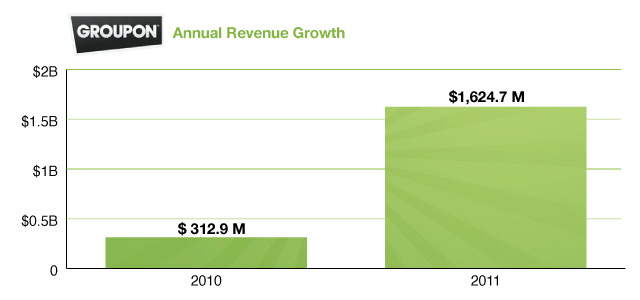

Groupon just announced its first earnings report after going public last October (it missed, read our liveblog of the earnings call here.). For the full year, Groupon’s revenues were $1.6 billion, up 419 percent. The daily deal company, however, lost $350 million, most of that attributable to its very aggressive international expansion (7,000 out of its 10,000 employees are overseas). In North America, it turned an operating profit of $22 million, which was counteracted by $137 million in international operating losses.

Gross billings (which is the amount Groupon collects before giving local merchants their cut) was more than $4 billion for the year. Gross billings is a good measure of the Groupon economy in that it is the dollar amount Groupon is bringing in total to local commerce.

For the quarter, revenues were $506 million, up 194 percent. The net loss was $42.7 million, which at least was down from $379 million quarterly net loss the year before. Revenue growth reaccelerated to 18 percent from the third quarter, when quarterly growth had slowed to 9.4 percent.

Also notable is that Groupon is spending significantly less on marketing, $156 million in the quarter versus $170 million in the third quarter and $291 million the year prior. Groupon is also shifting its spending from trying to acquire new customers to get existing customers to spend more. “We are investing more in transactional marketing,” says Groupon CEO Andrew Mason. “It is designed to drive purchases, not just new subscribers.”

Some other stats from the earnings:

Active customer base: 33 million, up 275% from Q4 2010 and up 20% from Q3 2011

Active gross billing per active customer (trailing 12 months): $188, up from $160 in Q4 2010

Mobile downloads: 26 million

Cash: $1.1 billion