EA shares slipped 5 percent in after-hours trading to $14.38 as the company said it expected losses of 40 to 45 cents a share for the next quarter. It said it expects to make $4.3 billion for the year and will earn $1.05 to 1.20, on a non-GAAP basis.

Another piece of data that might have dragged down performance were subscriber numbers for Star Wars: The Old Republic, the title that was going to going to help it take market share away from World of Warcraft. EA said it had 1.3 million active subscribers, compared to the 1.7 million subscriber figure that the company had shared before. The company said most of the decrease had to do with “casual and trial players cycling out of the subscriber base, driving up the overall percentage of paying subscribers,” according to Ken Barker, EA’s senior vice president and chief accounting officer.

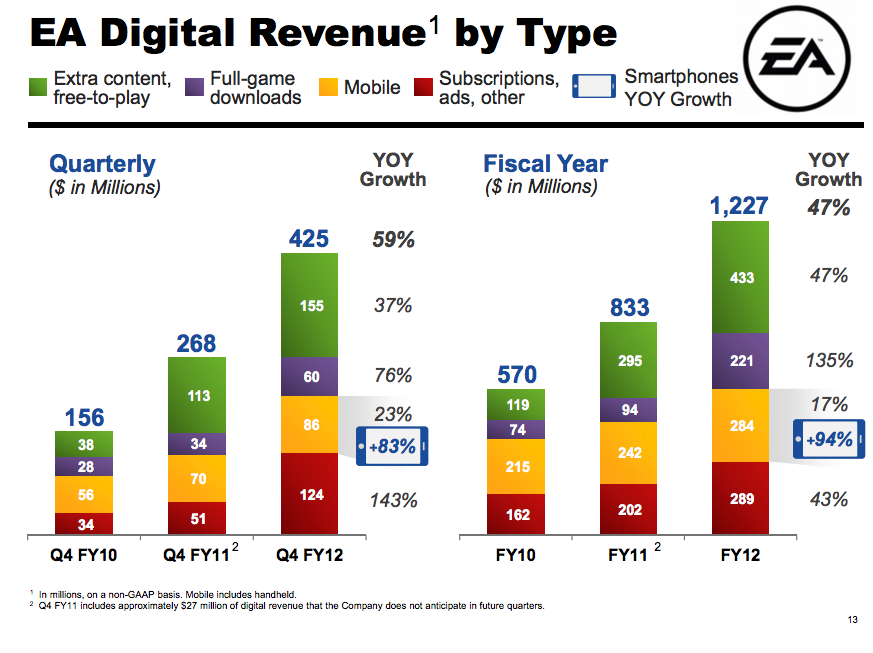

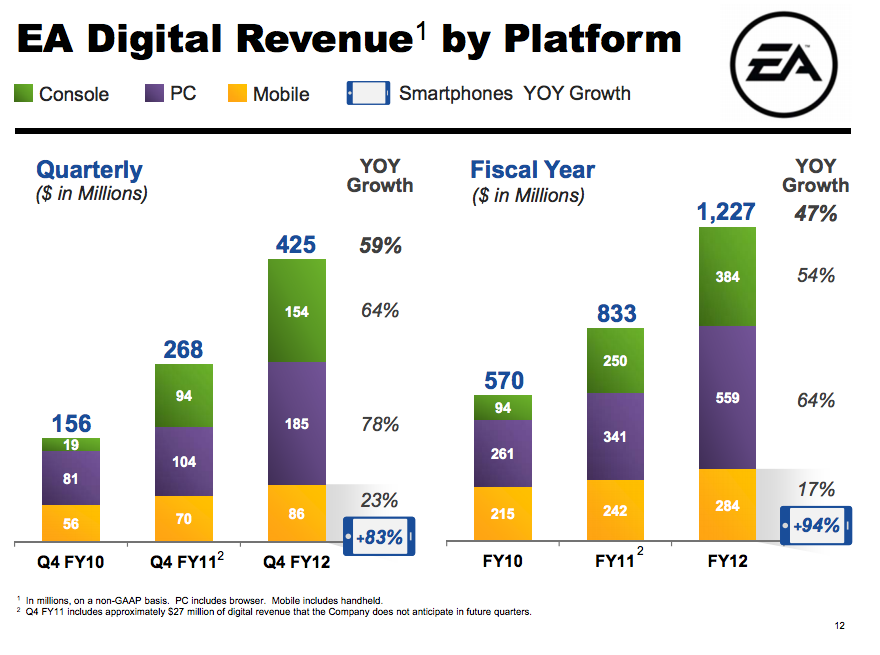

On the positive side, EA beat earnings estimates for the quarter ending in March with $977 million in total net revenue on a non-GAAP basis. Analysts had expected net revenue of $959.6 million or 17 cents a share. One other positive is that digital revenue continues to creep up as a share of EA’s overall earnings as the company transitions away from selling games like packaged, consumer goods. Digital revenue was nearly double was it was a year ago at $419 million.

