Last year, we covered an ambitious collaborative R&D project called “Startup Genome,” created by three young entrepreneurs, Bjoern Herrmann, Max Marmer, and Ertan Dogrultan. The goal of the ongoing project was (and is) to take a comprehensive, data-driven dive into what makes tech startups successful — and not so successful.

Out of its research came, among other things, Startup Compass: A free benchmarking tool that leverages its data to allow entrepreneurs to evaluate their progress compared to other startups in their space. The product’s overarching goal is to allow founders to make more informed product and business decisions by “utilizing a data-driven feedback loop,” according to its mission statement.

While part of the team has since split off to focus on Blackbox, an educational program and startup accelerator, Herrmann and Marmer have continued toiling away at Startup Genome, collecting data from the some-16K startups that signed up for Startup Compass — and beyond. Today, a year removed from launch, the entrepreneurs believe that Startup Genome is finally crossing the threshold, reaching a critical mass of data on the world’s top entrepreneurial ecosystems.

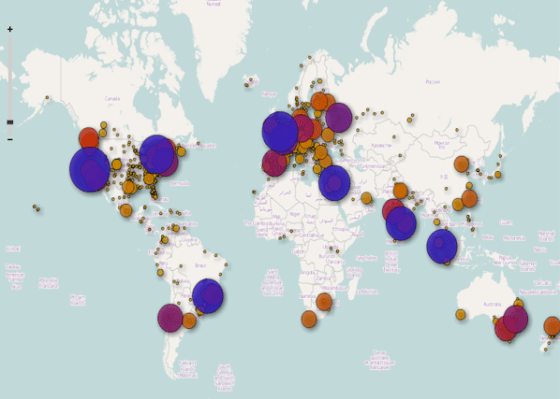

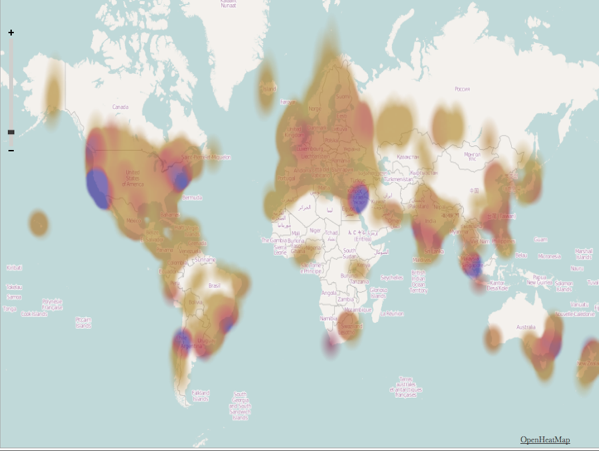

With its data set growing, Startup Genome is beginning to launch a thorough, comparative analysis on those ecosystems in an effort to give startups a more granular glimpse into how (and at what rate) the world’s top entrepreneurial hubs are evolving — and which are leading the way.

Over the last five years, web (and the diversity of digital technologies that accompany it) have matured, which has, among other things, succeeded in bringing down the cost (and amount of capital needed) to launch a viable business — or at least a MVP. Concurrently, this has caused an explosion in the number of software companies being created (an element inherent to Marc Andreessen’s argument that software is eating the world) and, as a result, new ecosystems are popping up all over the globe to help grow these companies, help jumpstart those that follow in their footsteps, as well as light a fire under regional economic growth.

In terms of the overall health of the global economy, these fertile startup ecosystems are essential, as they have the potential to become both regional and global engines of job creation. In the U.S., for example, companies less than five years old created 44 million jobs over the last three decades and accounted for all net new jobs created in the U.S. over that period, according to the White House. This is the undercurrent that led to the uncharacteristic bipartisan support for the JOBS Act.

As such, healthy startup ecosystems, Herrmann agrees, can be a democratizing force. Typically, startups plant themselves close to extant networks of support, be it financial capital, human capital, or technologies. Startups go where the money is — and historically, that’s been Silicon Valley, with Boston and New York City being mentioned as addenda. Yet, over the last few years, things have been changing, and today that’s more apparent than ever, as viable companies are popping up across the globe.

