SalesVu, a new mobile payments application and SaaS solution designed for distributed sale teams, has closed $600,000 in angel funding, the company is announcing today. Like Square, SalesVu’s service includes a dongle that attaches to an iPhone or iPad, allowing its users to process mobile payments on the go using a mobile app. But unlike Square, the gadget doesn’t plug into the headphone jack – it uses the iPhone or iPad’s main port instead. The dongle also offers hardware encryption, something which Square’s competitors have criticized the company for not including.

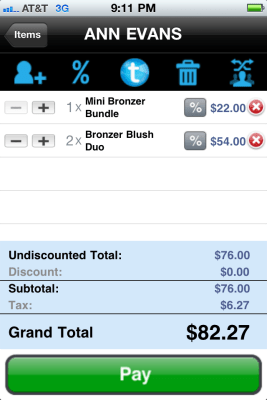

In addition, SalesVu takes Square head on in terms of pricing: it’s just 2.7% for all transactions (swiped or keyed in) compared with Square’s 2.75% (for swiped transactions only).

To achieve these rates, the company does things a little differently than Square. For starters, it doesn’t hand out all its dongles for free. Each business customer gets the first dongle for free, but then has to pay $99 for each additional device. Of course, a company could get around this requirement if they wanted to by signing up using a separate email address for each employee in need of a device. But doing so would preclude the business from taking advantage of SalesVu’s other key feature: the cloud-based infrastructure for centralized price management, reporting and marketing.

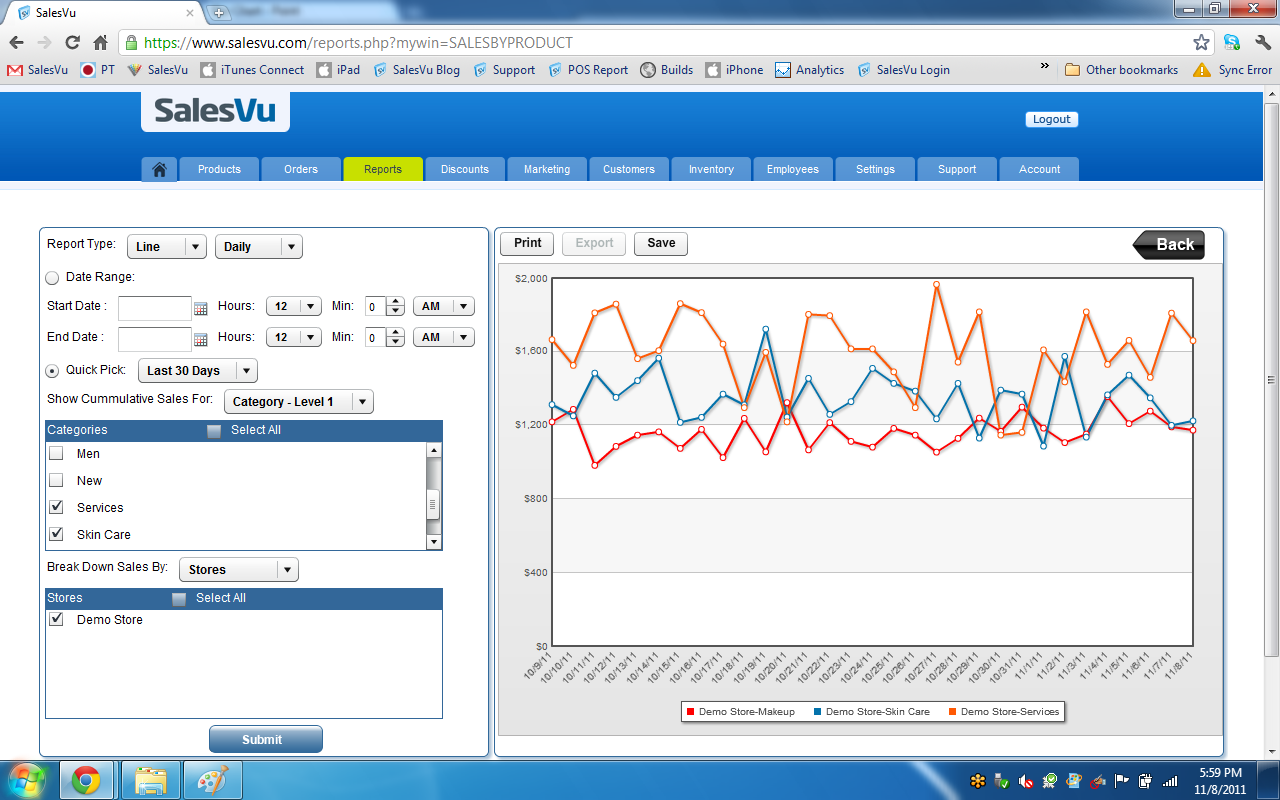

Using SalesVu’s SaaS solution, businesses can monitor mobile transactions, watching for trends by product, time of day and employee, and then make adjustments to pricing and inventory data on the fly, based on those findings. All of this happens in real-time and is presented in an easy-to-read format complete with graphs, bar charts, tables and other reports. As the pricing changes, business owners can also share those discounts directly from SalesVu to Facebook, offering a coupon code that will work to activate the deal.

Because of its rich, real-time reporting capabilities, SalesVu is trying to solve a slightly different problem than Square or even Intuit’s GoPayment. That is, it’s not going after the small business or individual who could never before afford to take credit card payments – it’s going after businesses who rely on the performance of a highly mobile salesforce. The ideal customer is one whose potential bottom line can be impacted by access to real-time sales data and the ability to adjust product inventory quickly based on the analysis of that data.

And as for that rate? The low 2.7%? According to SalesVu CEO Pascal Nicolas, the company had to negotiate quite a bit with its partner, Mercury Payment Systems, to get there. But Mercury sees mobile payments as a growth opportunity, so it was willing to take the risk.

Austin-based SalesVu initially became available to the public on August 18th and now has around 1,000 customers worldwide. Its mobile applications for iPhone and iPad can work as standalone order processing/business management apps, but the credit card processing portion only works in the U.S. and Canada.