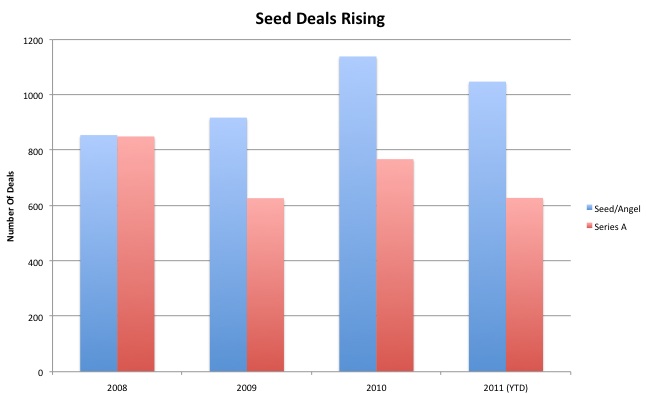

Angel investing has been on the rise over the past few years (see Crunchbase chart below), and this year is no exception. A quirk in the tax laws is helping. Any “qualified small business stock” purchased between September 27, 2010 and January 1, 2012 and held for at least five years is 100 percent exempt from capital gains. After January 1, the tax exemption reverts to the normal 50 percent.

So individual angel investors have a huge incentive to invest in startups before January 1 (if they plan on holding onto the stock for at least 5 years). If you are a startup raising an angel round and your investors are rushing you to get it done before the end of the year, now you know why.

The tax exemption is a result of the Small Business Jobs Act of 2010. It applies to many kinds of small businesses, as long as they have less than $50 million in assets at the time the stock is issued and more than 80 percent of its assets are used in the “active conduct” of the business. However, it does not apply to S corporations. You can read more about the details in this article or on the IRS website.

Between Feb. 17, 2009 and Sept. 27, 2010, the tax exemption was 75 percent. The time period these tax loopholes were in effect coincided with a general increase in angel and seed investing. Once the loophole goes away, will we see a corresponding drop in angel investing? Congress should make the tax exemption permanent to encourage the creation of more startups.

(Hat tip to TechCrunch’s tax accountant, Bob McEligot at Calegari & Morris for pointing this out to us).

Image credit: Shutterstock/thumb