Y Combinator startup FutureAdvisor has raised an undisclosed amount of funding from Sequoia Capital and angel investors Keith Rabois and Jeremy Stoppelman.

FutureAdvisor, which debuted in 2010, is an online financial advisor designed to help people get the most out of their investment portfolios. FutureAdvisor’s web app provides people with personalized financial advice by recommending ways to reduce fees, maximize on tax efficiency and select the right investments.

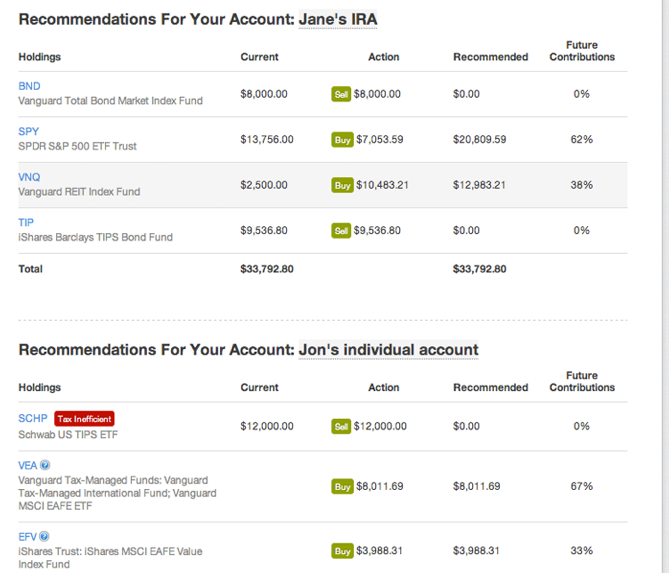

When you integrate your financial accounts and information (via Yodlee), the startup will analyze your entire financial picture and takes these details into account by providing personalized, actionable recommendations for future investments based on age, risk tolerance as well as current and existing investment situations. FutureAdvisor provides a free platform for unlimited investment advice but also offers premium plans, with a flat annual fee ($49-$195), that allow clients to schedule personalized video consultations with financial advisors on staff to answer any specific questions they may have, as well as receive alerts and more.

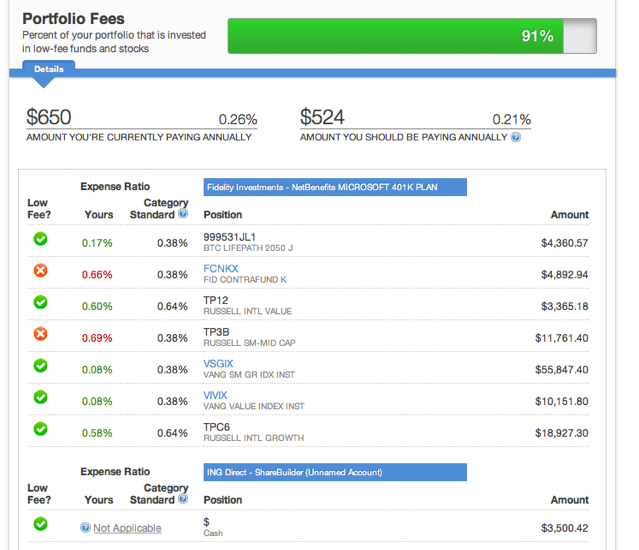

FutureAdvisor will also provide data-driven analysis and recommendations to reduce portfolio fees and give you tips on how to keep your portfolio diversified with market fluctuations. In terms of retirement, the startup will answer questions such as how much you need to save per year to stay on track of your retirement goals and how much you need to save to retire comfortably.

Additionally, you can enter in data about your age and retirement goals and the FutureAdvisor algorithm provides you with options for asset allocation, how to optimize your return, and, if you currently work at Google, Microsoft or Intel, the app can tailor its advice within your 401K’s limits.

Bo Lu, cofounder of FutureAdvisor explained in an interview that the startup aims to democratize the ability to find quality financial and investment advice. We want to empower the 99% of everyday investors with information they need to manage their own investments online,” he said. The startup doesn’t accept commissions or charge percentage fees on gains, he adds.

FutureAdvisor faces competition from Betterment, WealthFront, and others.