Personal finance service (and TechCrunch Disrupt alum) Credit Sesame is launching its first mobile application today which gives users instant access to their current financial standing and their credit score. For free. And I don’t mean “free” as in free, but if you don’t read the fine print we’ll sign you up for our monthly service.

I mean free as in free.

For those of you unfamiliar with Credit Sesame, the young startup helps users better understand their personal finances. But unlike Mint, which looks at a person’s bank accounts, investments, budget, goals and loans, Credit Sesame is primarily focused on credit and loans. Using the same technology as banks, the company is able to analyze a user’s complete debt situation and then recommend various loan and credit options that can save them money .

However, Credit Sesame isn’t paid for lead generation, so it doesn’t just hand over customers’ information to banks and lenders in order to generate revenue. Instead, it only receives payment when a customer signs up for one of its recommendations.

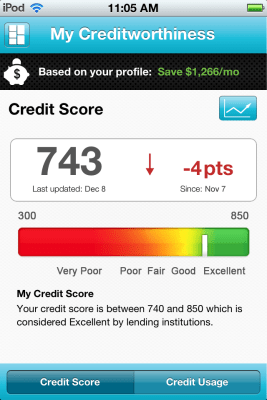

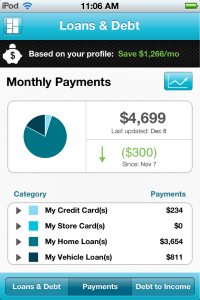

With the new mobile application, customers will be able to do much of what you could previously do only via the website, including sign up for an account, access your financial information, check your credit score, view your available credit and debt payments and more. It’s important to note that when you check your credit score via the app, it doesn’t ding your credit, as it would when a company runs a credit check for you to determine whether you qualify for a new credit card, store card or loan, for example. The score comes from Experian.

For now, consumers can use this information to get a general idea as to their financial health, but in the future, Credit Sesame will provide more specific guidance. (“Can I get a Macy’s card?”, “Can I buy this car?” are some example that come to mind).

Credit Sesame secures your information using bank-grade security approved by VeriSign and McAfee, protects mobile users’ data behind a PIN and enables you to switch off mobile access if your phone is lost or stolen. In addition, although the service requires your Social Security Number upon sign-up, this information is not stored on the phone.

According to founder Adrian Nazari, the startup helps two out of three people find “substantial” savings, even if not everyone chooses to act on its recommendations. He won’t disclose the size of the user base yet, but hints that it’s now in the six digits. The company raised $6.15 million from Menlo Ventures this March, and has been growing steadily since.

The mobile app is first available for the iPhone, but an Android app will follow shortly. You can download the new app from here on iTunes.