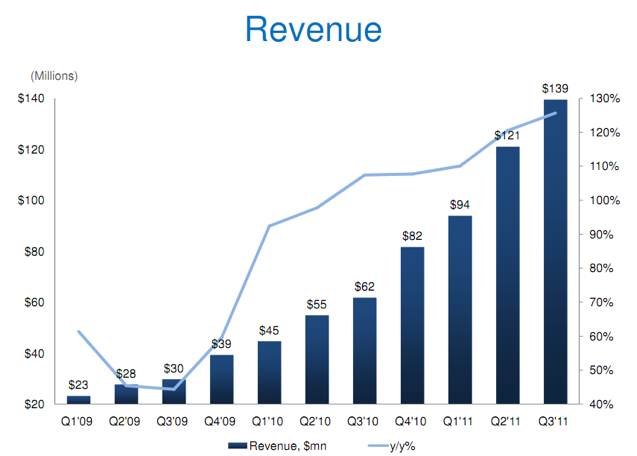

In its second quarter as a public company, LinkedIn posted Q3 earnings today. Revenue for the third quarter was $139.5 million, up 126 percent from the third quarter in 2010. GAAP Net loss for the third quarter was $1.6 million (or a loss of $0.02 per share), compared to net income of $4 million for the third quarter of 2010; Non-GAAP net income for the third quarter was $6.6 million (or $0.06 per share), compared to $6 million for the third quarter of 2010. Analysts expected LinkedIn to break even on an earnings on a per share basis with revenue expected to come in at $128 million.

Members grew to 131.2 million, an increase of 63% from the third quarter of 2010. “LinkedIn had a strong third quarter, with significant, broad-based growth across all of our revenue streams, member engagement metrics, geographies, and sales channels,” said Jeff Weiner, CEO of LinkedIn. “Our results underscore the long-term strength of our global platform and our business model.”

Revenue from the U.S. totaled $94 million, and represented 67% of total revenue in the third quarter of 2011. Revenue from international totaled $45.5 million, and represented 33% of total revenue in the third quarter of 2011.

LinkedIn’s main revenue channel, from Hiring Solutions products, totaled $71.0 million, an increase of 160% compared to the third quarter of 2010. Revenue from Marketing Solutions products totaled $40.1

million, an increase of 113% compared to the third quarter of 2010. And revenue from Premium Subscriptions products totaled $28.4 million, an increase of 81% compared to the third quarter of 2010.

In terms of the outlook, revenue for the fourth quarter of 2011 is projected to be in the range of $154 million to $158 million. Revenue for the full year of 2011 is projected to be in the range of $508 million to $512 million.

As you may know, LinkedIn filed to go public back in May, and has seen its stock remain steady for the past six months. And the product itself has been luring in more engagement and activity. Traffic is up post IPO, and LinkedIn now has more unique monthly visitors than MySpace and Twitter. The company reported average comScore unique visitors of 87.6 million per month, an increase of 64% from the third quarter of 2010 and total page views of 7.6 billion, an

increase of 51% from the third quarter of 2010

And LinkedIn is now adding two new members every second.

In the third quarter, Linkedin continued to push its data-focused products, unveiling a new feature called Classmates, which gives the professional social network’s users new insights and networking features to connect with fellow alumni of colleges and universities. The company also redesigned its mobile offerings, and adding HTML5 technology to its mobile site. And LinkedIn is seeking to open up new revenue streams with more customized products for recruiters.

The company was more acquisitive this quarter, buying real-Time, hosted search startup IndexTank. AllThingsD reported that LinkedIn bought social contact management startup Connected. And in September, LinkedIn hosted U.S. President Barack Obama for a town hall.

LinkedIn’s stock is down around 5 percent in after hours trading.

We’ve embedded the Earnings call for LinkedIn, which will start at 2 pm PT. We’ll live blog the call.

Liveblog:

CEO Jeff Weiner and CFO Steve Sordello are leading the call.

LinkedIn users conduct over 4 billion searches on the platform in a given year.

More than 15 million people joined LinkedIn in Q3.

Hundreds of thousand of job applications have been submitted with the new Apply For LinkedIn button.

Mobile page views are up 400 percent and mobile visits accounted for more than 13% of LinkedIn’s unique visits

LinkedIn has 7,400 customer using its hiring solutions product.

More than 180,000 domains use the LinkedIn Share button on their sites, an increase of more than 250%.

LinkedIn added 200 employees in the quarter.

Q&A

Q: This is the second quarter where you have been overly conservative in you guidance-why have you been coming in above your guidance? What does Q4 look like from a hiring perspective?

A (SS): The top line revenue flowed through to the bottom line in the third quarter. We take a long term perspective on our business. In Q4, we are trying to pull in some of the 2012 hires. We are going to pull in 500-600 more employees especially in consumer products, technology, and sales.

(JW) We’ll be able to manage this hypergrowth of employees. We won’t hire folks that we aren’t capable of being productive from day one.

Q: Mobile page views-what percent of pageviews are from mobile and how did that compare to Q3 last year?

(SS) Mobile page views are north of ten percent of total pageviews, last year was immaterial.

Q: How will mobile usage differ from usage on the desktop?

(JW) We are trying to learn as much from mobile interaction as possible and leverage that into interactions. Mobile is our fastest growing service and we are going to think next year about how we monetize mobile.

Q: Any update on new product talent pipeline?

(JW) It has yet to be rolled out officially, we will have pilot partners that will use the product in the next few weeks. It’s the first step in making our recruiter product into a platform

Q: You talked about an interesting growth area with students and recent graduates? What are the monetization opportunities there?

(JW) It’s consistent with the existing business model. There are nuances about that demographic, such as adjusting the profile so that it is unique for a student vs. someone who has been in the industry for a few years. We also rolled out the alumni product (mentioned above).

Q: You mentioned record levels of engagement, can you expand on this? What impact do new products have on engagement?

(SS) We’re very pleased with the engagement this quarter, our page views are growing faster than our unique visitors. In terms of the financial impact, it’s much more directly correlated with online businesses.