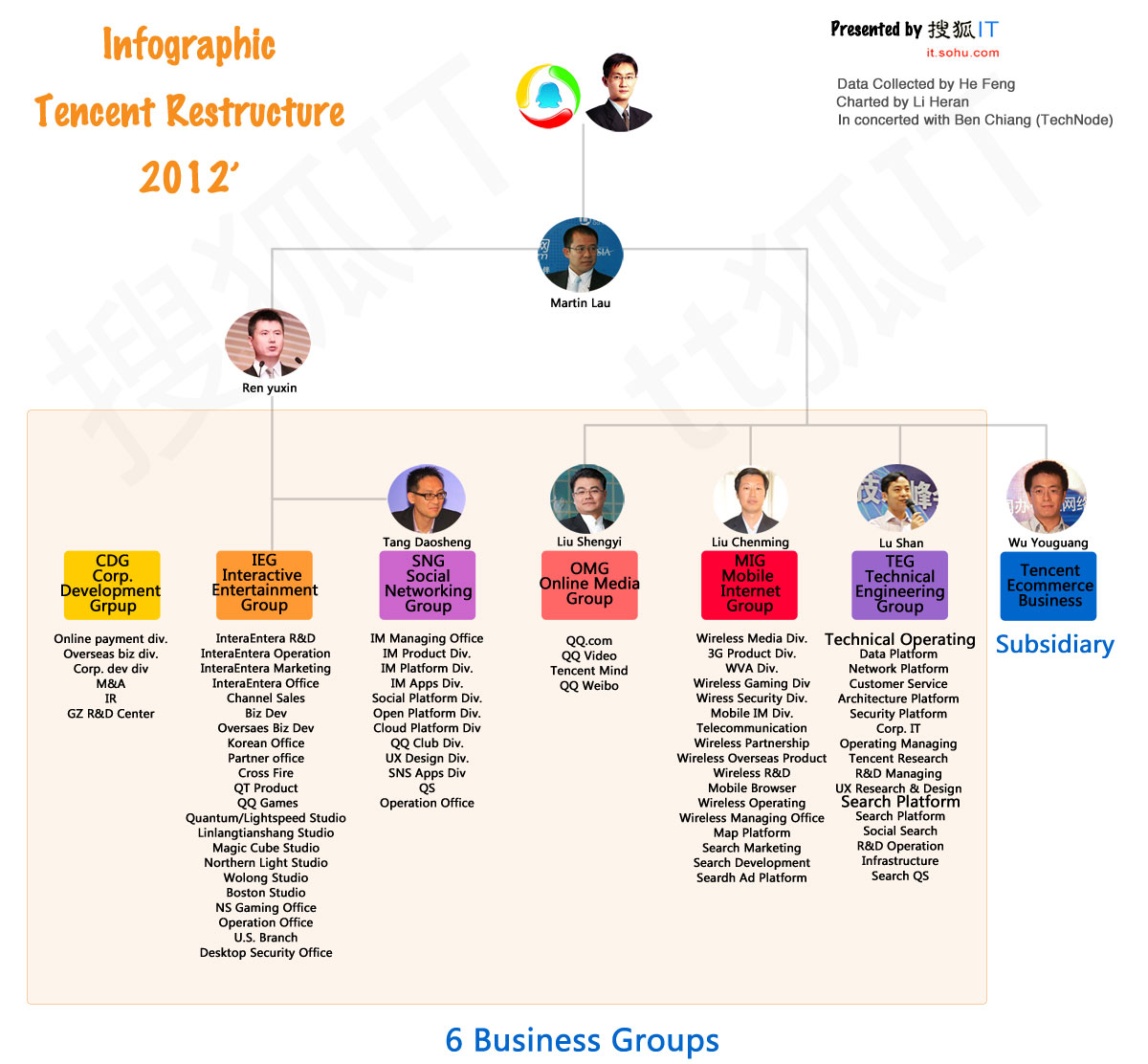

China’s Internet juggernaut Tencent announced today that it would undergo a restructuring of its business units into six groups. Ren Yuxin was also named as the new chief operating officer and will head up the media and social-networking groups.

The six groups include:

TEG – Technology & Engineering Group, comprised of Tencent Research and operating divisions.

SNG – Social Networking Group, comprised of its Internet business lines and some divisions from Tencent Research.

CDG – Corp. Development Group, formed by Tencent Guangdong R&D Center and its corporate development arm.

IEG – Interactive Entertainment Group, original Interactive Entertainment service.

MIG – Mobile Internet Group, made up of wireless services and some divisions from Tencent Research.

OMG – Online Media Group, namely its portal business.

The most profitable Chinese Internet company and its red scarf clad penguin mascot, has been growing into quite the force by competing with other Chinese Internet companies on many fronts like portal business (rivals with Sina, Sohu and NetEase), online games (Sohu, NetEase and Shanda), social networking service (Sina, Renren), software and anti-virus services (Qihoo 360), online video (Qiyi, Sohu Video), eCommerce (Taobao), travel booking (Ctrip), online payment (Alipay) and search (Baidu and Sogou). Just to name a few.

In the firm’s freshly released Q1 2012 financial results, the company turned a profit of US $470.6 million on revenue of 1.53 billion, a 2.8% increase from this time last year.

All of its major offerings are still seeing big growth, for example, its instant messaging system QQ now boasts 751.9 million accounts, up 11.5% YOY. Both QZone and Pengyou.com, Tencent’s approach to social networking to date claims 576.7 million and 214.5 million users respectively, up 9.7% since last quarter and a stunning 30.2% YOY. And the Shenzhen-based company’s profit-making businesses including QQ Game Open Platform, Internet value-added service, wireless Internet value-added service as well as online advertising business all pulled off decent growth in the past quarter.

However, there’s always more than meets the eye.

For starters, Tencent’s investment spree last year hasn’t brought on too much revenue, for example, it still lags behind Alibaba/Taobao on the eCommerce front in spite of all its recent acquisitions. Starting last year, Tencent invested in a handful of eCommerce services, like Gaopeng (think Groupon), China’s Zappos OKBuy.com, the Chinese OTA elong.com, diamond dealer kela.cn, 3C etailer 51buy.com and so forth, with elong.com being the only one turning a profit.

Furthermore, Sina Weibo, which is like a Chinese mix of Facebook and Twitter, is posing a real threat to Tencent’s dominance in social networking. Just like Tencent built its empire on QQ, Sina has been working relentlessly on Weibo to reinvent itself from the traditional online media company to the leading social media outlet by adding a swath of innovations to the platform like Weibo Open Platform, Enterprise Weibo, Weibo gaming center and so on.

At the same time, Tencent’s search effort Soso has been long-rumored to be facing serious downsizing, which shows that a company that seems as strong as Tencent can still have weaknesses. Soso hasn’t had any major breakthroughs since its inception six years ago. It currently accounts for 1.5% of China’s search market in the first quarter of this year, according to a report by Beijing-based market researcher iResearch.

Tencent should be wary of the rise of its peers and an organizational restructure might help it be more responsive to market change and be nimble in execution.