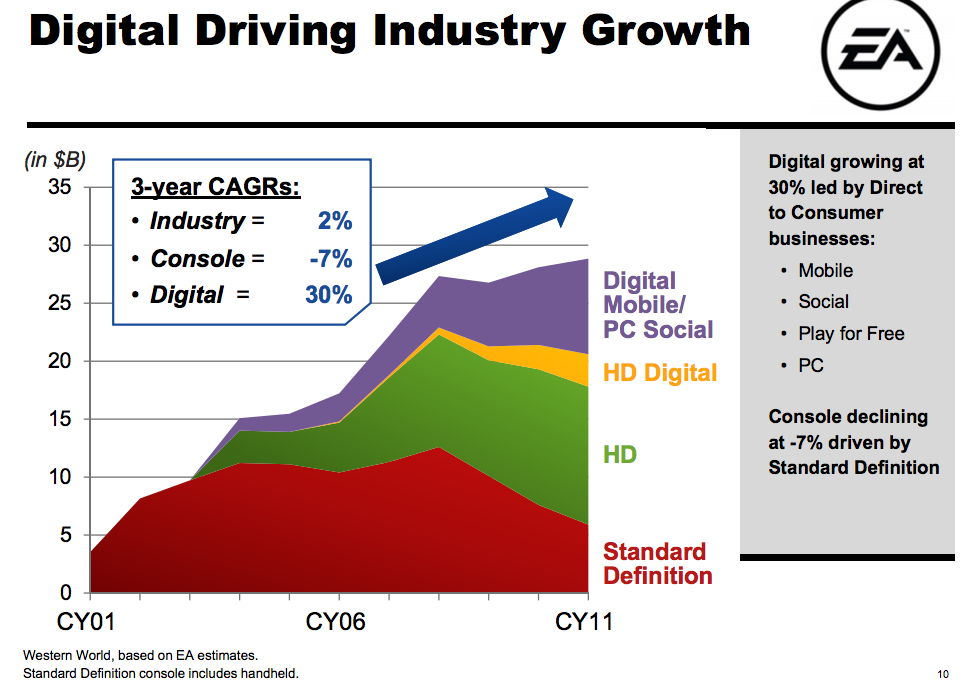

“Four years ago, we set out to turn-around our core console game business while transforming EA from a packaged goods company to a truly global digital pure play,” said EA chief executive officer John Riccitiello on the call. He pointed out that three years ago, the company had published 67 standalone games that were basically packaged goods. This past year, the company launched 25 online games that operate more like services than single-use products.

He said that Origin, EA’s network for direct downloads of games, has 11 million registered users and had generated $150 million in revenue for the fiscal year. Mobile revenue was also up to $87 million from $70 million a year ago, according to generally accepted accounting principles. Non-smartphone handheld devices basically negligible now with PlayStation and Nintendo at $6 and $5 million for the quarter respectively.

Here’s the release. We’ll be updating as we go:

REDWOOD CITY, Calif.–(BUSINESS WIRE)– Electronic Arts Inc. (NASDAQ: EA) today announced preliminary financial results for its fourth fiscal quarter and fiscal year ended March 31, 2012.

