This post is co-written with Daniel Cunha, my partner at Initial Capital.

Initial Capital was launched in 2011 as an investment firm targeting early stage startups in Israel and Brazil. The unlikely investment focus is the result of three friends — two Israeli and one Brazilian — turned professional investors.

Our Israeli investment network was rather mature when we launched, so we were able to hit the ground running and in the eleven months since our launch, Initial has invested in six Israeli-based startups. In Brazil, however, we spent our first months developing a similar network from scratch. Slowly but surely learning and embracing the state of, and the challenges facing, the Brazilian startup industry.

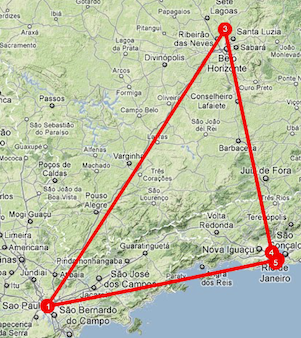

A few months ago we embarked on a week long, 50-meeting tour across São Paulo, Belo Horizonte and Rio de Janeiro. Here are our insights:

Local Matters: If you’re an investor and don’t have a local on the ground in Brazil, don’t bother considering any professional investment activities in the country.

Brazilians are very much a face-to-face culture. Speaking the language and being within a 1-1.5hr flight away, are not only assets, they’re absolute musts. In Initial Capital’s case, the first thing we did was set-up the local HQ in São Paulo.

Entrepreneurs: The most important piece of the puzzle—high quality entrepreneurs—is already in place.

Out of a sample-set of 50 startup teams we met, only two spoke broken English (we don’t perceive translation to be an issue btw). Ability to effectively communicate value propositions was quite high as well (especially at Rio de Janeiro based accelerator 21212).

We found Brazilian entrepreneurs to have a tight grasp of contemporary Internet in terms of real-time, geo, and eCommerce. We were also fortunate to come across hustler-DNA. All very reassuring.

Experience: While the entrepreneur potential is high, we’d be negligent not to address a deficiency in experience.

Consider that most entrepreneurs we met never worked at a startup other than their own. Most do not know what ‘comes next’. We felt this was particularly poignant when it came to paid media campaigns and user acquisition strategies.

Also, Brazil is not a ‘fail fast & iterate’ culture. Failing is both frowned upon, and painful bureaucratically – for instance, closing a company in Brazil can be a Kafka-esque experience for those who try.

Business Strategies: Given the still limited supply of venture capital, young entrepreneurs tend to avoid capital-intensive businesses such as eCommerce. Considering its large and fast growing middle-class, this means there are still great gaps (read: opportunities) in areas where Brazil has a huge potential for growth in.

The ‘me too’ mentality was another recurring theme. While we have no qualms with this type of approach, and indeed support it as a way to reduce learning curves in a country like Brazil, entrepreneurs must be diligent in recognizing trends that can be consistent in the long run, and avoid those that are already showing signs of doubt in other markets.

That said, we feel that Brazil beckons best-of-breed local alternatives to existing plays in other geographies.

Ecosystem: If we had to identify one major critical issue it would be the thin supporting ecosystem currently available for Brazilian startups.

There’s a very short supply of entrepreneurs that have ‘done this before,’ commercial lawyers that have negotiated startup investment deals and advised on tax structures, and of course, a pool of private and institutional investors to do business with.

Charting startup waters is difficult enough, doing it alone is orders of magnitude more difficult.

Taxation & Bureaucracy: Whether you are an investor, and especially if you are an entrepreneur, this is no doubt a major downside and one of the more challenging aspects of doing business in Brazil.

The Brazilian tax system is heavy, hugely cumbersome, and at times very unclear, resulting in unknown liabilities.

Labor costs are very high both on hiring and firing, and the legislation is inflexible and hardly supportive of entrepreneurship.

Take for example a recent decision by a major multinational company to block email distribution to its workforce in non-working hours and on vacations, after having lost a an ‘overtime’ labor suit for this reason.

Imagine the potential liabilities, and restrictions to productivity, of such a legal decision(!)

Brazil is laden with these ‘mines’ and unfortunately considerable time has to be spent dealing with bureaucracy rather than building great businesses.

This ends Part I, and to sum-up: Brazil’s potential is massive. At the same time, the current challenges and shortcomings must be embraced and tackled one-by-one, both on the individual level of each start-up, and as a community as a whole.

In Part II we’ll suggest a possible course of action for the Brazilian startup community, and how an umbilical cord with the Israeli startup community can be established for mutual benefit.