Research firm eMarketer has put together a few interesting data points that show Google doing better in display ads than you might have realized. That is, by growing this business across properties and networks that it at some point acquired — YouTube, DoubleClick, and mobile (AdMob) — it’s set to pass Facebook’s own display business.

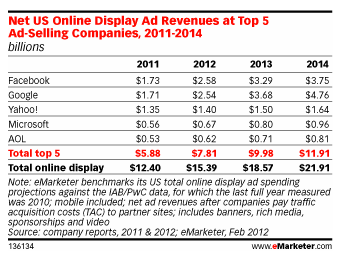

The social network had the highest online ad sales of any company in the U.S. last year, at $1.73 billion. But that was a mere $200 million or so above Google. This year, eMarketer expects a similar story, with Facebook bringing in $2.58 billion versus Google’s $2.54 billion. Things change in 2013 and 2014, further off from what the data can tell us accurately.

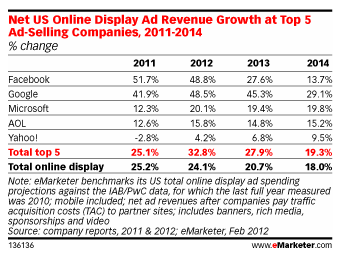

The firm thinks Facebook’s growth rate is going to plummet after this year, down to 13 percent in 2014, while Google’s is going to continue at nearly 50 percent through 2013 and still at nearly 30 percent in 2014.

I’m not ready to bet on that.

The estimates are based on publicly available documents from both companies, and other sources. On Google’s side, its earnings from last quarter indicated that its non-search ads were on track to reach $5 billion a year, or 12 percent of its total business. This is double what it brought in over the previous five quarters. YouTube is getting better and better at monetizing videos, DoubleClick is a market leader in online display ads, and AdMob has a strong position across mobile platforms. I agree it makes sense to be bullish about this part of Google’s business.

The estimates are based on publicly available documents from both companies, and other sources. On Google’s side, its earnings from last quarter indicated that its non-search ads were on track to reach $5 billion a year, or 12 percent of its total business. This is double what it brought in over the previous five quarters. YouTube is getting better and better at monetizing videos, DoubleClick is a market leader in online display ads, and AdMob has a strong position across mobile platforms. I agree it makes sense to be bullish about this part of Google’s business.

On Facebook’s side, eMarketer’s original estimate for its revenue had been $2.01 billion in the US, but Facebook’s S-1 filing proved this to be around 15 percent over what it actually was. The projections here read as if eMarketer feels burned by being so positive about last year. But the report manages to qualify itself in the event that Facebook revenue does in fact start to grow more quickly, by noting the potential benefits of newer advertising features like Sponsored Stories.

That’s the thing. Facebook’s ad business is still young, the company is fine-tuning all sorts of interesting features, and there are other ways that the business could see new growth, for example if Facebook launches a web-wide ad network that competes with DoubleClick and the rest of the online ad industry. 2013 and 2014 are a long ways off, and other numbers like traffic are looking fine.