.

The company will have to rebound on other business models. The Karma acquisition could lay the groundwork for a real gifting service across the entire site tied to birthdays. If even a single-digit percentage of Facebook’s 901 million users start buying birthday gifts for their friends multiple times a year through the site or mobile app, that’s not an insignificant revenue stream.

They could also launch a web-side display advertising network, an AdSense-killer if you will. But it’s not clear how much extra revenue that would add since Facebook already has a significant share of all display impressions across the web.

Even though mobile is tough right now, Facebook actually has a notable competitive advantage over rival mobile ad networks. If Apple fully removes the UDID soon, it will damage everyone else’s targeting abilities. But since Facebook knows who its users are and has recorded their tastes and preferences for years, that’s not as much a problem for them. They could launch a mobile display advertising network for all apps. Again, mobile display advertising is a tough business that isn’t producing that much revenue for anyone (even Google and Apple), but Facebook could take the lead if it pushed hard enough.

But remember that Facebook is a company that is built for the long-term: Despite the noise right now, Facebook is the one company out of the last generation of Silicon Valley startups that has enough untapped opportunities and is sufficiently mission-driven to keep attracting the best talent for years to come. Apple CEO Tim Cook even said that Facebook is the company that’s “closest” to being like Apple, according to Fortune.

If the shares fall too much by the six-month lock-up date, I would not be surprised if the company did something to make its employees feel more comfortable with their compensation (especially as the headhunters come out). This is an industry where it only takes a decade to become a geriatric company (see Yahoo). Facebook is eight. Talent is everything.

Internally, it doesn’t sound like Facebook employees are paying too much attention to the media fracas surrounding the IPO. It’s funny because the Hackathon leading into the IPO actually had a dual purpose. It wasn’t just to celebrate and maintain Facebook’s culture. One source told me it was to tire the employees out so much that they wouldn’t be able to pay attention to stock fluctuations the next morning. Good advice, indeed.

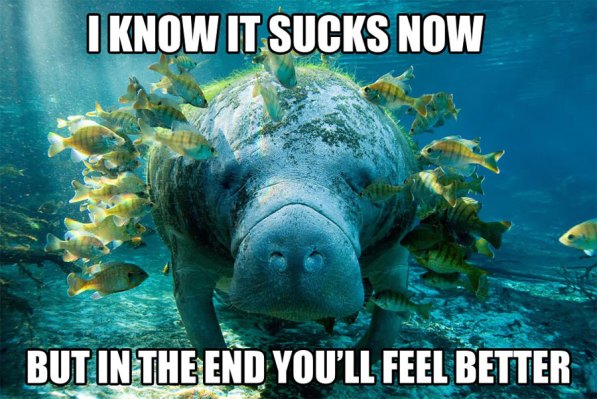

The images in this post are from CalmingManatee.com, because what is more calming than a manatee?