Leaf, a Cambridge-based startup, is aiming to make the experience of paying in a shop more modern with paperless receipts for customers and transaction data in the cloud for merchants.

Backed with $1 million in seed funding, the company just kicked off an alpha with more than a dozen merchants in Boston. It enters a super competitive and complicated space with many other players like PayPal, Intuit, Square, which has its own Pay With Square service, and Stockholm’s iZettle.

So first off, Leaf is not a mobile wallet. It’s not a dongle. It’s a service that’s either an app integrated into a merchant’s existing point-of-sale terminal or part of a special terminal that Leaf leases for $20 a month. There will also be a consumer-facing app you can download in two weeks for the iPhone and Android devices.

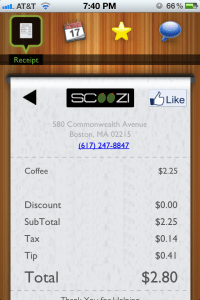

When a customer swipes their card, the app sends them a paperless receipt and lets them rate their experience with the merchant. The merchant in turn gets data in a usable format about transactions in their store. They can target specific customers with discounts.

More importantly, Leaf isn’t asking merchants to change payment providers. The company’s chief executive Aron Schwarzkopf says that all the data is encrypted and they’re using a payments gateway that’s Level 1 PCI compliant, or the highest security standard.

“Most small businesses have this very old legacy point-of-sale system,” Schwarzkopf said. “They have to figure out their inventory themselves. But really, all of this transaction data should be based in the cloud and easy for them to access.”

So the issue is that mobile payments is a notoriously difficult space. Even Google can’t get it right! However, what is worth pointing out is how young the team is and what they’ve done on such little capital.

So the issue is that mobile payments is a notoriously difficult space. Even Google can’t get it right! However, what is worth pointing out is how young the team is and what they’ve done on such little capital.

Leaf was co-founded by a pair of recent graduates, Schwarzkopf and Sebastián Castro Galnares, from Babson College and MIT. They recruited Robert Wesley, who was a senior vice president of global product management and development at MasterCard and an executive at American Express, to be their chief strategy officer. Their chief technology officer, Marty Sirkin, had previously sold a company to Clarify and worked for IBM.

With the seed funding, they prototyped a point-of-sale terminal for less than $250,000.

“It was our biggest challenge to work with a very small of money,” Schwarzkopf said. “We did our own custom hardware. Some people hated the idea until we completed it.”