Attention TV world: consumers, it appears, are not as tech-friendly as you might think. According to a new survey out in the UK, the vast majority of the public is not interested in fancy new 3D or mobile TV services, and even less of them care about TV apps. What they would like are better players to watch on-demand content on their main TVs and better TV guides for discovering what is on where.

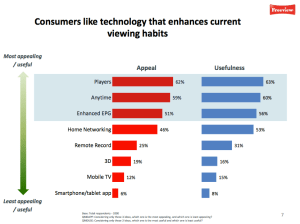

These conclusions come from Freeview, the UK’s subscription-free digital TV service, which canvassed opinion from some 2,000 UK consumers for its survey. Only 12 percent of consumers said they consider mobile TV an appealing service, and only 19 percent thought the same of 3D TV. And TV apps — something that has become standard among producers and broadcasters — fared worst of all, with only six percent saying these apps were appealing, and only eight percent thinking they were in any way “useful.”

But the company also notes that this year could potentially be a watershed for these newer technologies: with the Olympics coming to London this summer, this will be the first year that the games will be broadcast in HD to a mass market in the UK, and Freeview believes that this, plus general interest in the event (especially since most of us UK residents haven’t even been able to get a sniff of a ticket to the actual event… grrr) may drive uptake in some of the newer ways of consuming that content.

Freeview found that “players” — either in the form of set-top boxes or something more integrated in a smart TV — were considered to be the most appealing and useful of the wave of new services that have arisen out of the connected TV revolution. This rated at 62 percent and 63 percent among consumers.

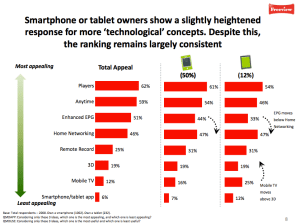

Freeview notes that the results proved to be largely the same, whether the respondent considered himself a technophile or a technophobe, and regardless of that person’s age. And as you can see from the table below, the results didn’t change all that much (but did get slightly better for new technologies) when owners of smartphones and tablets were asked the same questions.

These conclusions paint a picture of a mass market not as interested in new technology as some might think — in the UK at least — and are a sign that companies that are investing money into developing services like TV apps, mobile TV and 3D technology might not be seeing a lot of return on that investment in the near future.

It also is a likely indicator of where Freeview — a disruptive presence in the UK market in that it offers a range of digital TV channels free of charge, against paid offerings from the likes of Sky and Virgin Media — may choose to invest (and disrupt) in the future.

That disruption is already coming home to roost: Freeview notes that as of last quarter, it has overtaken Sky TV, its largest competitor and a Pay-TV provider, in terms of number of active users in the UK. Freeview is now being used on the main TV sets of 10.8 million homes, compared to Sky’s 10.1 million active base.