Editor’s note: Contributor Ashkan Karbasfrooshan is the founder and CEO of WatchMojo, he hosts a weekly show on business and has published books on success. Follow him on Twitter @ashkan.

“How You’re Defined by the Stories You Tell Yourself”

Oprah Winfrey recently interviewed Anthony Robbins, who talked about “how we’re defined by the stories we tell ourselves”.

Last month, I met two investors; one of them asked how come I’d never raised capital. I answered with the “story” I’ve told for 6 years to the point I believed it: “No one really wants to invest in a producer of video content based in Montreal.”

Then the other VC interjected: “But that’s not true, I’ve made you two offers.” He was right. Just because the offers I’d been getting over the years weren’t what I was looking for didn’t make my “story” true, yet I conditioned myself to believe it, to the point that it prevented me from maximizing the value of the company despite successfully bootstrapping it.

Before you can focus your energies on the “right” investor, you need to emancipate yourself from the stories that hold you back.

The Real Cost of Financing Isn’t Dilution

We’ve all heard about the story of the founder who was left with 0.5 percent after five back-breaking years. But the real cost of financing isn’t dilution.

The adage is “raise money when you can, not when you need it.” In fact, raise money because you want to, not because you need to.

Realistically, VCs care about 1 percent of companies, and maybe 1 percent of those actually raise money; so we’re talking about 0.01 percent of startups while 99.99 percent get the attention.

In Silicon Valley, lifestyle businesses are derided while funding and spending other people’s money is celebrated, even though revenue is the cheapest form of equity and the only celebration that is warranted is a successful exit.

With society increasingly embracing entrepreneurs, many VC-backed founders fail to understand what they’re bound to once they raise capital: The clock starts ticking and you have to give in to envy and be willing to put a bullet in your otherwise healthy baby’s head and pivot when greed comes calling.

In other words, just because others say they prefer to own a smaller piece of a potentially larger business, doesn’t mean you do too (or that it will actually happen). Bear in mind, an investor has his money spread out across dozens of companies, you have one company to keep you up at night.

Targeting the Right Investors: The Interested, Willing and Able

Despite this, many want to raise VC. In that case, focus on the right investor, based on tangible and intangible variables.

Tangible ways include i) sector preference, ii) company stage and iii) regional focus.

Intangible variables include two main variables:

1) How you know the investor?

– Are you going in cold?

– Is someone referring you? or

– Have you already worked with the investor in one capacity or another?

For example, Chris Sacca’s lowercase capital (best VC website) admits to never investing in anyone who has emailed them cold off their website.

Then at the other extreme, the PayPal Mafia have funded one another with multiple successes.

2) Ability and Capacity to Invest

Is the investor a talker or doer?

– Is the investor interested and able to actually lead?

– Will they tag along only once another investor sets the terms? or

– Can they actually lead?

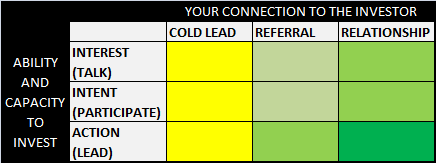

The following matrix represents the 1 percent of VC-fundable companies; focus on investors that fall in the darkest green areas, make those in yellow court you and avoid all of the ones that fall outside of the matrix.

You can have someone interested but not able or willing to lead; or you can have someone who can/does lead not being interested; in the end the outcome is the same: wasted time.

Similarly, your best bet is to secure financing from someone who has already worked with you, if that is not an option, then get a warm referral.

Leave the Bluffing for Poker Night

Entrepreneurs should drop the cowboy act and be sincere, because if you fail to raise capital then all you have is your word and integrity. In other words, in this context,

a) don’t rush those who are interested and can lead;

b) don’t force those who are interested but can’t lead; and whatever you do,

c) don’t waste time on those who can’t lead and aren’t interested to begin with.

The Art of Being a Challenge, Interest Level and the 51 Percent Rule

An investor’s level of interest is different from their capacity and ability to lead a round. If you throw yourself at someone, they will want you less.

In my previous lifetime, I wrote for a lifestyle magazine. One of my fellow dating columnists talked about being a challenge, interest level and the 51 percent rule. While his doctrine was geared towards dating, it was psychology 101 and absolutely applies to the courting that comes with fundraising as well.

He would argue that when you met a woman, if she was

– More than half interested in you (51 percent or more) then it was worth investing your time and energy in winning her over. But to accomplish that, you had to be a challenge, for if you threw yourself at her she’d lose interest;

– Simply not all that into you (less than 51 percent interest level), then she would never come around and fall for you.

A couple of weeks ago I was chatting with one of the VCs I respect most. He told me that while he never chased the popular deals, he was always interested in the harder deals (those where the company/entrepreneur was being a challenge).

To conclude, to paraphrase a wise man, “one of the marks of a great entrepreneur is following your convictions and convincing the world of the truth you know in your heart” even if investors are quick to dismiss your idea or mock and misunderstand you, but to do that you have to be honest with yourself and others.

If you liked this article, you may also enjoy mistakes VCs make and things entrepreneurs should avoid when raising capital.

[image via flickr/Sister72]