Venture capital firms put more money into US startups at higher valuations in the third quarter of this year versus the second, according to a new report out today by law firm Fenwick & West, with Internet and software firms accounting for some of the biggest gains.

But the overall venture environment is looking “schizophrenic,” Fenwick partner and report co-author Barry Kramer tells me today. “The amount of money invested by VCs continues to be more than the money they raise, and that’s not healthy or sustainable for an extended period.”

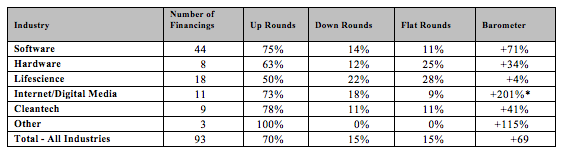

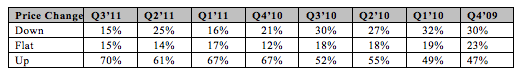

Despite venture firm fears, including uncertainty about effects from Europe’s financial issues and US government intervention in the economy, up rounds — where a company’s valuation was higher than the previous round — accounted for 70% of all fundings in the quarter. Only 15% of fundings were down from previous rounds, with 15% flat. In contrast, Fenwick had previously found that only 61% of rounds were up in the second quarter, with 25% down.

Splitting up the quarters also obscures the relatively slow funding process, Kramer notes. Fundings can take months to get finalized, and some of the upward changes last quarter could have been due to decisions made in the second quarter.

Still, it’s particularly striking that relatively early companies — those raising their second venture rounds — had the highest proportion of gains, with 89% up of their rounds going up. Venture firms typically invest with the intention of getting liquidity in three to five years. The fact that that they’re putting the money that they have into companies now shows they think their investments are going to make them money down the road despite all the fears.

There’s a big caveat here, though. Kramer says that one company, which he isn’t disclosing, had a 1500% up round, and if it were excluded from the data, up rounds would have only been 54% of the total. Readers, tell us in the comments if you know who this mystery company is.

Fenwick, which pulls a variety of other sources in addition to its own research, cites recent DowJones VentureSource data showing that traditional venture firms as well as corporate investing arms put a total of $8.4 billion into 765 deals in the U.S. over the quarter, which is up 5% from the $8.0 billion invested in 776 deals that it reported for the second quarter.

All this funding is coming in spite of larger concerns about the world economy and the opportunity for startups in it. “Valuations are continuing to increase while VCs are professing reduced confidence in the future,” Kramer observes. The report references the Silicon Valley Venture Capitalist Confidence Index, produced by Professor Mark Cannice at the University of San Francisco, which indicated a drop in Silicon Valley investor confidence. VCs in aggregate reported a 3.41 confidence level on a 5 point scale last quarter, down from 3.66 in the second quarter.

Finally, it’s worth noting that there’s a mix of results coming on how the quarter went. For example, the DowJones VentureSource data doesn’t fit with follow an earlier report put together by MoneyTree, Pricewaterhouse Coopers and the National Venture Capital Association. That one had shown VCs investing $6.9 billion across 876 deals, down from the $7.9 billion invested in 1,015 deals in the second quarter.

The numerical discrepancies between the reports are partially due to methodology differences, like whether a company is in Internet or software, or whether an international firm gets only its US investing activity counted. The more important point here is the trends that each show, Kramer says — and the relatively high investments in the face of larger economic fears and liquidity questions is what’s odd.

You can find the full report here.