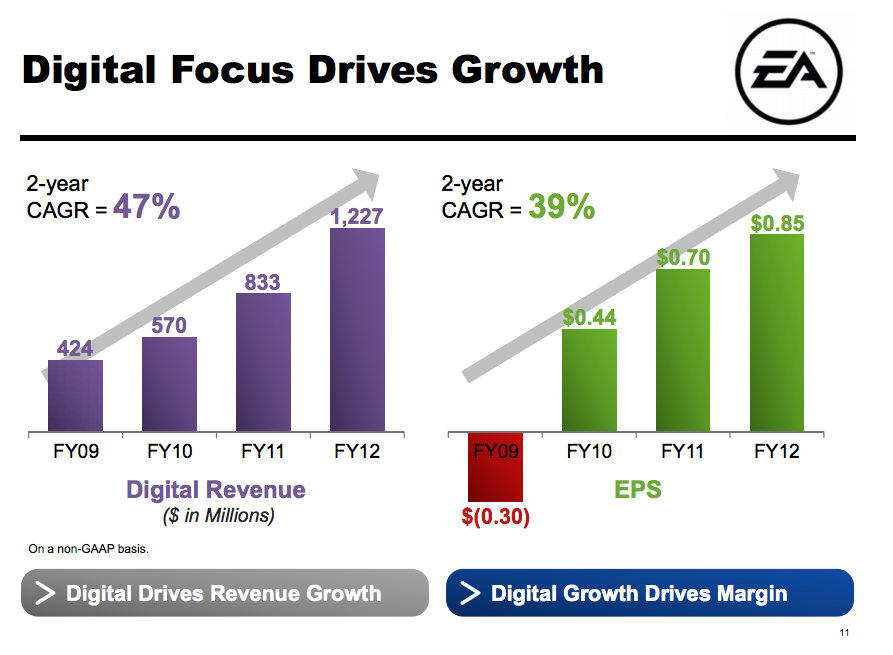

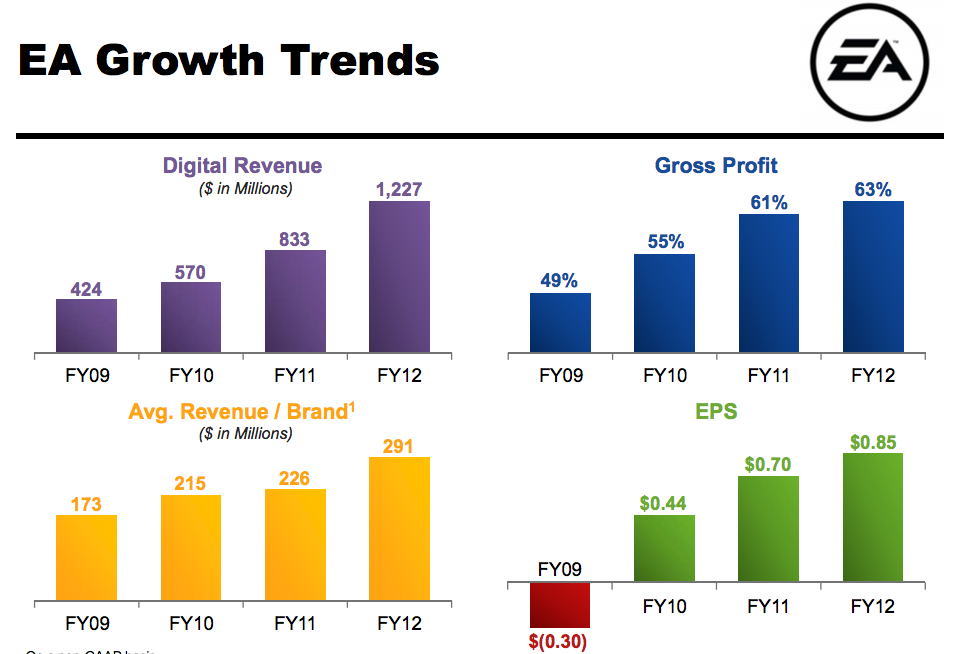

“We are proud to report a strong quarter and a fiscal year highlighted with $1.2 billion of digital revenue,” said Chief Executive Officer John Riccitiello. “In the coming year, we break away from the pack, with a very different profile than the traditional game companies and capabilities that none of our new digital competitors can match.”

“Digital growth drove our margins in fiscal 12 and we project this trend will continue in fiscal 13,” said Interim Chief Financial Officer Ken Barker. “We saw more than 20 percent non-GAAP diluted EPS growth in fiscal 12, and are guiding to more than 30 percent growth in fiscal 13 based on the midpoint of our guidance.”

Selected Operating Highlights and Metrics:

*On a non-GAAP basis

Strong results driven by the successful launches of Mass Effect™ 3, FIFA Street 4, SSX™ and Kingdoms of Amalur: Reckoning™.

FIFA 12 established the best year in franchise history – with downloads and micro-transactions totaling $108 million*. FIFA Ultimate Team — a pure digital companion to recent FIFA titles was the second best-selling EA offering in the UK in fiscal 12.

Battlefield 3™ had a record year, establishing itself as one of EA’s premier game services and in the process successfully took share in the growing First-Person-Shooter market.

Battlefield 3 players are still deeply engaged — 6.3 million MAUs in March. New content downloads available in May and June.

Q4 full-game downloads were up 76 percent* year-over-year, contributing $60 million* in the quarter, driven in part by Mass Effect 3 and STAR WARS®: The Old Republic™.

STAR WARS®: The Old Republic™ active subscribers are 1.3 million. Two new content packs — Legacy and Allies, available in Q1.

EA’s Play4Free brands are generating an average of nearly $2 million* per week. Several more EA brands will be introduced in the Play4Free portal in fiscal 13.

EA shattered its goal for digital revenue growth — generating more than $1.2 billion* in fiscal 12 for a 47 percent year-over-year growth, and driving operating margin to 10%. Another 40 percent increase in digital non-GAAP revenue and continued operating margin expansion is forecasted for fiscal 13.

EA’s Origin™ platform for games and services has registered 11 million players and generated approximately $150 million* in just ten months. EA’s Nucleus database has registered 220 million consumers.

Casual game leader PopCap™ — acquired by EA in August — is growing on mobile and social platforms with new games like Solitaire Blitz™ and Lucky Gem Casino™. A new version of Bejeweled™ is EA’s top grossing game on the Apple® App StoreSM.

EA repurchased 27.7 million shares for $529 million through March 31, 2012, and as of the call, the $600 million share repurchase program has been completed.

In fiscal 13, EA will invest $80 million in development of games for Gen4 console systems.

Q4 and Full-Year FY12 Financial Highlights:

For the quarter, non-GAAP net revenue of $977 million was slightly ahead of our guidance of $925 million to $975 million. Non-GAAP diluted earnings per share of $0.17 was in line with our guidance of $0.10 to $0.20. Non-GAAP net revenue in Q4 fiscal 2012 was slightly lower as compared to Q4 fiscal 2011 due to a reduction in the number of package goods titles in the quarter.