Entrepreneur Magazine claims that this was the overarching theme of SXSW this year — that entrepreneurs no longer have to locate themselves in Silicon Valley to build successful tech or consumer web businesses. And given this growing abundance of choice, it’s become increasingly important for entrepreneurs to be able to answer questions like, “What are the advantages and disadvantages of particular ecosystems?” and “What are the characteristics that differentiate successful entrepreneurs across those ecosystems?”

Herrmann and Marmer believe that there has been a wealth of qualitative reporting about the benefits of each ecosystem, but that, to date, there’s been very little data to support our collective intuitions.

In compiling its data, the team has begun to uncover valuable insights into the strengths and weaknesses of the world’s startup ecosystems, and as the study progresses, the founders say they hope it will continue to “yield insights for entrepreneurs deciding where to start their company, investors deciding where to allocate their capital, large companies looking for acquisition targets, and policymakers who want to make their entrepreneurship ecosystems flourish.”

Tapping into the collective idealism of all those invested in the success of these startup ecosystems, we know that the world is desperately in need of an economic revival, and thus we all hope that unleashing an “entrepreneurial renaissance” as Herrmann puts it, will help drive that evolution forward.

Attempting to play its part, Startup Genome is today sharing some of its findings on the top startup ecosystems, providing a data-based look into how they compare — starting with what it’s found to be the three most active startup hubs: Silicon Valley, New York City, and London.

Below, you’ll find some 20-odd insights into those comparisons, intended to get entrepreneurs thinking about what’s working, and what isn’t. Readers can find more on how the report defines its terms in our coverage here or on the project’s blog here. There’s also more on how it defines “Types” here.

- Startup Throughput: Perhaps unsurprisingly, the Silicon Valley startup ecosystem continues to lead the way, but the gap is growing smaller every year. Silicon Valley’s ecosystem is currently 3-times bigger than New York City, 4.5-times bigger than London, 12.5-times bigger than Berlin, and 38-times larger than Boulder.

- Startup Success Rate: Proportionally, the Silicon Valley ecosystem has 22% more companies in the “scale stage” than in NYC and 54% more than in London.

- Availability of Capital: On average, Silicon Valley startups raise two to three-times more money in the first three stages of development: Discovery, Validation, and Efficiency. But in the scale stage, compared to Silicon Valley, New York City startups raise 27% more money and London startups raise 30% more money.

- Job Creation: In the Efficiency and Scale stages, Silicon Valley startups create 11 percent more jobs than NYC startups and 38 percent more jobs than London startups.

- Risk Profile: The number of high risk companies decreases steadily through the startup lifecycle, except in New York City where the number of high risk companies spikes from 45% to 67%, and has 4x more high risk companies in the scale stage than Silicon Valley.

- Product Types: Compared to New York entrepreneurs, Silicon Valley entrepreneurs are 2-times more likely to build games, 50 percent less likely to build marketplaces, 23 percent more likely to be build social networks, 3.5-times more likely to be build infrastructure and 2.5-times less likely to be build financial tools. Compared to entrepreneurs in Silicon Valley, London entrepreneurs are 50 percent more likely to be build eCommerce products, 35 percent less likely to be build social products, 3.5-times less likely to be build products based on user-generated content and 2-times more likely to be build project management software.

- Market Type: Silicon Valley entrepreneurs are 13 percent more likely to tackle new markets than London entrepreneurs whereas London entrepreneurs are 21 percent more likely than entrepreneurs in Silicon Valley to tackle existing markets with better products. New York entrepreneurs have the highest proportion of companies trying to re-segment existing markets with niche products. They are 30 percent more likely to build something niche than entrepreneurs in London.

- Market Size: Entrepreneurs in Silicon Valley are much more “ambitious” than entrepreneurs in New York City and London. Silicon Valley entrepreneurs are 22% more likely to estimate their market size as greater than 10 billion compared to New York City entrepreneurs and 120% more likely than entrepreneurs in London. They are also almost 2x less likely to estimate their market size to be less than 100 million.

