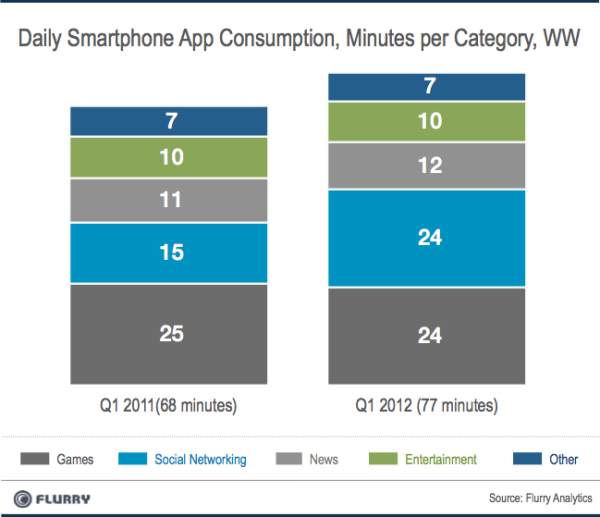

In another sign that something fundamental is changing on the iOS and Android platforms, mobile analytics provider Flurry has found that consumers are spending as much time in social networking apps as they are in mobile games.

Games have historically led usage on mobile. The last time that Flurry took a look back in January, it found that half of app sessions were spent in games while 30 percent was spent in social networking apps.

“We take the rise in Social Networking apps as a signal of maturation for the platform,” wrote Flurry’s vice president of marketing Peter Farago. “As game demand may be hitting its saturation point, consumers are also discovering other apps, namely Social Networking.”

You can actually visually see the changes on the charts compared to a year ago. Today apps like Viddy, Socialcam and Instagram are in the Top 5 free in the U.S. on iOS. These are all apps for sharing content like videos and friends. A year ago, these would have probably been mostly games.

There are probably several forces at work in addition to the ones that Flurry describes. 1) The platforms are mature and other app categories are starting to develop. 2) Apple has cracked down on more unscrupulous forms of user acquisition, which benefited developers who had the cash to spend on marketing. Pre-revenue apps like Instagram can’t really justify spending tens or hundreds of thousands of dollars a month in marketing dollars. 3) Twitter and Facebook are starting to emerge as effective ways of distributing mobile apps. If you search Twitter for “Viddy” or OMGPOP’s “#drawsomething,” you’ll see that there are several tweets per minute about both apps.

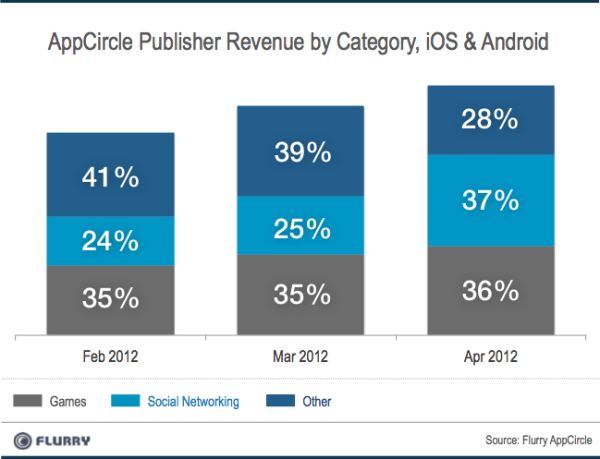

Flurry also found that the time spent is affecting the revenue that apps in both categories earn. For the first time, advertising revenue for social networking apps in Flurry’s ad network AppCircle, surpassed that of ad revenue for games. The thing you have to consider, though, is that gaming apps are more dependent on in-app purchases of virtual currency. If you look on iOS’ top grossing charts, it’s still virtually all games in the Top 25.

Flurry results are a little worrying for the mobile gaming industry. Perhaps the audience is reaching scale and doesn’t have much more room to grow.

Farago writes, “The games category could start behaving more like a “zero sum game” from here on out, meaning that game companies would have to fight over a finite group of consumers in order to grow their businesses.”