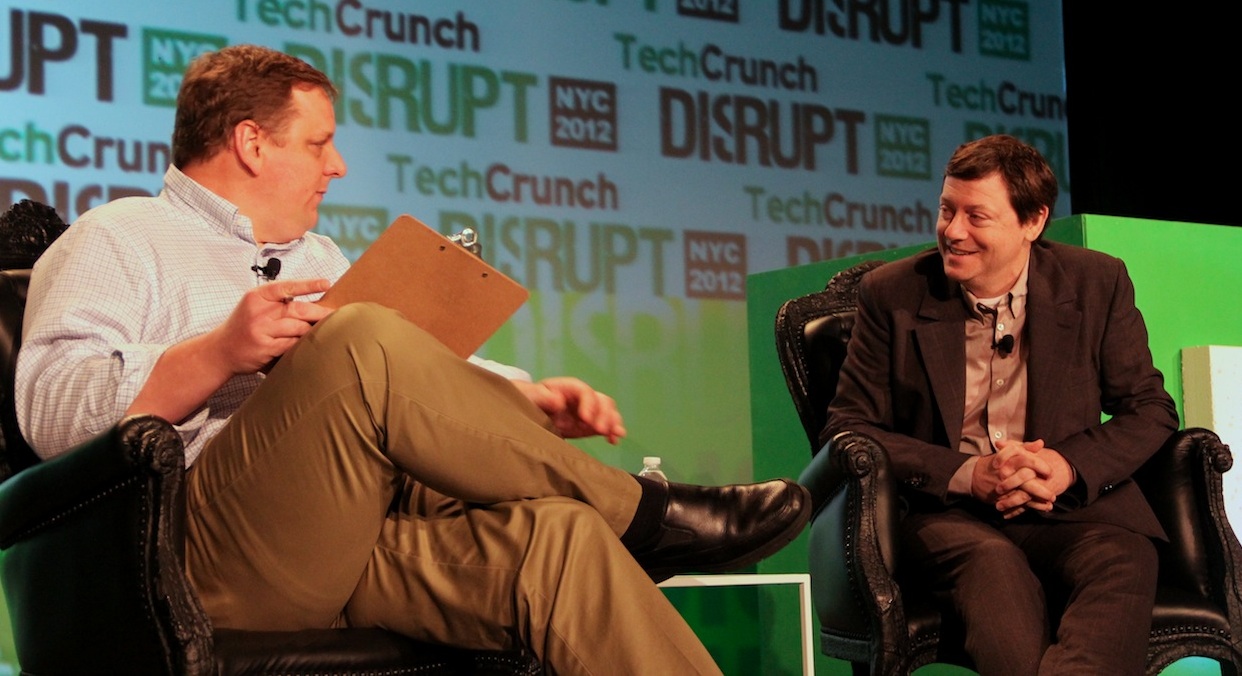

Google got the chance to buy Twitter, but the search giant passed, says Michael Arrington. “Google hasn’t been interested in buying Twitter since they committed themselves to Google+” says Fred Wilson, Union Square Ventures founder and former Twitter board member, in his fireside chat this morning with Arrington at the TechCrunch Disrupt New York conference. [Update: To clarify, I believe Google missed the boat on buying Twitter, while Wilson simply said Google wasn’t interested in such a purchase since it committed to Google+. Wilson did not make a value judgement on Google not buying Twitter, nor did he confirm that acquisition discussions ever took place.]

Now Google+ is widely seen as a ghost town, and not buying Twitter could be a mistake that haunts Mountain View for years to come. Wilson has one of the most envied portfolios in venture capital, with Union Square Ventures getting in early on Twitter, Zynga, Etsy, and Tumblr. But the future might not be as bright. “I don’t think I’m going to be very good at investing in the next big thing. I don’t come from it. I didn’t work in it. The next thing isn’t going to be evolutionary. It’s going to be something completely different.”

Arrington poked Wilson about writing “Silicon Valley could become the next Detroit” in a recent AVC blog post. Wilson explains “I didn’t mean to say [that]. Silicon Valley is the center of the digital revolution. But if there’s another revolution, [like] the teleportation revolution, and teleportation is invented in Mumbai, Silicon Valley might not be the locus of the next big thing.”

Google Lost The Flock

On the war for the future of social, Arrington asked “Do you think Facebook is overvalued?” Despite the newly public company’s share price dropping over 10% from its Friday close price, Wilson defend Mark Zuckerberg’s creation. “Markets come and go, good companies survive. The price of Facebook stock is not that important. Mark built an incredible platform and organization. I don’t think it matters that much if it’s trading at $25 or $50.” But Arrington pressed “is it going to be a half-trillion dollar company?” Wilson admitted “They’re going to have to grow into that.”

Google had a big opportunity to compete with Facebook, but that’s passed. Arrington cites a rumor that Twitter CEO Dick Costolo took the company to Google saying it was raising this big a round at this valuation, and gave the search giant a chance to acquire Twitter, but ”Google pooh-poohed it”. After the chat, Arrington told me this was when Twitter ended up raising $200 million at a $3.7 billion valuation, so the price Google would have had to pay could have been around there.

Wilson, who’s Twitter investment and former board seat must have made him familiar with the discussion, said Google decided to build social, and hasn’t considered buying something as big as Twitter in the space ever since. [Update: Wilson never confirmed Arrington’s rumor, nor did he imply that not purchasing Twitter was the wrong move for Google] Google+ is off to a slow start, at least in terms of people actually using it, not just signing up. But Twitter might not have been the right fit. Google needed a social layer that could integrate into all its product, not just a micro-blogging platform. Still, Google is now a distant third in social, and Twitter’s off the table. Wilson says Twitter’s founders and board are now deadset on it staying independent.

Update: Google better hope it doesn’t end up like Yahoo, who famously reduced its bid to buy Facebook in 2006 and then lost the deal. Now Wilson says Yahoo’s former chief, the disgraced Scott Thompson “was a terrible CEO. The first thing he did was sue Facebook as a patent troll, proving he’s clueless about the way the world works. He was one of a terrible string of CEOs for that company.” There’s still a chance for Thompson to redeem himself, though. “Elliot Spitzer recovered” says Wilson, “I think people can rehabilitate themselves, but it’s definitely not a good thing to be lying on your resume.”

What’s The Value Of Angels?

“I’ve never seen angels being lazy” says Wilson , refuting Ben Horowitz’s claim that angel investors make too much money for too little work. Wilson released a flood of insights into Facebook’s valuation, and the future of Silicon Valley

“Venture capital is not the most risk-taking part of the equation. We wait until things are more developed” says Wilson. He trusts angels and the early legwork and diligence they do. “I don’t know where ‘lazy’ comes from. They’re probably the most important part of the capital stack because they believe in entrepreneurs before VCs do.”

[Image Credit: Joi Ito]