- Revenue Streams: Subscription is the most popular revenue stream everywhere. Compared to London, Silicon Valley entrepreneurs are 4.4-times more likely for their primary revenue stream to be Lead Generation, 3.6-times more likely for it to be virtual goods and 2.6-times less likely for it to be the rapidly fading model of license fees.

- Perceived Competitive Advantage: Compared to Silicon Valley entrepreneurs, New York City entrepreneurs are 4.3-times more likely to consider content their primary competitive advantage, 40 percent more likely for it to be niche focus, and 90 percent less likely for it to be centered around the team. Compared to Silicon Valley entrepreneurs, London entrepreneurs are 58 percent more likely to consider technology their primary competitive advantage and 5.3 less likely to consider user experience to be.

- Product Development: London and NYC companies outsource 34 percent more of their product development than Silicon Valley companies.

- Adaptability: Pivoting happens much more frequently in Silicon Valley. Pivots happen 45 percent more on average in Silicon Valley than New York City and 33 percent more than London.

- Mentorship: The Silicon Valley and New York City ecosystems have more helpful mentors than the London ecosystem. Silicon Valley companies have 46 percent more helpful mentors than companies in London.

- Thought Leaders: In Silicon Valley, Steve Blank and Paul Graham are the most popular startup experts. In London, Paul Graham is by far most popular expert and NYC shows their local pride, voting Fred Wilson as their favorite startup expert.

- Work Ethic: Companies in Silicon Valley work 35% more than companies in New York City. In Silicon Valley teams work 9.5 hours a day on average vs. 8 hours in London and 7 in New York City.

- Founding Team Composition: Silicon Valley founding teams are 34% more likely to be technical heavy than founding teams from NYC. Whereas NYC founding teams are almost 2x as likely to be business heavy than Silicon Valley founding teams.

- Founder Education Background: In London most founders have a masters degree, whereas in Silicon Valley and NYC most founders have just an undergraduate degree. But NYC has 2.2x more founders with Ph.Ds than Silicon Valley.

- Founder Gender: New York City has almost double the female founders of Silicon Valley and London (80-20 vs 90/10 ratios, respectively).

- Founder Age: The average age of founders in all three ecosystems is about the same, with an aggregate average of 33.5.

- Founder Experience: Silicon Valley founders have on average started almost twice as many startups as founders from NYC and London.

- Founder Motivation: Silicon Valley has 30 percent more founders that want to change the world than London or New York. New York has 50 percent more founders that want to make a good living than Silicon Valley or London. London has twice as many founders that want to make a quick flip than Silicon Valley or New York.

- Founder Challenges: New York City startups are 3.7-times less likely for team building to be their biggest challenge, at the same time they are almost twice as likely to consider “having too much do and being over capacity” their biggest challenge.

Startup Genome is also offering a new ranking for the world’s top 25 startup ecosystems, ordered by their average throughput:

- Silicon Valley (San Francisco, Palo Alto, San Jose, Oakland)

- New York City (NYC, Brooklyn)

- London

- Toronto

- Tel Aviv

- Los Angeles

- Singapore

- Sao Paulo

- Bangalore

- Moscow

- Paris

- Santiago

- Seattle

- Madrid

- Chicago

- Vancouver

- Berlin

- Boston

- Austin

- Mumbai

- Sydney

- Melbourne

- Warsaw

- Washington D.C.

- Montreal

Startup Genome has already brought on the support of a number of entrepreneurial enterprises across the world, including Endeavor, Mamstartup in Warsaw, Startupi in Sao Paulo, sgentrepreneur in Singapore, Metavallon and Loft2work in Greece, and Startup America in other cities around the US.

The founders are looking to find local support for each of these ecosystems, and readers interested in learning more or that have any suggestions, can contact them at contact@startupcompass.co. And to sign up for the next full, in-depth report, navigate over here.

This Startup Genome continues to be an awesome “Startups helping startups” enterprise, and the more data the group collects, the more founders and entrepreneurs across the globe stand to benefit. So, if you run a tech company, check out Startup Compass, as it will not only help you gain insights into your own business, but also contribute to the project’s data set and to amassing more quality comparative data on the world’s startup hubs.

What do you think?