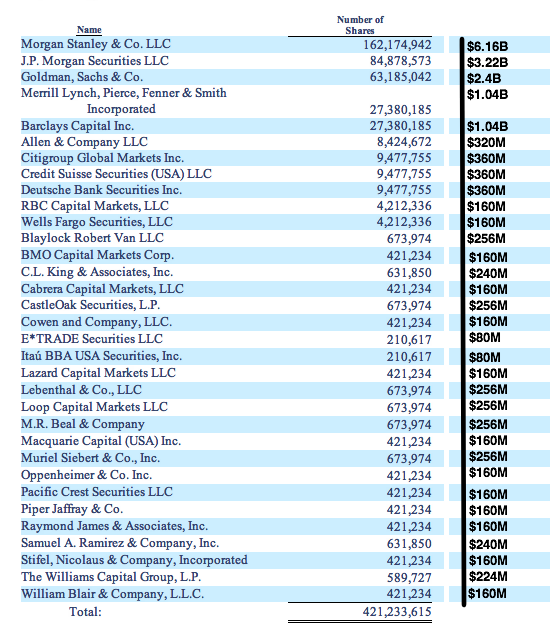

Just after the markets closed on its first day of public trading, Facebook amended its S-1 with a complete prospectus detailing how much stock each underwriter got to sell. Morgan Stanley, the lead-left bank, received 162.1 million shares ($6.15 billion worth) followed by J.P. Morgan with 84.8 million ($3.22 billion), and Goldman Sachs pulled down 63.1 million shares ($2.4 billion).

E*Trade and Itaú got the short end of the stick, receiving just $80 million in stock. That’s less than any of the other underwriters despite being listed in the middle of the pack in the previous versions of the prospectus. But none of the banks made too much on the Facebook stock. FB shares closed just $0.23 above its IPO price this morning. That means Facebook maximized the amount it raised in the offering, but its underwriters didn’t receive the massive cash windfall many expected.